PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721472

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721472

Gate-All-Around (GAA) Transistor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

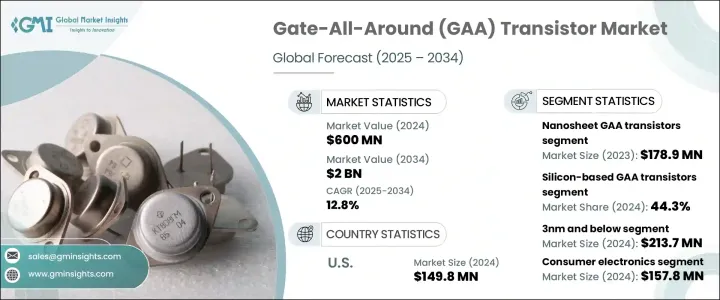

The Global Gate-All-Around Transistor Market was valued at USD 600 million in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 2 billion by 2034. This growth is driven by the increasing demand for high-performance processors, the expansion of 5G networks, and the rise of edge computing technologies. GAA transistors are poised to play a critical role in next-generation chipsets used across mobile processors, network hardware, and AI-driven platforms. Their enhanced energy efficiency, faster switching capabilities, and superior electrostatic control compared to traditional FinFET designs make them an ideal solution for addressing the performance demands of modern computing applications. As data-intensive industries like cloud computing, telecom, and automotive evolve, GAA transistors are emerging as a cornerstone for future technology.

Nanosheet GAA transistors have become the most prominent segment in the market, generating USD 178.9 million in 2023. These transistors are highly favored due to their advanced control over short-channel effects, improved scalability for sub-3nm process nodes, and higher transistor density. Leading semiconductor foundries are adopting nanosheet architecture to enhance power efficiency and chip performance, making them a critical choice for AI, high-performance computing, and mobile platforms. The compatibility of nanosheet GAA transistors with existing manufacturing equipment is also contributing to their rapid adoption in large-scale production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $600 Million |

| Forecast Value | $2 Billion |

| CAGR | 12.8% |

The silicon-based GAA transistor segment held a 44.3% market share in 2024. Silicon's cost-effectiveness and compatibility with established semiconductor fabrication processes contribute to its dominance. Major players like Intel and Taiwan Semiconductor Manufacturing Company (TSMC) are leveraging silicon-based nanosheet designs in their sub-5nm technologies, optimizing energy efficiency, and boosting logic density. These advancements are crucial for meeting the growing performance needs of digital devices and addressing the challenges of shrinking transistor sizes.

In Germany, the GAA transistor market is set to reach USD 112.6 million by 2034. The country's strong semiconductor sector, aligned with industries like automotive, automation, and smart manufacturing, is driving the adoption of GAA transistors. Notably, GAA technology is being integrated into electric vehicle systems and industrial automation platforms. Germany is also investing heavily in research to stay at the forefront of advanced chip technologies, positioning itself as a key player in Europe's strategy for semiconductor self-reliance and technological sovereignty.

The market is witnessing significant contributions from industry giants such as Intel, Samsung Electronics, and Taiwan Semiconductor Manufacturing Company (TSMC). These leading companies are investing heavily in research and development for nanosheet and forksheet transistor architectures. Additionally, they are forming strategic partnerships with design tool providers and foundries to speed up time-to-market, while expanding their geographic reach and participating in government-funded semiconductor initiatives. These efforts help maintain their competitive edge in the rapidly evolving GAA transistor market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for High-Performance Computing (HPC)

- 3.6.1.2 Advancements in semiconductor fabrication technology

- 3.6.1.3 Growth in 5G and edge computing

- 3.6.1.4 Rising investments in AI and IoT devices

- 3.6.1.5 Strategic expansion by foundries and IDMs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High manufacturing complexity and costs

- 3.6.2.2 Supply chain and yield challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Nanosheet GAA transistors

- 5.3 Nanowire GAA transistors

- 5.4 Forksheet GAA transistors

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Silicon-based GAA transistors

- 6.3 Germanium-based GAA transistors

- 6.4 III-V compound semiconductor GAA transistors

Chapter 7 Market Estimates & Forecast, By Node Size, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 3nm and below

- 7.3 Above 3nm

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 High-Performance Computing (HPC)

- 8.3 Internet of Things (IoT) devices

- 8.4 AI & machine learning processors

- 8.5 5G & communication infrastructure

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Consumer electronics

- 9.3 Automotive

- 9.4 Data centers & cloud computing

- 9.5 Industrial electronics

- 9.6 Healthcare & medical devices

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices

- 11.2 ams-OSRAM AG

- 11.3 Broadcom Inc.

- 11.4 Everlight Electronics Co., Ltd.

- 11.5 Honeywell International Inc.

- 11.6 Melexis NV

- 11.7 Microchip Technology Inc.

- 11.8 OmniVision Technologies, Inc.

- 11.9 ON Semiconductor Corporation

- 11.10 Panasonic Corporation

- 11.11 Renesas Electronics Corporation

- 11.12 ROHM Semiconductor

- 11.13 Samsung Electronics Co., Ltd.

- 11.14 Sharp Corporation

- 11.15 Silicon Labs

- 11.16 Sony Semiconductor Solutions Corporation

- 11.17 STMicroelectronics

- 11.18 Texas Instruments Incorporated

- 11.19 Vishay Intertechnology