PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721477

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721477

Biocompatible 3D Printing Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

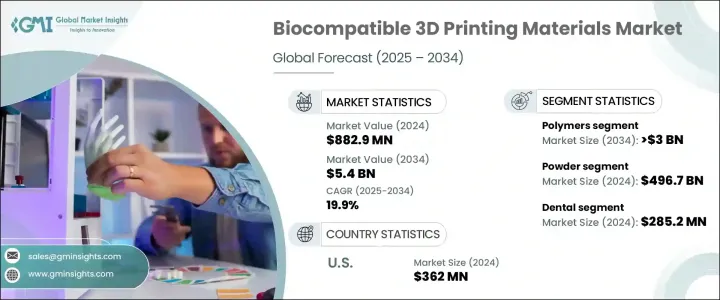

The Global Biocompatible 3D Printing Materials Market was valued at USD 882.9 million in 2024 and is estimated to grow at a CAGR of 19.9% to reach USD 5.4 billion by 2034. This growth trajectory reflects the rising demand for next-generation medical materials that offer high levels of precision, performance, and patient compatibility. The increasing need for advanced medical interventions, particularly among the aging population, is fueling the adoption of 3D-printed materials across a variety of healthcare applications. As global healthcare systems pivot toward more patient-centric approaches, the use of biocompatible 3D printing materials is becoming critical in delivering customized, efficient, and minimally invasive medical solutions. In addition to orthopedics and prosthetics, the materials are gaining widespread traction in dental care, surgical tools, tissue scaffolds, and regenerative medicine. The ability of these materials to support complex geometries, enhance surgical outcomes, and reduce recovery times positions them as essential components in modern medical manufacturing. With favorable regulatory policies, growing R&D investments, and expanding awareness about personalized healthcare, the market continues to experience substantial momentum across both developed and emerging economies.

The market's growth is also largely attributed to rapid advancements in additive manufacturing techniques, including Selective Laser Sintering (SLS), Stereolithography (SLA), and Direct Metal Laser Sintering (DMLS). These technologies enable the production of highly accurate and biocompatible medical components that align with individual anatomical requirements. Material innovations further contribute to market expansion, with the development of high-performance metal alloys, polymers, and bioinks improving the reliability, durability, and compatibility of printed biomedical products. These breakthroughs are particularly relevant in creating functional implants, prosthetics, and surgical tools that offer improved performance and reduced complication rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $882.9 Million |

| Forecast Value | $5.4 Billion |

| CAGR | 19.9% |

The market is segmented into polymers, metals, and other material types, with the polymers category expected to lead future growth. This segment is projected to reach USD 3 billion by 2034, growing at a CAGR of 19.9%. The rising demand for customized 3D-printed polymers is evident in the production of patient-specific implants, dental restorations, and prosthetic devices. Advanced materials such as Polyether Ether Ketone (PEEK), Polylactic Acid (PLA), and bioresorbable polymers are gaining ground due to their superior strength, biocompatibility, and adaptability to complex medical requirements.

The dental sector accounted for USD 285.2 million in 2024 and is expanding steadily, driven by the increasing prevalence of conditions like tooth loss, periodontal diseases, and dental caries. Technologies such as SLA, Digital Light Processing (DLP), and SLS have dramatically improved the precision, strength, and fit of dental restorations, boosting demand among dental professionals and patients alike.

The U.S. Biocompatible 3D Printing Materials Market was valued at USD 362 million in 2024 and is experiencing significant growth due to the aging population's heightened risk of dental and orthopedic issues. The ability to rapidly manufacture tailored prosthetics and implants has accelerated the adoption of 3D printing in medical facilities across the country.

Key players in the global market include Stratasys, 3D Systems, GE Additive, Formlabs, Materialise, Renishaw, Royal DSM, Arkema, Solvay, Cellink, Concept Laser, EOS, Evonik Industries, EnvisionTEC, and Hoganas. These companies are actively investing in advanced, high-performance materials to improve biocompatibility and application precision. Strategic collaborations with healthcare providers and research organizations are helping to expand the clinical utility of 3D printing. Moreover, ongoing product development focused on innovative, condition-specific solutions is allowing market leaders to enhance their global footprint and competitive positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand of biocompatible 3D printing in healthcare industry

- 3.2.1.2 Technological advancements in 3D printing materials

- 3.2.1.3 Growing adoption of personalized medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biocompatible 3D printing materials

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Polymers

- 5.3 Metals

- 5.4 Other material types

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Liquid

- 6.4 Other forms

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dental

- 7.3 Drug delivery systems

- 7.4 Surgical tools and implants

- 7.5 Tissue engineering

- 7.6 Cardiovascular

- 7.7 Orthopedic

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arkema

- 9.2 BIO INX

- 9.3 Cellink

- 9.4 EnvisionTEC

- 9.5 EOS

- 9.6 Evonik Industries

- 9.7 Formlabs

- 9.8 GE Additive

- 9.9 Hoganas

- 9.10 Materialise

- 9.11 Renishaw

- 9.12 Royal DSM

- 9.13 Solvay

- 9.14 Stratasys

- 9.15 3D Systems