PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721478

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721478

Corrugated Fanfold Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

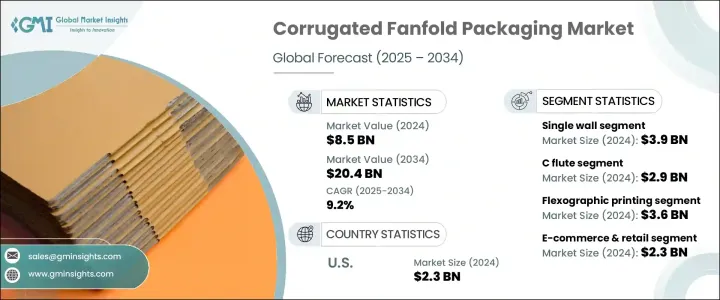

The Global Corrugated Fanfold Packaging Market was valued at USD 8.5 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 20.4 billion by 2034. This surge is largely attributed to the rapid rise in e-commerce, dynamic shifts in consumer purchasing patterns, and an industry-wide pivot toward sustainable and cost-efficient packaging solutions. As online retail expands globally, the demand for smarter, more flexible packaging formats is growing rapidly. Businesses across sectors are prioritizing solutions that enable right-sized packaging to streamline operations, reduce waste, and lower shipping costs. Corrugated fanfold packaging is fast becoming a preferred choice for enterprises focused on operational agility and sustainability. The fanfold format supports automation and customization while eliminating the need for stocking multiple pre-formed box sizes. This significantly reduces storage space and allows companies to tailor packaging for varying order volumes. Environmental consciousness among consumers and regulatory pressure on businesses to cut down on their carbon footprint has further accelerated the adoption of recyclable, lightweight fanfold solutions.

With technological advancement and smart packaging solutions gaining traction, manufacturers are investing in automation tools and on-demand box-making systems that seamlessly integrate with fanfold packaging. These innovations not only improve packaging efficiency but also minimize excess material use and drive down logistics costs. Moreover, the increasing demand for eco-friendly packaging from sectors like food delivery, electronics, and fashion is fueling sustained interest in fanfold packaging across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.5 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 9.2% |

Among wall types, the single wall fanfold boards segment generated USD 3.9 billion in 2024. This segment is popular for its lightweight design and cost-effectiveness, making it the go-to option for e-commerce retailers and subscription-based services. As online purchasing continues to rise-especially for consumer categories like cosmetics, fashion, and food-single wall fanfold boards offer a reliable solution that balances strength with affordability. The continued expansion of food delivery platforms is also fueling demand for packaging that is both sustainable and tailored to different order sizes, helping reduce waste and optimize delivery efficiency.

C flute held the largest share among flute types, generating USD 2.9 billion in 2024. Its ability to support moderate weight while maintaining durability and impact resistance makes it ideal for a wide range of applications. This flute type is widely used for packaged food and beverage items such as bottled drinks, canned goods, and meal kits. Its structural integrity ensures safe transport, making it a preferred option for companies looking to enhance both performance and sustainability in packaging.

Germany Corrugated Fanfold Packaging Market generated USD 481.1 million in 2024. The country's strong position as a major exporter of electronics, consumer goods, and food products continues to drive demand for custom and durable packaging. Growth in Germany's industrial and automotive sectors further boosts the need for double and triple-wall fanfold boards. Businesses are also under increasing pressure to align with EU sustainability directives, encouraging widespread adoption of recyclable and bio-based packaging alternatives.

Key players in the Global Corrugated Fanfold Packaging Market include Smurfit Kappa Group, Ribble Packaging, Papierfabrik Palm, Stora Enso, Hinojosa Packaging Group, Kite Packaging, Abbe, DS Smith, International Paper Company, Rondo Ganahl, Papeles y Conversiones de Mexico, Corrugated Supplies Company, and Mondi. These companies are actively investing in automation technologies, expanding product portfolios to cater to niche industries such as electronics and pharmaceuticals, and aligning with green initiatives through FSC-certified and recyclable packaging materials. Strategic collaborations with e-commerce platforms and logistics providers are also enabling faster packaging operations and improved delivery turnaround.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise of e-commerce and online shopping

- 3.2.1.2 Growing demand for customization and personalization

- 3.2.1.3 Rise in automation and smart packaging solutions

- 3.2.1.4 Expansion in the food and beverage industry

- 3.2.1.5 Advancements in digital printing technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment in automated packaging systems

- 3.2.2.2 Recycling and waste management challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Wall Type, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Single wall

- 5.3 Double wall

- 5.4 Triple wall

Chapter 6 Market Estimates and Forecast, By Flute Type, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 B flute

- 6.3 C flute

- 6.4 E flute

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Printing Technology, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Flexographic printing

- 7.3 Digital printing

- 7.4 Lithographic printing

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 E-commerce & retail

- 8.3 Consumer electronics

- 8.4 Healthcare & pharmaceuticals

- 8.5 Personal care & cosmetics

- 8.6 Automotive & industrial goods

- 8.7 Food & beverage

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbe

- 10.2 Corrugated Supplies Company

- 10.3 DS Smith

- 10.4 Hinojosa Packaging Group

- 10.5 International Paper Company

- 10.6 Kite Packaging

- 10.7 Mondi

- 10.8 Papeles y Conversiones de Mexico

- 10.9 Papierfabrik Palm

- 10.10 Ribble Packaging

- 10.11 Rondo Ganahl

- 10.12 Smurfit Kappa Group

- 10.13 Stora Enso

- 10.14 WestRock