PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721479

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721479

5G Enterprise Private Network Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

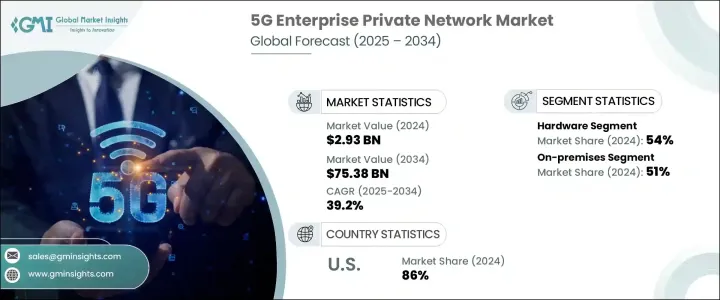

The Global 5G enterprise private network market was valued at USD 2.93 billion in 2024 and is estimated to grow at a CAGR of 39.2% to reach USD 75.38 billion by 2034. Enterprises across sectors are increasingly embracing private 5G networks to gain tighter control over their digital operations, improve security, and enhance scalability. The demand is driven by the growing reliance on ultra-reliable, low-latency communication and the need for seamless, high-speed data flow. Private 5G networks are transforming enterprise connectivity by enabling real-time decision-making, uninterrupted data streaming, and secure communication, particularly for mission-critical applications.

Companies in manufacturing, logistics, energy, and healthcare are leveraging these networks to implement intelligent automation, industrial IoT, robotics, and remote monitoring systems. The push for digital transformation, combined with favorable regulatory support and robust R&D initiatives, is further accelerating market growth. With increasing investments in smart cities, connected infrastructure, and edge computing, private 5G networks are emerging as a key enabler of next-gen enterprise strategies. National-level initiatives that support digital infrastructure, including expansive 5G rollouts and the creation of smart technology zones, are playing a pivotal role in shaping this landscape. These developments are creating a competitive advantage for early adopters and fostering innovation across sectors that demand resilient and highly secure network solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.93 Billion |

| Forecast Value | $75.38 Billion |

| CAGR | 39.2% |

Hardware continues to dominate the 5G enterprise private network space, accounting for 54% of the global market in 2024, and is projected to grow at a CAGR of 39.9% through 2034. The rising need for high-performance equipment such as antennas, routers, small cells, and base stations is fueling this momentum. These hardware components are essential to deploying scalable and secure private 5G infrastructures, particularly in sectors like manufacturing, logistics, and defense, where performance and security cannot be compromised. Businesses are strategically investing in robust hardware to ensure smooth, uninterrupted connectivity and to accommodate advanced use cases that demand minimal latency and maximum reliability.

The on-premises deployment model led the market with a 51% share in 2024 and is expected to retain a strong position in the coming years. Enterprises that manage sensitive data, including those in defense, industrial manufacturing, and healthcare, prefer on-premises networks due to enhanced control, improved data protection, and real-time data management. These networks provide tailored infrastructure that allows for operational continuity, reduced security risks, and seamless integration with existing enterprise systems. The preference for on-site deployment is further supported by the growing demand for customization and compliance with strict industry regulations.

The United States held an 86% share of the global market in 2024, driven by its advanced research ecosystem, high automation penetration, and proactive regulatory framework. Private 5G networks in the country are facilitating secure and efficient operations across critical sectors like defense, energy, and healthcare, where edge computing and robotics are becoming integral.

Major players in the global 5G enterprise private network market include Qualcomm, Cisco Systems, Microsoft Azure, Accenture, IBM, NVIDIA, Huawei Technologies, AT&T, Hewlett Packard Enterprise (HPE), and AWS (Amazon Web Services). These companies are forging strong partnerships with telecom operators and cloud service providers to deliver scalable, secure, and industry-specific 5G solutions. Many are also focusing on integrating AI-powered optimization tools and edge computing technologies to enhance network performance and meet real-time demands. Tailored offerings for sectors such as smart manufacturing, logistics, and infrastructure development, along with strategic pilot programs and regulatory collaborations, are helping firms strengthen their market footprint and accelerate adoption across global enterprises.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Equipment manufacturers

- 3.2.2 Telecom service providers

- 3.2.3 System integrators

- 3.2.4 Technology providers

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for low-latency communication

- 3.8.1.2 Rise in edge computing

- 3.8.1.3 Growing data security & privacy needs

- 3.8.1.4 Surge in IoT and connected devices

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial deployment costs

- 3.8.2.2 Integration challenges with legacy systems

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Radio Access Network (RAN)

- 5.2.2 Core network

- 5.2.3 Edge computing infrastructure

- 5.3 Software

- 5.3.1 Network management software

- 5.3.2 Security software

- 5.3.3 Network slicing software

- 5.3.4 Automation and orchestration tools

- 5.4 Services

- 5.4.1 Consulting

- 5.4.2 Managed services

- 5.4.3 Support and maintenance

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Sub-6 GHz

- 7.3 Millimeter Wave (mmWave)

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 SMEs

- 8.4 Chemicals & hazardous materials

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Manufacturing

- 9.3 Healthcare

- 9.4 Transportation and logistics

- 9.5 Retail

- 9.6 Energy and utilities

- 9.7 Smart cities

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Accenture

- 11.2 AT&T

- 11.3 AWS (Amazon Web Services)

- 11.4 BT Group (British Telecom)

- 11.5 Cisco Systems

- 11.6 Ericsson

- 11.7 Hewlett Packard Enterprise (HPE)

- 11.8 Huawei Technologies

- 11.9 IBM

- 11.10 Intel

- 11.11 Juniper Networks

- 11.12 Mavenir

- 11.13 Microsoft Azure

- 11.14 Nokia

- 11.15 NVIDIA

- 11.16 Qualcomm

- 11.17 Samsung Electronics

- 11.18 T-Mobile US

- 11.19 Verizon Communications

- 11.20 ZTE