PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721494

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721494

High Bandwidth Memory Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

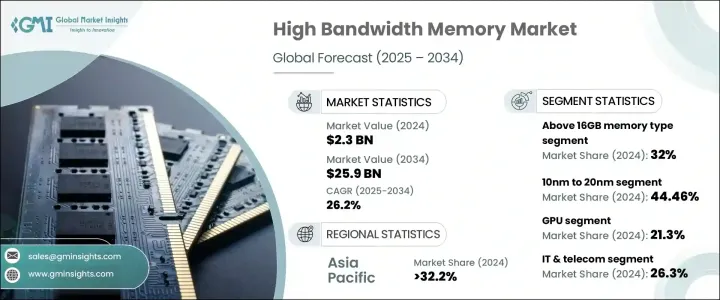

The Global High Bandwidth Memory Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 26.2% to reach USD 25.9 billion by 2034. The global shift toward data-centric technologies is reshaping the landscape of memory solutions, with high bandwidth memory emerging as a critical enabler for faster data processing and energy-efficient computing. As organizations across various sectors race to adopt next-generation technologies, the demand for high-speed, low-latency memory has seen a notable surge.

The growing influence of artificial intelligence (AI), machine learning (ML), advanced driver-assistance systems (ADAS), and 5G networks continues to fuel demand for powerful memory technologies. Enterprises are leaning heavily on HBM to support big data, high-resolution imaging, real-time analytics, and deep learning workloads. With digital transformation accelerating in sectors like automotive, healthcare, financial services, and media, HBM solutions are rapidly becoming foundational to the development of smarter, faster, and more connected systems. Companies worldwide are responding by investing in cutting-edge innovations and expanding manufacturing capabilities to stay competitive in this rapidly evolving space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 26.2% |

The market is segmented by technology node into below 10nm, 10nm to 20nm, and above 20nm. The 10nm to 20nm category accounted for USD 1 billion in 2024 and is projected to grow at a CAGR of 26.7% between 2025 and 2034. This node has proven ideal for applications requiring balanced performance and cost-efficiency, such as automotive electronics, IoT devices, and mid-range consumer products. Its scalability, coupled with high-yield production and reliable thermal management, continues to make it a go-to option for developers aiming to optimize performance without inflating manufacturing costs.

Based on application, the high bandwidth memory market is categorized into GPUs, CPUs, FPGAs, ASICs, AI, ML, HPC, networking, and data centers. The GPU segment captured a 21.3% share in 2024, supported by soaring demand in professional and immersive gaming ecosystems. As ultra-high-definition graphics, real-time rendering, and extended reality environments become mainstream, graphics processing units are integrating advanced HBM technologies such as HBM3E to meet rising bandwidth needs. This trend is particularly prominent in the gaming and animation sectors, where rapid refresh rates and responsive user experiences are essential.

The Asia Pacific region led the global market with a 32.2% share in 2024. Meanwhile, the U.S. high bandwidth memory market was valued at USD 523 million in the same year, driven by the digital modernization of cloud and data center infrastructures. The country's vast number of data centers makes it a dominant force in HBM adoption, with real-time data analytics and edge computing applications paving the way for accelerated deployment.

Leading players in the global high bandwidth memory market include Cadence Design Systems, Inc., Advanced Micro Devices, Inc. (AMD), Broadcom Inc., GlobalFoundries Inc., IBM Corporation, Fujitsu Limited, and Infineon Technologies AG. These companies are investing heavily in R&D to boost the speed, scalability, and efficiency of their HBM offerings. Strategic alliances across AI, gaming, and semiconductor sectors further support their global expansion efforts.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Expansion of Data-Intensive Applications

- 3.7.1.2 Growth of High-Performance Computing

- 3.7.1.3 Next-Generation Platform Integration

- 3.7.1.4 Enhanced gaming and graphics demand

- 3.7.1.5 Expansion of the data center and cloud services

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High Production Costs

- 3.7.2.2 Technical Integration Complexity

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Memory Capacity, 2021 – 2034 ($ Mn & Bn GB)

- 4.1 Key trends

- 4.2 Less than 4GB

- 4.3 4GB to 8GB

- 4.4 8GB to 16GB

- 4.5 Above 16GB

Chapter 5 Market Estimates and Forecast, By Technology Node, 2021 – 2034 (USD Mn & Bn GB)

- 5.1 Key trends

- 5.2 Below 10nm

- 5.3 10nm to 20nm

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Mn & Bn GB)

- 6.1 Key trends

- 6.2 Graphics Processing Units (GPUs)

- 6.3 Central Processing Units (CPUs)

- 6.4 Field-Programmable Gate Arrays (FPGAs)

- 6.5 Application-Specific Integrated Circuits (ASICs)

- 6.6 Artificial Intelligence (AI) and Machine Learning (ML)

- 6.7 High-Performance Computing (HPC)

- 6.8 Networking and Data centers

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Mn & Bn GB)

- 7.1 Key trends

- 7.2 IT & telecom

- 7.3 Gaming & entertainment

- 7.4 Healthcare & life Sciences

- 7.5 Automotive

- 7.6 Military & defense

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021– 2034 (USD Mn & Bn GB)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 UAE

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Advanced Micro Devices, Inc. (AMD)

- 9.2 Broadcom Inc.

- 9.3 Cadence Design Systems, Inc.

- 9.4 Fujitsu Limited

- 9.5 GlobalFoundries Inc.

- 9.6 IBM Corporation

- 9.7 Infineon Technologies AG

- 9.8 Intel Corporation

- 9.9 Marvell Technology Group Ltd.

- 9.10 Micron Technology, Inc.

- 9.11 Nanya Technology Corporation

- 9.12 NVIDIA Corporation

- 9.13 Qualcomm Incorporated

- 9.14 Rambus Inc.

- 9.15 Samsung Electronics Co., Ltd.

- 9.16 SK Hynix Inc.

- 9.17 Synopsys, Inc.

- 9.18 Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- 9.19 Toshiba Corporation