PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721497

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721497

Hydrostatic Transmission Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

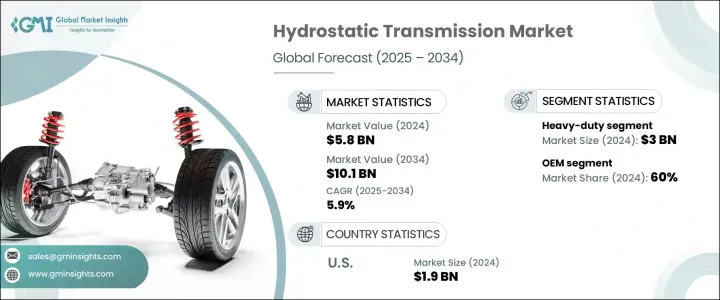

The Global Hydrostatic Transmission Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 10.1 billion by 2034. As industries worldwide continue to evolve toward smarter, cleaner, and more energy-efficient technologies, hydrostatic transmission systems are gaining strong traction. The market is experiencing heightened demand from sectors such as automotive, agriculture, construction, and mining, where the need for smooth, responsive, and fuel-efficient power delivery is reshaping design priorities. The increasing adoption of automation and electrification across industrial and vehicular platforms is significantly influencing transmission technologies.

Manufacturers are focusing on integrating advanced features that support seamless machine operation and intelligent control to match the needs of next-generation equipment. End users are leaning toward systems that ensure precision handling, reduced emissions, and higher reliability-factors that are crucial in today's performance-driven and sustainability-conscious landscape. Moreover, growing infrastructure investments, labor shortages, and the push for smart farming and automated material handling are adding substantial momentum to the hydrostatic transmission market, especially across North America, Europe, Asia Pacific, and the Middle East & Africa.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 5.9% |

Growth across key industries is largely driven by the rising preference for energy-efficient transmission systems and the demand for seamless power modulation. Enhanced vehicle performance, precise control, and improved fuel economy are among the core benefits propelling adoption. As hydraulic technology continues to mature, manufacturers are incorporating intelligent features such as electronic controls and smart sensors into their systems. These innovations are redefining vehicle architecture, allowing smoother operation and greater system reliability. The movement toward automated, sustainable machinery is fueling robust demand in sectors such as heavy construction, agricultural equipment, and industrial vehicles.

Segmented by capacity, the market includes light-duty, medium-duty, and heavy-duty systems. Among these, heavy-duty hydrostatic transmissions held a commanding USD 3 billion in 2024. This dominance stems from their ability to deliver high torque, long operational life, and reliability in high-load, rugged applications. Heavy-duty systems are especially attractive for their consistent performance under extreme conditions while maintaining fuel efficiency. Industry leaders are developing next-gen systems equipped with precision control modules, electronic management units, and energy-saving enhancements to meet escalating industrial requirements. These upgrades are strengthening the foothold of heavy-duty solutions across mission-critical operations.

Based on distribution, the market is split between OEM and aftermarket channels. The OEM segment secured a 60% share in 2024, bolstered by rising integration of hydrostatic systems into new vehicle designs. Consumers are increasingly favoring factory-installed units that work in sync with built-in safety and automation features. OEMs are responding by delivering units optimized for compatibility with ADAS and other intelligent driving systems. The demand is especially high among premium models where smooth drive control and fuel savings are non-negotiable. Regulatory mandates pushing for enhanced safety and sustainability continue to drive OEM adoption.

United States Hydrostatic Transmission Market generated USD 1.9 billion in 2024 and is poised to grow at 6.2% CAGR between 2025-2034. Growth is primarily driven by innovation in hydraulic system designs, infrastructure investments, and the surge in precision-focused equipment in agriculture and construction. The adoption of hybrid transmissions and sensor-based control features is accelerating. With a national focus on automation and sustainable industrial practices, the US market is witnessing fast-paced deployment across varied applications.

Companies such as Parker Hannifin, Dana, Bosch Rexroth, John Deere, CNH Industrial, Eaton, Danfoss, Mahindra & Mahindra, Husqvarna, and Kubota are sharpening their edge with R&D investments, strategic partnerships, and innovative product launches. Many players are investing in IoT-enabled systems and diagnostic technologies to optimize lifecycle performance and operational efficiency. Collaborations with OEMs are simplifying integration into advanced vehicle platforms, while mergers and regional expansions are enabling global players to better serve the surging demand from emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increased use in off-highway and specialty vehicles

- 3.7.1.2 Advancements in smart hydraulic systems

- 3.7.1.3 Regulatory push for fuel efficiency

- 3.7.1.4 Development of hybrid hydrostatic-electric powertrains

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs

- 3.7.2.2 Complex maintenance requirements

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Heavy-duty

- 5.3 Medium-duty

- 5.4 Light-duty

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Hydraulic pumps

- 6.3 Hydraulic motors

- 6.4 Valves & controls

- 6.5 Filters

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Agriculture

- 7.3 Construction

- 7.4 Material handling

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Transmission, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Closed-loop

- 8.3 Open-loop

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Aftermarket

- 9.3 OEM

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AGCO

- 11.2 Ariens

- 11.3 Bosch Rexroth

- 11.4 CNH Industrial

- 11.5 Daedong Industrial

- 11.6 Dana

- 11.7 Danfoss

- 11.8 Eaton

- 11.9 Husqvarna

- 11.10 Iseki

- 11.11 JCB

- 11.12 John Deere

- 11.13 Kubota

- 11.14 Mahindra & Mahindra

- 11.15 MTD

- 11.16 Parker Hannifin

- 11.17 Sauer-Danfoss

- 11.18 Tuff Torq

- 11.19 Yanmar

- 11.20 ZF Friedrichshafen