PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721503

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721503

Broccoli Seed Aqueous Extract Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

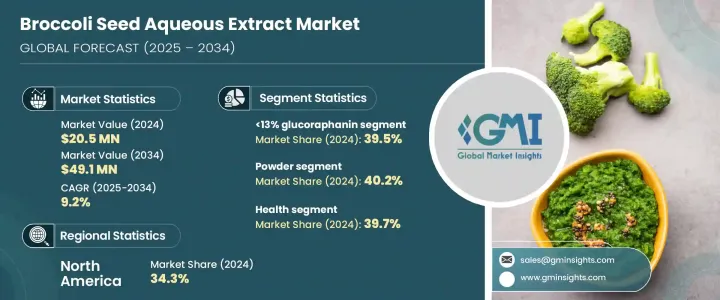

The Global Broccoli Seed Aqueous Extract Market was valued at USD 20.5 million in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 49.1 million by 2034. The market has experienced consistent growth as more consumers embrace plant-based wellness products and prioritize natural ingredients in their health regimens. With the rising awareness of the risks associated with synthetic supplements, health-focused individuals are shifting toward organic and plant-based alternatives. Broccoli seed aqueous extract, known for its high concentration of sulforaphane-a potent antioxidant compound-has gained attention for its ability to support detoxification, reduce inflammation, and combat oxidative stress. Sulforaphane's broad therapeutic potential has sparked interest not only among consumers but also within the scientific community, where research continues to uncover its protective effects against various chronic conditions. Additionally, the surge in veganism and plant-based diets has further amplified demand for broccoli seed-derived supplements, particularly in developed markets. Brands that highlight clean labels, functional ingredients, and transparency in sourcing are thriving, aligning with modern consumer values and wellness goals.

Initially, the demand for broccoli seed aqueous extract came primarily from health-conscious individuals and the dietary supplement segment. As awareness grows, this demand has broadened to include functional food producers and clinical nutrition sectors. The market is divided into various categories, one of which is resin type-this includes 13% glucoraphanin, a combination of 13% and 20% glucoraphanin, and 20% glucoraphanin concentrations. In 2024, the 13% glucoraphanin segment accounted for a 39.5% market share. It is especially popular due to its strong antioxidant and anti-inflammatory characteristics, making it a go-to ingredient for general wellness supplements and functional food formulations. Its affordability compared to higher concentrations makes it accessible to mass-market supplement manufacturers. The balanced bioactivity and reasonable cost have made this category a staple among suppliers of clinical-grade dietary supplements and medical nutrition brands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.5 Million |

| Forecast Value | $49.1 Million |

| CAGR | 9.2% |

The market is further segmented by product form, including powder, capsules, and tablets. In 2024, powder form captured a 40.2% share and is expected to expand at a 9.4% CAGR from 2025 to 2034. Powders are favored in the health and wellness space due to their versatility and ease of use in smoothies, protein blends, and plant-based nutrition products. Capsules are also gaining momentum, especially among users seeking convenience and precise dosage without preparation. This format resonates with the nutraceutical and preventive health markets where consistency and accuracy matter.

North America held a 34.3% share of the global broccoli seed aqueous extract market in 2024. Growth in this region is driven by increasing consumer preference for natural, plant-based wellness solutions. Rising disposable incomes, coupled with growing awareness of preventive healthcare, have contributed to this momentum. Across regions-including North America, Europe, Asia Pacific, and Latin America-consumer behaviors, income levels, and health priorities vary, shaping regional growth patterns and market potential.

Key players in the global market include Sabinsa Corporation, Kemin Industries, NutraScience Labs, Frutarom Health, NutraBio, and Nikko Chemicals. These companies are expanding their portfolios with diverse product formats such as powders, capsules, and tablets to meet evolving consumer needs. With a focus on innovation and enhanced bioavailability, many are investing in R&D to deliver more effective formulations. Strategic partnerships with wellness influencers and collaborations with retailers and online platforms have been instrumental in boosting brand visibility and capturing new audiences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics

Note: the above trade status will be provided for key countries

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising consumer preference for natural products

- 3.8.1.2 Growth in clean beauty & personal care

- 3.8.1.3 Stricter regulations & clean label demand

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High production costs

- 3.8.2.2 Supply chain constraints

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 <13% Glucoraphanin

- 5.3 13% Glucoraphanin

- 5.4 20% Glucoraphanin

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Capsule

- 6.4 Tablet

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Health products

- 7.3 Functional foods

- 7.4 Pharmaceutical

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Kemin Industries

- 9.2 Sabinsa Corporation

- 9.3 Frutarom Health

- 9.4 NutraScience Labs

- 9.5 NutraBio

- 9.6 Sabinsa Corporation

- 9.7 Nikko Chemicals