PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721519

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721519

Resilient Flooring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

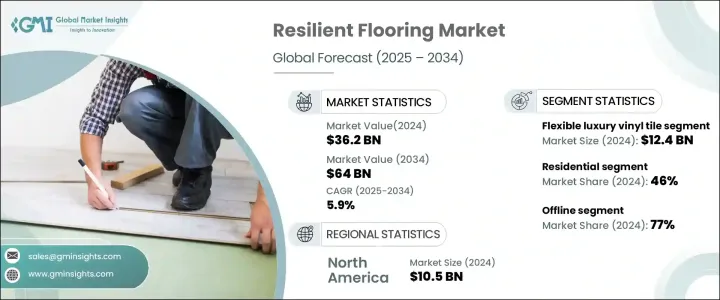

The Global Resilient Flooring Market was valued at USD 36.2 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 64 billion by 2034. Industry players are witnessing a steady surge in demand for resilient flooring solutions, driven by rising consumer awareness around long-term value, low maintenance, and superior durability. As consumers and businesses alike continue to invest in aesthetically pleasing yet functional flooring solutions, the market is experiencing renewed momentum. Resilient flooring is gaining popularity not only for its ability to replicate high-end materials like wood, stone, and ceramic but also for its cost-efficiency and environmental compatibility. Rapid urbanization, growing disposable incomes, and a booming remodeling sector across both residential and commercial sectors are paving the way for future growth. Technological advancements have further fueled the market, with manufacturers rolling out innovative designs and sustainable materials that meet the expectations of modern consumers. Additionally, increasing investments in infrastructure development and smart city projects across developed and emerging economies continue to create new opportunities for the global resilient flooring industry.

The market is segmented by product type, including flexible luxury vinyl tile (LVT), rigid LVT, sheet vinyl, linoleum flooring, cork flooring, rubber flooring, and others. Among these, the flexible LVT segment emerged as the top contributor in 2024, generating USD 12.4 billion. Flexible LVT continues to gain traction for its high resemblance to natural surfaces, combined with excellent durability, ease of installation, and low maintenance. Consumers looking for premium yet affordable flooring solutions increasingly prefer LVT, especially for renovation projects. Manufacturers are also leveraging the sustainability trend by introducing products made from recycled content and ensuring recyclability, aligning with the growing push for green building materials and circular economy practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.2 Billion |

| Forecast Value | $64 Billion |

| CAGR | 5.9% |

In terms of application, the residential segment held a dominant 46% market share in 2024. This growth is primarily fueled by the rising popularity of DIY home improvements, greater availability of eco-friendly flooring alternatives, and heightened focus on interior aesthetics. Homeowners are choosing resilient flooring for its affordability, durability, and modern appearance, making it a go-to option in living rooms, kitchens, and basements. On the commercial front, the demand remains strong across offices, hospitals, educational facilities, and retail environments where resilience, hygiene, ease of upkeep, and design flexibility are paramount.

North America accounted for 78% of the global market share in 2024, driven by an active construction landscape, consumer inclination toward renovations, and the early adoption of advanced flooring technologies. The U.S. continues to lead the charge, backed by robust housing trends, higher renovation budgets, and a shift toward sustainable building practices.

Key players shaping the global resilient flooring space include Shaw Industries, Mohawk Industries, Tarkett, Armstrong Flooring, Beaulieu, Gerflor, Forbo, Mannington Mills, Interface, and Polyflor. These companies are expanding their footprint through strategic acquisitions, innovation in eco-conscious products, and investment in cutting-edge manufacturing to meet evolving consumer needs and strengthen their global presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rising trend of home renovations

- 3.5.1.2 Growing Urbanization

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High initial costs

- 3.5.2.2 Volatile Organic Compounds (VOCs) concerns

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Millions/Square Feet)

- 5.1 Key trends

- 5.2 Flexible luxury vinyl tile

- 5.3 Rigid luxury vinyl tile

- 5.4 Sheet vinyl

- 5.5 Linoleum flooring

- 5.6 Cork flooring

- 5.7 Rubber flooring

- 5.8 Others (vinyl composition tile, etc.)

Chapter 6 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Millions/Square Feet)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Millions/Square Feet)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 Healthcare

- 7.3.2 Educational institute

- 7.3.3 Hospitality

- 7.3.4 Retail

- 7.3.5 Others (stadiums, public spaces, etc.)

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Millions/Square Feet)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Millions/Square Feet)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Amtico

- 10.2 Armstrong Flooring

- 10.3 Beaulieu

- 10.4 Congoleum

- 10.5 COREtec

- 10.6 Forbo

- 10.7 Gerflor

- 10.8 Interface

- 10.9 Karndean

- 10.10 LG Hausys

- 10.11 Mannington Mills

- 10.12 Mohawk Industries

- 10.13 Polyflor

- 10.14 Shaw Industries

- 10.15 Tarkett