PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721524

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721524

AI Governance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

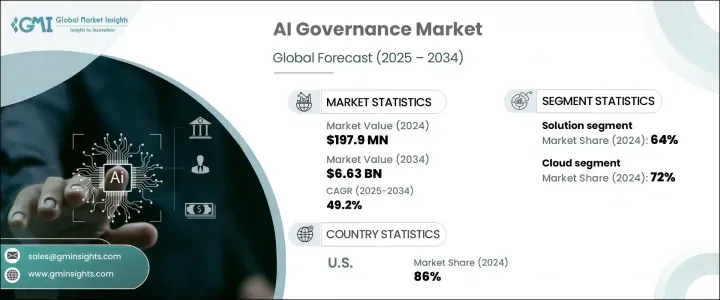

The Global AI Governance Market was valued at USD 197.9 million in 2024 and is estimated to grow at a CAGR of 49.2% to reach USD 6.63 billion by 2034. With the rapid adoption of artificial intelligence across various sectors, organizations are facing increasing challenges in protecting sensitive data and maintaining control over AI-powered systems. As AI continues to influence core business functions, the need for governance frameworks becomes more urgent to safeguard against risks such as data misuse, model bias, and unauthorized access. AI governance plays a crucial role in ensuring compliance with ethical standards, maintaining transparency, and enabling responsible decision-making across intelligent systems.

While AI-driven tools help secure digital infrastructures through applications like fraud detection and automated threat analysis, their growing complexity demands rigorous oversight. Regulatory gaps and the potential for ethical breaches create vulnerabilities that must be addressed proactively. With mounting concerns over the integrity of AI systems, businesses are recognizing the importance of deploying governance solutions that can not only detect risks but also provide real-time insights into algorithm performance, bias mitigation, and data accuracy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $197.9 Million |

| Forecast Value | $6.63 Billion |

| CAGR | 49.2% |

The increase in sophisticated cyberattacks, often backed by state actors, has amplified the urgency to implement strong AI governance structures. Organizations are also beginning to leverage AI-enabled penetration testing, simulating real-world attacks to detect internal weaknesses. However, without solid governance protocols, these advanced defense strategies risk introducing bias and compliance errors. AI governance ensures alignment with core cybersecurity principles like ethics, explainability, and accountability, helping organizations maintain visibility and control in AI deployments.

In terms of market segmentation, the component landscape is divided into solutions and services. In 2024, the solution segment led the market, accounting for nearly 64% of the global share, and is set to grow at over 48% CAGR through the forecast period. These platforms integrate policy formulation, implementation, and monitoring, offering a centralized framework for managing AI systems effectively. They also support the detection and reduction of bias in training data and algorithms using advanced interpretability tools. These solutions emphasize explainability through technologies designed to make AI-generated outputs understandable and traceable for both developers and auditors.

When it comes to deployment, the AI governance market is segmented into cloud and on-premises models. In 2024, the cloud segment captured approximately 72% of the market and is projected to register a CAGR of over 49.5% between 2025 and 2034. The growing preference for cloud-hosted platforms stems from their scalability, accessibility, and ease of integration into existing workflows. Cloud-based AI governance tools help automate compliance tasks, enable real-time policy enforcement, and streamline AI monitoring efforts. Cloud providers also offer robust security features, including encryption, access controls, and identity management to protect sensitive AI data from external threats.

By organization size, the market is classified into large enterprises and SMEs. Large enterprises dominated the space in 2024 due to their broader AI adoption across diverse operational units. These businesses typically invest in dedicated AI governance teams that oversee integration, compliance, and accountability within internal and external frameworks. They play a pivotal role in standardizing ethical AI practices, ensuring systems are deployed responsibly and aligned with global regulatory mandates. From performance monitoring to risk mitigation, large organizations rely on governance structures to maintain integrity across AI deployments.

Regionally, North America emerged as a leading market in 2024, with the United States alone contributing nearly USD 75 million, representing around 86% of the North American share. The regional growth is largely driven by increased AI deployment across industries, supported by evolving regulatory frameworks and public awareness of AI ethics. Businesses in this region are investing heavily in governance tools that prioritize transparency, auditing capabilities, and compliance with local and international standards.

Key companies shaping the AI governance landscape include Capgemini, IBM, Alphabet, Meta Platforms, NTT DATA, Microsoft, Oracle, SAP, Palantir Technologies, and SAS Institute. These vendors are focusing on automating AI model oversight, integrating governance into MLOps, and developing tailored frameworks to match sector-specific compliance needs. They are also collaborating with regulatory authorities to co-create governance models that support ethical and responsible AI use across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Platform providers

- 3.2.2 Software providers

- 3.2.3 Service providers

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 High rate of cybersecurity events globally

- 3.8.1.2 Proliferating interest towards ethical hacking and penetration testing

- 3.8.1.3 Growing data security and privacy concerns

- 3.8.1.4 Integration of ethical AI and IoT technology

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High implementation costs & resource requirements

- 3.8.2.2 Lack of standardized AI governance frameworks

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Platform

- 5.2.2 Software tools

- 5.3 Service

- 5.3.1 Consulting

- 5.3.2 Integration

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprise

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Government & defense

- 8.4 Healthcare & life sciences

- 8.5 Media & entertainment

- 8.6 IT & telecommunication

- 8.7 Automotive

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Alphabet

- 10.2 BigID

- 10.3 Capgemini

- 10.4 Dataiku

- 10.5 Deloitte

- 10.6 EY (Ernst & Young)

- 10.7 FICO

- 10.8 H2O.ai

- 10.9 IBM

- 10.10 KPMG

- 10.11 Meta Platforms

- 10.12 Microsoft

- 10.13 NTT DATA

- 10.14 Oracle

- 10.15 Palantir Technologies

- 10.16 PWC

- 10.17 SAP

- 10.18 SAS Institute

- 10.19 Stefanini

- 10.20 Teradata