PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721562

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721562

Warehouse Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

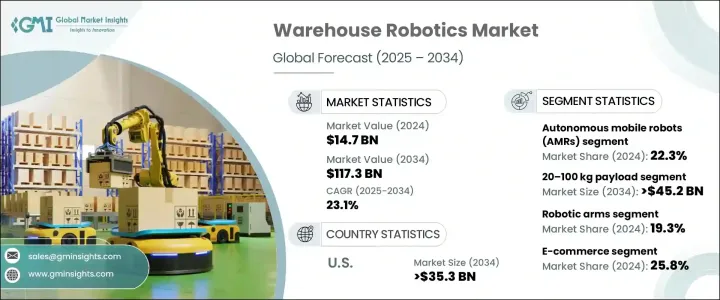

The Global Warehouse Robotics Market was valued at USD 14.7 billion in 2024 and is anticipated to grow at a CAGR of 23.1% to reach USD 117.3 billion by 2034. The market is witnessing rapid expansion as warehousing and logistics operations increasingly transition toward automation to meet rising consumer expectations. With the explosion of e-commerce, the need for streamlined supply chains and faster delivery models has never been greater. Online retailers, third-party logistics providers, and large-scale distributors are rapidly investing in robotic solutions to boost productivity, minimize labor dependency, and optimize warehouse floor space.

From intelligent navigation systems to precision-based pick-and-place technologies, warehouse robotics are transforming how inventory is managed, handled, and shipped. The emergence of Industry 4.0 and the convergence of AI, IoT, and ML technologies are further reinforcing the role of robotics in warehouse ecosystems. Organizations are adopting robotics not only to manage high order volumes but also to future-proof their operations in an increasingly competitive and automation-driven landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.7 Billion |

| Forecast Value | $117.3 Billion |

| CAGR | 23.1% |

AMRs segment held a 22.3% share in 2024. These robots are powered by AI and mapping technologies, allowing them to navigate warehouse floors autonomously and adapt to dynamic layouts and high-traffic conditions. Their ability to operate without fixed infrastructure makes them ideal for fast-paced environments such as e-commerce fulfillment centers. Robotic arms are also gaining traction across warehouse setups for their capacity to automate repetitive tasks like picking, palletizing, and sorting. When integrated with AI and machine learning, these arms achieve higher precision and flexibility, enabling them to handle diverse SKUs with greater accuracy and speed.

The warehouse robotics market is segmented by end-use into automotive, chemical, semiconductor & electronics, e-commerce, healthcare, food & beverage, metals & heavy machinery, and other industries. In 2024, the e-commerce sector accounted for 25.8% of the overall market share. The increasing reliance on digital commerce has amplified the demand for advanced automation tools to support high-throughput operations and timely last-mile delivery. E-commerce players are leveraging robotics to streamline inventory control, improve picking efficiency, and deliver faster order turnaround times to maintain customer satisfaction.

U.S. Warehouse Robotics Market is projected to reach USD 35.3 billion by 2034, largely driven by surging automation initiatives led by top-tier e-commerce giants. With rising labor costs and the growing need for intelligent, scalable automation systems, U.S. warehouses are turning to robotics to enhance operational efficiency and reduce overheads.

Prominent players in the Global Warehouse Robotics Market include ABB, KUKA, Fanuc Corporation, Yaskawa Electric Corporation, Dematic, and Honeywell Intelligrated. These companies are investing heavily in next-gen robotics to deliver smarter, more adaptive solutions. Through AI integration, strategic collaborations with logistics leaders, and continuous R&D, these firms aim to strengthen their presence across high-growth regions and address the evolving demands of the warehousing landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising E-commerce industry

- 3.2.1.2 Advancements in AI and machine learning

- 3.2.1.3 Labor shortages and rising wages

- 3.2.1.4 Increasing adoption of autonomous mobile robots (AMRs)

- 3.2.1.5 Growing demand for warehouse automation in the retail and logistics sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complexity in system integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Billion)

- 5.1 Safety systems

- 5.2 Communication systems

- 5.3 Job control systems

- 5.4 Traffic management systems

- 5.5 Battery charging systems

- 5.6 Sensors

- 5.7 Controllers

- 5.8 Drives

- 5.9 Robotic arms

Chapter 6 Market estimates & forecast, By Robot Type, 2021 - 2034 (USD Billion)

- 6.1 Autonomous mobile robots (AMRs)

- 6.2 Automated guided vehicles (AGVs)

- 6.3 Articulated robots

- 6.4 Cylindrical robots

- 6.5 SCARA robots

- 6.6 Collaborative robots

- 6.7 Parallel robots

- 6.8 Cartesian robots

Chapter 7 Market estimates & forecast, By Payload Capacity, 2021 - 2034 (USD Billion)

- 7.1 Less than 20 kg

- 7.2 20–100 kg

- 7.3 100–200 kg

- 7.4 More than 200 kg

Chapter 8 Market estimates & forecast, By End Use, 2021 - 2034 (USD Billion)

- 8.1 Automotive

- 8.2 Chemical

- 8.3 Semiconductor & electronics

- 8.4 E-commerce

- 8.5 Food & beverage

- 8.6 Healthcare

- 8.7 Metals & heavy machinery

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Amazon Robotics

- 10.3 Bastian Solutions

- 10.4 Boston Dynamics

- 10.5 Daifuku

- 10.6 Dematic

- 10.7 Fanuc Corporation

- 10.8 Fives

- 10.9 Fortna

- 10.10 Geek+

- 10.11 GreyOrange

- 10.12 Honeywell Intelligrated

- 10.13 Knapp

- 10.14 Korber

- 10.15 KUKA

- 10.16 Murata Machinery

- 10.17 SSI Schaefer

- 10.18 Symbotic

- 10.19 Swisslog

- 10.20 Vanderlande

- 10.21 Yaskawa Electric Corporation