PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721568

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721568

Animal Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

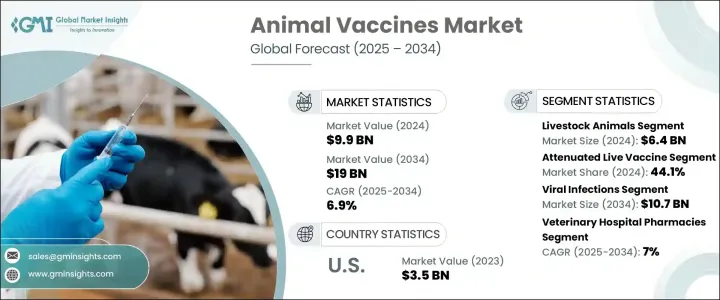

The Global Animal Vaccines Market was valued at USD 9.9 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 19 billion by 2034. The global demand for animal vaccines is on the rise as concerns over animal health and food safety gain increasing prominence. With the growing emphasis on preventing zoonotic diseases and reducing economic losses from animal disease outbreaks, the importance of vaccination programs has grown multifold. A steady rise in the global animal population, along with the increasing trend of pet adoption and ownership, is reshaping how veterinary care is perceived and prioritized. Pet owners today are more inclined to invest in preventive healthcare, including vaccinations, to ensure longer and healthier lives for their companion animals. At the same time, livestock farmers are adopting proactive immunization strategies to safeguard their herds against highly contagious diseases that can cripple supply chains and impact international trade. Governments across the globe are tightening regulations related to animal health, implementing compulsory vaccination programs to protect animal welfare, secure the food supply chain, and minimize the risk of cross-species disease transmission. This broader awareness of animal health as an integral part of public health is significantly contributing to market growth.

The animal vaccines market is broadly segmented into two key categories: livestock and companion animals. In 2024, the livestock category dominated the market with a valuation of USD 6.4 billion. Livestock species such as poultry, cattle, swine, and aquaculture are critical to global food security and agricultural economies. Preventing disease outbreaks in these animals is crucial to maintaining productivity and minimizing financial losses. Incidences of foot-and-mouth disease, swine fever, and avian influenza remain serious concerns in this sector, reinforcing the need for robust vaccination strategies. While the companion animal segment is also expanding due to rising pet ownership and increased attention to pet wellness, the livestock segment continues to generate the highest revenue.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $19 Billion |

| CAGR | 6.9% |

Vaccines in the animal health sector include several types, such as attenuated live, conjugate, inactivated, DNA, recombinant, and others. Among these, attenuated live vaccines held the highest market share in 2024, accounting for 44.1% of the total. These vaccines are widely favored for their ability to produce strong immune responses and deliver long-term protection. Their capability to stimulate both humoral and cell-mediated immunity often reduces the need for repeated doses, making them a preferred option in both livestock and companion animal vaccination programs.

North America accounted for 40.6% of the global animal vaccines market in 2024. This dominant share is driven by a large population of domesticated animals and livestock in the region. The United States leads in pet ownership and has a well-established agricultural sector comprising cattle, poultry, and swine. The ongoing focus on maintaining herd health and minimizing infectious disease risks continues to drive vaccine adoption in the region.

Key players shaping the global animal vaccine landscape include Zoetis, Merck Animal Health, Virbac, Boehringer Ingelheim International, Bioveta, Brilliant Bio Pharma, Dechra Pharmaceuticals, Vetoquinol, Neogen Corporation, Elanco Animal Health, Hipra Animal Health Limited, and Henry Schein Animal Health (Covetrus, Inc.). These companies are actively expanding their vaccine portfolios through extensive research and development. Strategic partnerships with veterinary organizations and government agencies are helping improve vaccine accessibility. Additionally, the adoption of advanced technologies like genetic engineering and recombinant DNA is enabling the creation of more effective, long-lasting vaccines tailored to evolving disease threats.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of zoonotic diseases

- 3.2.1.2 Expanding livestock industry and food security concerns

- 3.2.1.3 Increasing pet adoption and expenditure on animal health

- 3.2.1.4 Advancements in vaccine technology

- 3.2.1.5 Increasing outbreaks of animal diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development costs

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Product pipeline analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Livestock animals

- 5.2.1 Poultry

- 5.2.2 Cattle

- 5.2.3 Swine

- 5.2.4 Aquaculture

- 5.2.5 Sheep and goats

- 5.3 Companion animals

- 5.3.1 Canine

- 5.3.2 Feline

- 5.3.3 Equine

- 5.3.4 Avian

Chapter 6 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Attenuated live vaccine

- 6.3 Conjugate vaccine

- 6.4 Inactivated vaccine

- 6.5 DNA vaccine

- 6.6 Recombinant vaccine

- 6.7 Other vaccine types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacterial infections

- 7.3 Viral infections

- 7.4 Parasitic infections

- 7.5 Fungal infections

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Injection vaccines

- 8.3 Oral vaccines

- 8.4 Immersion/spray vaccines

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 E-commerce

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Boehringer Ingelheim International

- 11.2 Brilliant Bio Pharma

- 11.3 Bioveta

- 11.4 Ceva Sante Animale

- 11.5 Durvet

- 11.6 Dechra Pharmaceuticals

- 11.7 Elanco Animal Health

- 11.8 Henry Schein Animal Health (Covetrus, Inc.)

- 11.9 Hipra Animal Health Limited

- 11.10 Indian Immunologicals

- 11.11 Merck Animal Health

- 11.12 Neogen Corporation

- 11.13 Vetoquinol

- 11.14 Virbac

- 11.15 Zoetis