PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721574

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721574

Biopsy Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

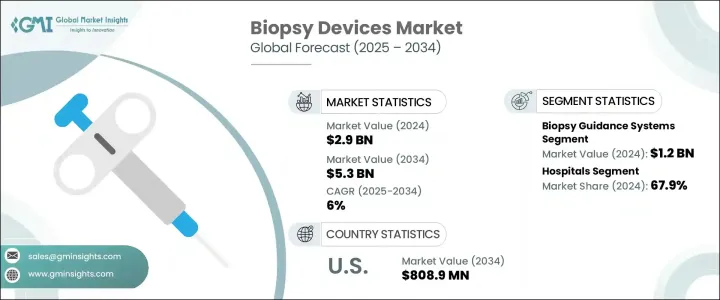

The Global Biopsy Devices Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 5.3 billion by 2034. Biopsy devices serve a critical role in modern healthcare by allowing the extraction of tissue samples for diagnostic evaluation. These tools support the identification and analysis of a wide range of medical conditions, often being instrumental in detecting and confirming malignancies. The increasing global burden of chronic diseases, particularly cancer, is pushing the demand for advanced diagnostic solutions. With rising emphasis on early detection, accurate diagnosis, and timely treatment planning, the role of biopsy devices has become more important than ever. The growing preference for image-guided and minimally invasive procedures has led to continuous innovation in biopsy technologies, further improving accuracy and reducing patient recovery time.

More healthcare professionals are now shifting toward devices that offer precision, ease of use, and real-time monitoring. Hospitals and diagnostic centers are also adapting quickly to this shift, which is helping streamline workflows and improve outcomes. Increasing global awareness and access to advanced diagnostic care are fueling the adoption of biopsy equipment across developed and emerging economies. Government initiatives and healthcare reforms focused on improving cancer diagnostics are also contributing to market expansion. Moreover, as procedural volumes continue to rise, providers are investing in efficient, patient-centric biopsy solutions that align with modern clinical demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6% |

The market is segmented by product type into needle-based biopsy guns, biopsy guidance systems, biopsy forceps, biopsy needles, and other associated devices. Among these, biopsy guidance systems held the largest share, generating revenue worth USD 1.2 billion in 2024. Their rising use is largely due to their ability to deliver real-time imaging and precise targeting, making them ideal for procedures requiring accuracy and minimal invasiveness. These systems are now seen as integral to clinical workflows where effective visualization is essential for locating and sampling tissues that are small or difficult to reach. With enhanced compatibility across different imaging modalities, biopsy guidance systems are helping healthcare professionals reduce procedural errors and boost patient safety. These tools are increasingly being integrated into hospital and diagnostic center environments, where their multi-functional capabilities are improving throughput and optimizing overall outcomes.

From the end-user perspective, the biopsy devices market is categorized into hospitals, ambulatory surgical centers, and other settings. Hospitals emerged as the dominant user segment, accounting for 67.9% of the overall market revenue in 2024, with projections estimating the value to reach USD 3.6 billion by 2034. Hospitals continue to lead in terms of adoption due to their access to high-end imaging equipment and skilled personnel capable of performing advanced biopsy techniques. The increasing need for accurate, real-time tissue sampling in complex diagnostic cases makes hospitals a preferred setting for these procedures. The rise in admissions related to chronic diseases and advanced diagnostics is pushing hospitals to invest in more sophisticated biopsy systems. Additionally, there has been significant growth in the use of robotic-assisted and minimally invasive procedures within these environments, improving both efficiency and patient satisfaction. Hospitals are also becoming central hubs for multidisciplinary treatment approaches, where precise diagnostics play a foundational role.

In regional terms, North America remains a leading contributor to the global biopsy devices market. The United States, in particular, has demonstrated strong market growth, with biopsy device revenue expected to rise from USD 451.9 million in 2023 to USD 808.9 million by 2034. This growth can be attributed to a well-established healthcare infrastructure, high procedural volumes, and favorable insurance coverage that supports advanced diagnostic interventions. Positive reimbursement environments enable both in-patient and out-patient facilities to adopt the latest biopsy technologies without significant financial barriers, promoting widespread use across multiple care settings.

The competitive landscape features several global leaders who maintain a stronghold through continued investments in technology, product innovation, and strategic acquisitions. Established players hold a considerable portion of the market thanks to their robust portfolios and commitment to integrated diagnostic solutions. At the same time, newer entrants and mid-tier manufacturers are gaining ground by focusing on cost-effective, specialized devices catering to targeted clinical applications. With growing interest in precision-guided, less invasive diagnostic tools, the biopsy devices industry is expected to see ongoing advancements tailored to the evolving demands of modern healthcare.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cancer across the globe

- 3.2.1.2 Technological advancements in biopsy devices

- 3.2.1.3 Favorable reimbursement scenario

- 3.2.1.4 Increasing awareness regarding breast cancer

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of complications after biopsy

- 3.2.2.2 Dearth of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biopsy guidance systems

- 5.2.1 Manual

- 5.2.2 Robotic

- 5.3 Needle based biopsy guns

- 5.3.1 Vacuum-assisted biopsy (VAB) devices

- 5.3.2 Fine needle aspiration biopsy (FNAB) devices

- 5.3.3 Core needle biopsy (CNB) devices

- 5.4 Biopsy needles

- 5.4.1 Disposable

- 5.4.2 Reusable

- 5.5 Biopsy forceps

- 5.5.1 General biopsy forceps

- 5.5.2 Hot biopsy forceps

- 5.6 Other product types

- 5.6.1 Brushes

- 5.6.2 Curettes

- 5.6.3 Punches

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Argon Medical Devices

- 8.2 B. Braun Melsungen

- 8.3 Becton, Dickinson, and Company

- 8.4 Boston Scientific

- 8.5 Cardinal Health

- 8.6 Cook Group

- 8.7 Devicor Medical Products

- 8.8 FUJIFILM

- 8.9 Hologic

- 8.10 INRAD

- 8.11 Medtronic

- 8.12 Olympus Corporation

- 8.13 Stryker Corporation