PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721584

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721584

Jute Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

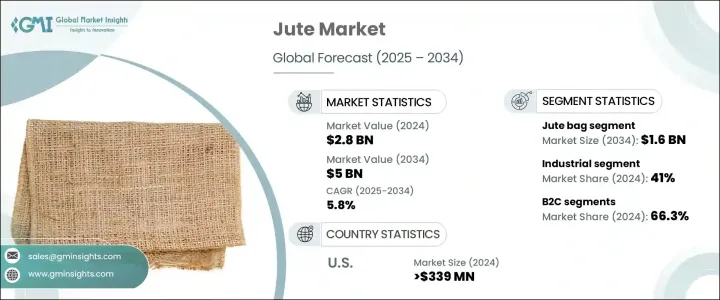

The Global Jute Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 5 billion by 2034, driven by rising environmental concerns and the global push to replace plastic with sustainable alternatives. Jute, a biodegradable and renewable material, is gaining rapid traction for its eco-friendly properties and exceptional versatility across industries. As global awareness around sustainability intensifies, businesses, policymakers, and consumers are actively seeking greener solutions. Jute's low environmental impact, minimal resource consumption, and compatibility with circular economy principles make it a preferred choice across packaging, construction, agriculture, and automotive sectors.

The market is witnessing a strong surge in demand as industries realign their material strategies to prioritize environmental stewardship. Government initiatives worldwide, such as bans on single-use plastics, incentives for sustainable material adoption, and regulations promoting green packaging, are further accelerating jute's adoption. With ESG goals becoming central to corporate agendas and consumers increasingly demanding eco-conscious products, jute is well-positioned to capitalize on this paradigm shift.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5 Billion |

| CAGR | 5.8% |

Consumer preferences are evolving quickly toward choices that emphasize both functionality and environmental responsibility. Jute, being biodegradable, renewable, and requiring low resource input, continues to capture attention across a wide spectrum of industries. Governments around the world are reinforcing this shift by introducing stricter regulations, tax benefits, and incentives that encourage the use of sustainable packaging and textiles, paving the way for jute's growing relevance.

Industries are swiftly replacing synthetic, non-biodegradable materials with jute-based alternatives. This transition is clearly visible in packaging, agriculture, automotive, and home furnishings. Jute's ability to integrate into circular economy models-where materials are reused, recycled, or safely returned to the environment-makes it a highly attractive choice for companies striving to meet carbon neutrality targets and sustainability commitments.

The jute bag segment alone generated USD 965.5 million in 2024 and is projected to reach USD 1.6 billion by 2034. Known for their biodegradability, durability, and reusability, jute bags are gaining popularity in both fashion and packaging sectors. Brands are leveraging jute bags to showcase eco-conscious branding, incorporating trendy designs and prints that appeal to modern consumers. Promotional use is also expanding rapidly as businesses aim to reduce their plastic footprint while enhancing their sustainability narratives.

Among end-users, the industrial segment commanded a 41% share in 2024, fueled by the use of jute-based materials in civil engineering, packaging, and automotive industries. Regulatory backing for sustainable materials continues to drive innovation and adoption of jute composites. Civil construction projects, in particular, are adopting jute geotextiles for their cost-effectiveness, biodegradability, and practical efficiency.

The United States Jute Market generated USD 339 million in 2024, reflecting rising demand for sustainable packaging and increasing imports of jute-based products. The US stands as a key market for Indian jute exports, driven by a growing eco-conscious consumer base and intensified governmental focus on reducing plastic waste, especially in printed jute bag segments.

Leading players shaping the Global Jute Market include Cheviot, Bangalore Fort Farms, Budge Budge Company, AI Champdany Industries, and Premchand Jute & Industries. These companies are emphasizing product innovation, diversifying jute-based solutions, expanding exports, and investing heavily in R&D to create superior, blended jute fabrics. Strategic global partnerships and the adoption of automation technologies are helping these firms scale operations, cut costs, and elevate quality standards to meet growing market demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Trade volume disruptions

- 3.2.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.2 Demand-side impact (selling price)

- 3.3.2.1 Price transmission to end markets

- 3.3.2.2 Market share dynamics

- 3.3.2.3 Consumer response patterns

- 3.3.1 Supply-side impact (raw materials)

- 3.4 Key companies impacted

- 3.5 Strategic industry responses

- 3.5.1 Supply chain reconfiguration

- 3.5.2 Pricing and product strategies

- 3.5.3 Policy engagement

- 3.6 Outlook and future considerations

- 3.7 Supplier landscape

- 3.8 Profit margin analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Environmental concern for synthetic material

- 3.11.1.2 Government regulation

- 3.11.1.3 Competition from synthetic material

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Fluctuating prices

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Jute bags

- 5.3 Jute handicrafts

- 5.4 Jute textile

- 5.5 Jute apparel

- 5.6 Jute furnishings

- 5.7 Other jute products

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 B2B

- 7.3 B2C

- 7.3.1 Hypermarkets and supermarkets

- 7.3.2 Specialty stores

- 7.3.3 Online

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aarbur

- 9.2 AI Champdany Industries

- 9.3 Bangalore Fort Farms

- 9.4 Budge Budge Company

- 9.5 Cheviot

- 9.6 Gloster Limited

- 9.7 Hitaishi-KK

- 9.8 Howrah Mills Co. Ltd.

- 9.9 Ludlow Jute & Specialities

- 9.10 Premchand Jute Industries

- 9.11 Shree Jee International India