PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721601

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721601

Smart Diapers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

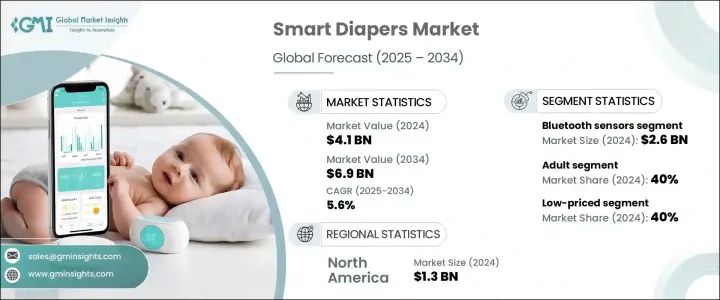

The Global Smart Diapers Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 6.9 billion by 2034. With digital health and wellness technologies becoming a regular part of daily life, smart diapering solutions are gaining rapid traction across global markets. Parents, caregivers, and healthcare providers are showing increased interest in smart diapers that offer convenience, real-time monitoring, and improved hygiene. These products align perfectly with the modern lifestyle that prioritizes efficiency, comfort, and data-driven caregiving. Whether used for infants, adults, or individuals with special care needs, smart diapers serve as a meaningful advancement over traditional alternatives. Integrated sensors enable caregivers to receive instant alerts on moisture levels, reducing unnecessary physical checks and minimizing the risk of skin irritation or infection. The market is also seeing growth due to the rising awareness surrounding personal care technologies, especially in urban households, where busy schedules demand practical solutions. As consumers increasingly opt for automated support systems in childcare and eldercare, the demand for smart diapers continues to surge. This shift is further supported by tech-savvy consumers who actively seek innovative, app-connected products that offer real-time insights, comfort, and long-term health benefits.

Bluetooth-enabled sensor diapers held the largest revenue share in 2024, generating USD 2.6 billion, and are projected to expand at a CAGR of 5.1% through 2034. These smart solutions transmit real-time data to mobile apps and connected devices, allowing caregivers to receive instant wetness notifications. Their popularity stems from their ability to prevent prolonged exposure to moisture, which is known to cause skin rashes and urinary infections. With easy-to-use interfaces and high accuracy in tracking, Bluetooth-integrated smart diapers are now preferred both at home and in professional caregiving settings such as hospitals and senior care centers. Their ability to enhance hygiene and reduce manual intervention continues to attract more users.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 5.6% |

Adult users accounted for 40% of the market share in 2024. This segment continues to expand due to the global rise in elderly populations and the growing focus on improving the quality of care in nursing homes and healthcare facilities. Smart diapers have transformed how incontinence is managed, providing prompt alerts and allowing caregivers to act faster. They offer better skin protection and comfort for seniors while reducing the workload of caregivers. Consumers are also integrating these smart solutions into their everyday routines, particularly in households with aging family members or individuals requiring special care.

North America Smart Diapers Market generated USD 1.3 billion in 2024. Widespread adoption of health tech, increasing disposable incomes, and a high number of dual-income households support regional market dominance. Working parents prefer smart diapering solutions that offer convenience and save time through automated wetness detection, helping them manage childcare more effectively. The growing dependence on tech-driven solutions across the healthcare and consumer sectors continues to support regional growth.

Key players in the Global Smart Diapers Industry include Ontex, Sensassure, HARTMANN, Abena, Simavita, Pixie Scientific, Kimberly Clark, Drylock Technologies, Wonderkin, Monit, Sinopulsar Technology, Essity, Procter & Gamble, Attends Healthcare Products, and Medline Industries. These companies are investing in advanced sensor technology, app connectivity, and user-friendly features. Some are collaborating with healthcare institutions to expand trials, while others are focusing on sustainable materials and subscription models to attract long-term users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Consumer buying behavior analysis

- 3.6.1 Demographic trends

- 3.6.2 Factors affecting buying decisions

- 3.6.3 Product preference

- 3.6.4 Preferred price range

- 3.6.5 Preferred distribution channel

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing awareness towards convivence & hygiene

- 3.7.1.2 Expansion into healthcare industry

- 3.7.1.3 Increasing aging population

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High costs of diaper

- 3.7.2.2 Lack of awareness among developing countries

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 RFID tags

- 5.3 Bluetooth sensors

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Baby

- 6.3 Adult

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce platforms

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Supermarkets/hypermarkets

- 8.3.2 Specialty stores

- 8.3.3 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Abena

- 10.2 Attends Healthcare Products

- 10.3 Drylock Technologies

- 10.4 Essity

- 10.5 HARTMANN

- 10.6 Kimberly Clark

- 10.7 Medline Industries

- 10.8 Monit

- 10.9 Ontex

- 10.10 Pixie Scientific

- 10.11 Procter & Gamble

- 10.12 Sensassure

- 10.13 Simavita

- 10.14 Sinopulsar Technology

- 10.15 Wonderkin