PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721612

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721612

Light Tower Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

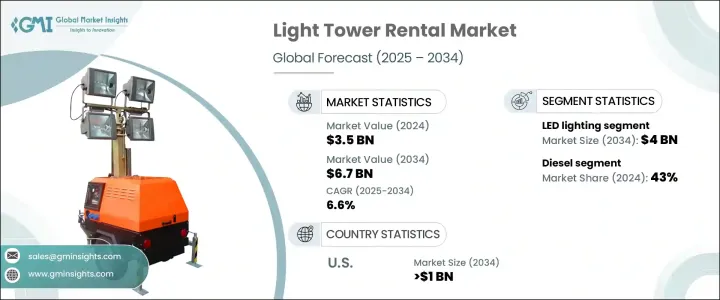

The Global Light Tower Rental Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 6.7 billion by 2034. The rising need for reliable, temporary lighting solutions across sectors such as construction, infrastructure development, emergency response, and outdoor events is playing a significant role in driving market expansion. Rapid urbanization, ongoing infrastructure upgrades, and increasing nighttime operations in industries like oil and gas and mining are contributing heavily to the demand for portable lighting systems. The rental model remains a preferred choice for businesses aiming to minimize capital investment while gaining access to advanced, high-performing light towers on a project basis. This trend is further reinforced by growing concerns around energy efficiency and environmental impact, which are prompting users to opt for technologically advanced, eco-friendly lighting solutions. Manufacturers and rental service providers are continuously upgrading their product lines with hybrid, solar-powered, and LED-based systems to meet evolving industry requirements. With sustainability targets gaining prominence across global industries, the shift toward clean energy-powered lighting towers is expected to accelerate in the coming years.

The market is witnessing increasing integration of smart technologies like remote monitoring and telematics in light towers, allowing users to track fuel usage, operating hours, and performance parameters in real time. These innovations not only enhance operational efficiency but also support preventive maintenance and reduce downtime. Industry participants are offering tailored rental plans and round-the-clock support to meet diverse client needs across construction sites, disaster recovery areas, and industrial operations. Moreover, governments and regulatory bodies enforcing stricter emission norms are pushing end-users to adopt cleaner alternatives, thereby influencing rental companies to diversify their fleets with sustainable options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 6.6% |

The light tower rental market is segmented based on power sources, including diesel, solar, direct, and others. Among these, diesel-powered towers continue to dominate with a 43% market share in 2024 and are estimated to grow at a CAGR of 5% through 2034. Their widespread use stems from their high output and reliability in remote, off-grid areas. Despite growing concerns over fuel costs and emissions, diesel remains a go-to option for many due to its robustness and efficiency. However, solar-powered towers are quickly gaining ground as cleaner alternatives, especially in projects where sustainability is a key requirement.

The LED lighting segment is expected to generate USD 4 billion by 2034. LEDs are becoming increasingly favored due to their superior energy efficiency, extended lifespan, and minimal maintenance requirements compared to older technologies such as metal halide lamps. Their ability to provide bright, uniform illumination while consuming less power makes them ideal for rental applications.

The U.S. Light Tower Rental Market is forecast to reach USD 1 billion by 2034. Rising demand for solar and LED-powered units in construction, oil, gas, and infrastructure projects is driving this growth. Sustainability goals and evolving emissions regulations are pushing rental firms to expand their fleets with environmentally friendly lighting solutions. Remote monitoring and hybrid models are also seeing greater adoption across the country, supporting operational efficiency and compliance.

Key players in the global market include Pro Tool & Supply, Access Hire Australia, BigRentz, Caterpillar, MacAllister Machinery, Cooper Equipment Rentals, Guys Rents, The Home Depot, Larson Electronics, Modern Energy Rental, RentalYard, Sudhir Power, HSS Hire Group, The Duke Company, and United Rentals. To maintain their competitive edge, these companies are focusing on fleet expansion, sustainable product lines, remote monitoring technology, and flexible leasing models to meet the dynamic demands of customers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Lighting, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Metal halide

- 5.3 LED

- 5.4 Electric

- 5.5 Others

Chapter 6 Market Size and Forecast, By Power Source, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Solar

- 6.4 Direct

- 6.5 Others

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Manual lifting system

- 7.3 Hydraulic lifting system

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Infrastructure development

- 8.4 Oil & gas

- 8.5 Mining

- 8.6 Military & defense

- 8.7 Emergency & disaster relief

- 8.8 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Iran

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 Access Hire Australia

- 10.2 BigRentz

- 10.3 Caterpillar

- 10.4 Cooper Equipment Rentals

- 10.5 Guys Rents

- 10.6 The Home Depot

- 10.7 HSS Hire Group

- 10.8 Larson Electronics

- 10.9 MacAllister Machinery

- 10.10 Modern Energy Rental

- 10.11 Pro Tool & Supply

- 10.12 RentalYard

- 10.13 Sudhir Power

- 10.14 The Duke Company

- 10.15 United Rentals