PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721614

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721614

Specialty Commercial Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

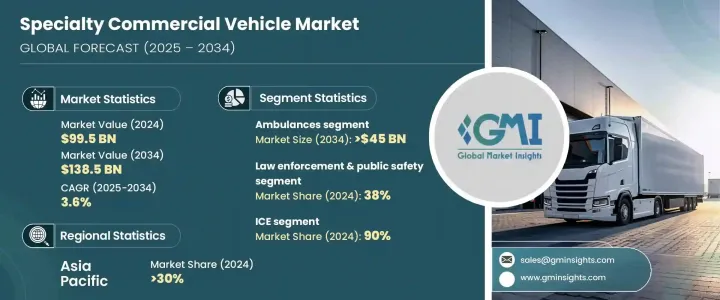

The Global Specialty Commercial Vehicle Market was valued at USD 99.5 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 138.5 billion by 2034. The growth trajectory of this market is being driven by rising demand for specialized transportation solutions tailored to emergency response, healthcare delivery, and public safety. As urbanization accelerates and healthcare systems evolve, there is a growing reliance on mobile units that can bring essential services directly to communities. Governments and private organizations are expanding their fleets to enhance accessibility and responsiveness, particularly in underserved and remote regions. The growing burden of chronic illnesses, a rising aging population, and the increasing emphasis on preventive care are pushing authorities to invest in vehicles equipped with smart healthcare capabilities. Moreover, in the post-pandemic landscape, infection control and remote diagnostics have become core considerations, further fueling demand for specialty vehicles that align with modern healthcare standards. From high-tech ambulances to mobile clinics and fire-rescue units, the global market is witnessing a transformation driven by innovation, technology integration, and a broader shift toward decentralized care and public safety operations.

The demand for specialized vehicles continues to rise as investments pour into advanced emergency response systems, including next-generation ambulances and mobile healthcare units. Heightened awareness around public health, combined with a renewed push to deliver medical services to rural and hard-to-reach areas, is propelling the deployment of mobile ICU vans and paramedic vehicles. Infection control protocols and the growing adoption of telemedicine tools are further accelerating the demand for modern specialty vehicles across global markets. In parallel, the increasing frequency of natural disasters and climate-induced emergencies is driving nations to bolster their firefighting fleets and public safety vehicle infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $99.5 Billion |

| Forecast Value | $138.5 Billion |

| CAGR | 3.6% |

Ambulances accounted for a 40% share of the global market in 2024 and are projected to generate USD 45 billion by 2034. Governments and private healthcare operators are prioritizing shorter emergency response times and are outfitting vehicles with state-of-the-art communication systems, 5G connectivity, and real-time patient monitoring solutions. These innovations enable seamless hospital coordination and better patient outcomes during transport. As digital healthcare continues to evolve, smart ambulance technology is expected to play a critical role in next-gen emergency response strategies.

Law enforcement and public safety vehicles captured a 38% market share in 2024, fulfilling diverse roles from mobile diagnostic labs to treatment units in remote zones. As the healthcare delivery model becomes more decentralized, there is strong momentum behind mobile services offering diagnostics, outpatient care, and dialysis. These vehicles support home-based care delivery and enhance access in under-resourced areas, driving a new wave of innovation in specialty vehicle design.

Asia Pacific represented 30% of the global market in 2024, led by China's rapid infrastructure development and investment in smart mobility. Rising demand for ambulances, fire trucks, and utility vans in the region is backed by government incentives favoring clean, sustainable vehicle fleets.

Major players such as Farber Specialty Vehicles, Mercedes-Benz, Volvo, Isuzu, Traton, Pierce, REV, LDV, Oshkosh Corporation, and NFI are pushing the envelope through electrification, modular designs, and AI-powered diagnostics. Strategic collaborations with municipalities and healthcare providers are helping these companies strengthen local footprints and meet rising demand across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Manufacturers

- 3.2.4 Service providers

- 3.2.5 Distributors

- 3.2.6 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade volume disruptions

- 3.3.2 Retaliatory measures

- 3.3.3 Impact on the industry

- 3.3.4 Supply-side impact

- 3.3.5 Demand-side impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Price trends

- 3.10 Cost breakdown analysis

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for emergency medical services across the globe

- 3.11.1.2 Increasing government investments in disaster response

- 3.11.1.3 Growing remote industrial activities

- 3.11.1.4 Surge in recreational travel

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial cost and long production lead times

- 3.11.2.2 Stringent regulatory and certification requirements

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Ambulances

- 5.3 Fire extinguishing trucks

- 5.4 Mobile fuel carrying tankers

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

- 6.3.1 BEV

- 6.3.2 HEV

- 6.3.3 PHEV

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Medical & healthcare

- 7.3 Law enforcement & public safety

- 7.4 Recreational vehicles

- 7.5 Municipal services

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Arctic Cat

- 9.2 Cargotec

- 9.3 Case New Holland

- 9.4 Demers Ambulances

- 9.5 Eicher

- 9.6 Emergency One

- 9.7 Farber Specialty Vehicles

- 9.8 Hino Motors

- 9.9 Isuzu

- 9.10 LDV

- 9.11 Matthews Specialty Vehicles

- 9.12 Mercedes-Benz

- 9.13 NFI

- 9.14 Oshkosh Corporation

- 9.15 Pierce

- 9.16 REV

- 9.17 Rosenbauer International

- 9.18 Specialty Vehicles

- 9.19 Traton

- 9.20 Volvo