PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721631

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721631

Industrial Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

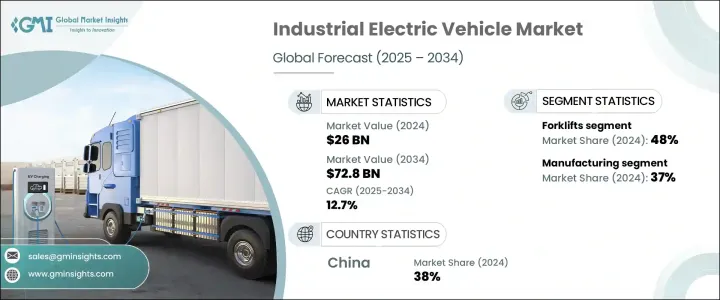

The Global Industrial Electric Vehicle Market was valued at USD 26 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 72.8 billion by 2034. This momentum stems from rising environmental awareness, regulatory mandates, and the evolution of support infrastructure such as EV-friendly industrial service centers. The growing urgency to reduce carbon emissions and operating costs has positioned electric vehicles as a viable alternative to traditional internal combustion engines. Businesses are now prioritizing electrification in logistics and warehouse operations not only to align with eco-goals but also to leverage long-term cost efficiencies. As industrial processes undergo digital transformation, the demand for quiet, emission-free, and automation-compatible vehicles is accelerating across global markets. Advancements in battery technologies and falling costs have further strengthened the case for electric adoption, making it easier for businesses to transition without compromising performance or scalability.

Among vehicle types, forklifts held the largest market share at 48% in 2024 and are expected to expand at a CAGR of over 13% through 2034. Their application across industries is growing rapidly, driven by the need for smart, low-emission material handling solutions that align with modern warehousing and manufacturing standards. On the application front, the manufacturing segment led the market with a 37% share in 2024 and is projected to grow at over 13% CAGR through the forecast period. This growth is being shaped by cleaner production mandates, tighter emissions regulations, and the growing demand for energy-efficient vehicle fleets that can seamlessly integrate with smart factory ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26 Billion |

| Forecast Value | $72.8 Billion |

| CAGR | 12.7% |

By propulsion, Battery Electric Vehicles (BEVs) continue to dominate the market, supported by their high energy efficiency, lower total cost of ownership, and zero dependence on fossil fuels. These vehicles offer quiet operation and minimal maintenance and are ideal for indoor and enclosed industrial environments. They are also easier to automate, making them increasingly suitable for Industry 4.0-enabled operations. Government incentives and emission-related regulations are also making BEVs the preferred option across various industrial domains.

Regionally, China led the Asia Pacific industrial electric vehicle market in 2024, capturing around 38% share and generating nearly USD 4.5 billion in revenue. The country's strong industrial base, proactive government support for clean energy transitions, and advanced EV manufacturing capabilities have positioned it as a key market player. Rapid automation in warehousing and aggressive electrification goals continue to drive regional demand, further strengthened by initiatives that promote smart factory infrastructure.

Key players in the global market include Hangcha Forklift, Hyundai Construction Equipment, Hyster-Yale Materials Handling, Jungheinrich AG, KION Group, Manitou, Komatsu, MITSUBISHI LOGISNEXT, Sany Electric, and Toyota. These companies are heavily investing in modular electric vehicle designs, expanding R&D in battery efficiency, and integrating IoT and telematics for real-time diagnostics. Their strategic efforts also involve expanding local production and aftersales service hubs to enhance market reach and customer support across both developed and emerging economies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material providers

- 3.2.2 Component providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Trump administration tariffs

- 3.3.1 Supply-side impact (Raw Materials)

- 3.3.2 Price volatility in key materials

- 3.3.3 Production cost implications

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rise in government initiatives for electric vehicles

- 3.9.1.2 Increasing demand for battery-operated forklift

- 3.9.1.3 Technology advancement in electric technology

- 3.9.1.4 Increasing demand for industrial vehicle form manufacturing industry

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs of industrial electric vehicles

- 3.9.2.2 Battery limitations and downtime

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Tow tractors

- 5.3 Forklifts

- 5.4 Container handlers

- 5.5 Aisle trucks

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicles (BEV)

- 6.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 6.4 Hybrid Electric Vehicles (HEV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Warehousing

- 7.4 Freight & logistics

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Aisle Master

- 9.2 Alke

- 9.3 Anhui Heli

- 9.4 Aprolis

- 9.5 CLARK

- 9.6 Crown Equipment

- 9.7 Doosan Industrial Vehicle

- 9.8 EP Equipment

- 9.9 Hangcha Forklift

- 9.10 Hyster-Yale Materials Handling

- 9.11 Hyundai Construction Equipment

- 9.12 Jungheinrich AG

- 9.13 Kalmar Global

- 9.14 KION Group

- 9.15 Komatsu

- 9.16 Manitou

- 9.17 Mitsubishi Logisnext

- 9.18 Motrec International

- 9.19 Sany Electric

- 9.20 Toyota Material Handling