PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740746

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740746

Surgical Helmet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

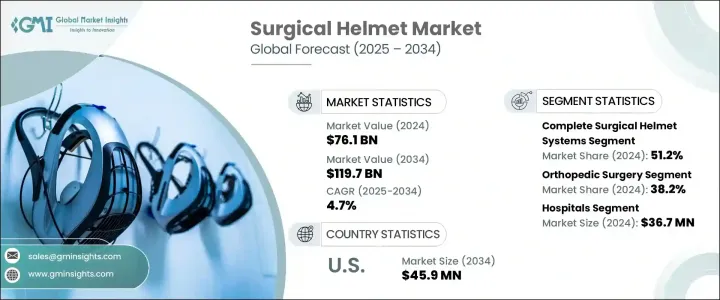

The Global Surgical Helmet Market was valued at USD 76.1 million in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 119.7 million by 2034. This growth is largely driven by the increasing demand for safer surgical environments and the rising number of complex medical procedures being performed worldwide. As surgical practices continue to evolve, there's a growing emphasis on protective equipment that minimizes the risk of contamination and infection during operations. Surgical helmets have become an essential part of operating room protocols, designed to maintain sterility and offer advanced protective features. These helmets not only cover the surgeon's head but often come equipped with additional functionalities such as built-in lighting, ventilation systems, and powered air supply mechanisms, enhancing both safety and surgeon comfort during long procedures.

Market expansion is significantly influenced by the increased global incidence of injuries requiring surgery. The rising number of emergency surgeries, particularly those involving trauma, has amplified the need for effective protective gear. As surgical volumes climb, so does the demand for headgear that can ensure a sterile and contamination-free operating space. Additionally, improvements in surgical helmet design and technology have made them more accessible and effective for daily use in high-risk surgical environments. These modern helmets not only shield the surgical staff from airborne pathogens and bodily fluids but also reduce fatigue during long procedures by integrating ergonomic and visual enhancements. Manufacturers are responding by developing advanced models with better airflow, improved visibility, and lightweight materials, all aimed at enhancing user experience while maintaining strict hygiene standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $76.1 Million |

| Forecast Value | $119.7 Million |

| CAGR | 4.7% |

In terms of product type, complete surgical helmet systems took the lead in 2024, accounting for 51.2% of the global market. Their dominance is due to the all-in-one nature of these systems, which offer comprehensive protection. These helmets typically cover the entire head and upper body, creating a sealed barrier that minimizes the chances of cross-contamination. Their popularity is further boosted by the availability of variations featuring integrated LED lighting, which supports better visibility in challenging surgical environments. This added feature not only improves the precision of procedures but also reduces visual strain on the surgical team.

The market also shows strong segmentation based on application. Orthopedic surgeries represented the largest application area in 2024, capturing a 38.2% market share. The growing number of procedures related to joint reconstruction, spinal corrections, and other musculoskeletal conditions is fueling this demand. These surgeries often involve long hours and carry a high risk of exposure to infection, making protective headgear a crucial component of operating room gear. The increased frequency of such procedures across both developed and emerging economies highlights the essential role of surgical helmets in modern medicine.

Based on end-use settings, hospitals emerged as the dominant segment, accounting for USD 36.7 million in 2024. Hospitals typically perform a larger volume of surgeries compared to other healthcare facilities, which naturally translates to higher consumption of surgical helmets. Additionally, hospitals are more likely to follow stringent infection control regulations, many of which mandate the use of personal protective equipment. With more financial and infrastructural resources at their disposal, hospitals can invest in higher-quality surgical helmets, reinforcing their leadership position in the market.

The U.S. surgical helmet market is projected to experience considerable growth, with revenues expected to reach USD 45.9 million by 2034. The demand is bolstered by the country's extensive surgical activity and strict regulatory framework regarding surgical safety. The U.S. healthcare sector continues to prioritize infection control and safety measures, making surgical helmets a standard component in operating rooms. This trend is further supported by increasing investments in medical infrastructure and safety technologies.

The global market is competitive, with both established brands and new entrants striving to innovate and improve product offerings. Leading players such as Zimmer Biomet, Stryker, MAXAIR Systems, Ecolab, and THI Total Healthcare Innovation collectively hold around 30% of the market share. These companies are investing in features like advanced ventilation, anti-fog technologies, and integrated face shields to enhance comfort, visibility, and overall surgical performance. As innovation remains central to market competitiveness, manufacturers are constantly upgrading their products to meet evolving surgical requirements and regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of surgical procedures

- 3.2.1.2 Increasing number of road and sports accidents

- 3.2.1.3 Technological advancements in surgical helmets

- 3.2.1.4 Rising emphasis on infection control

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with advanced helmets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Complete surgical helmet systems

- 5.2.1 With LED

- 5.2.2 Without LED

- 5.3 Ventilated surgical helmets

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Orthopedic surgery

- 6.3 Neurosurgery

- 6.4 Cardiac surgery

- 6.5 ENT surgery

- 6.6 General surgery

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers (ASCs)

- 7.4 Specialty clinics

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AresAir

- 9.2 Beijing ZKSK Technology

- 9.3 Ecolab

- 9.4 Kaiser Technology

- 9.5 Maharani Medicare

- 9.6 MAXAIR Systems

- 9.7 Prodancy

- 9.8 Stryker

- 9.9 THI Total Healthcare Innovation

- 9.10 Zimmer Biomet