PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740749

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740749

Electric Vehicle Reducer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

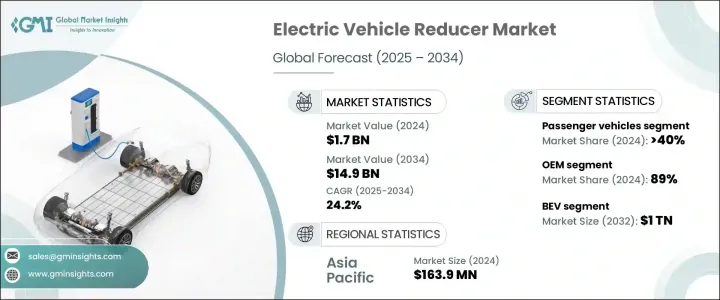

The Global Electric Vehicle Reducer Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 24.2% to reach USD 14.9 billion by 2034. This explosive growth is driven by the accelerating global transition toward electric mobility, as both consumers and corporations increasingly prioritize sustainable transportation. As governments across the globe roll out stricter emission regulations and offer attractive incentives for EV adoption, automakers are rapidly expanding their electric vehicle lineups to meet this rising demand. The shift is not only reshaping traditional vehicle manufacturing but also creating unprecedented opportunities across the EV component ecosystem.

Among these, the demand for EV reducers has surged, as these critical components play a vital role in optimizing drivetrain performance by converting high-speed motor output into manageable torque for the wheels. As electric vehicle production scales up-from compact passenger cars to heavy-duty commercial fleets-the need for reliable, high-efficiency reducers is becoming more crucial than ever. Original equipment manufacturers and tier-1 suppliers are now under intense pressure to deliver next-generation reducer solutions that align with evolving EV architectures and performance expectations. This rising momentum positions the reducer market as a key enabler in the broader electrification landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $14.9 Billion |

| CAGR | 24.2% |

The rising global demand for electric vehicles has directly boosted the need for EV reducers, which are essential in converting the high rotational speed of electric motors to usable torque for driving wheels. As adoption rates grow, the production of electric passenger cars, commercial vehicles, and fleet systems is increasing significantly, leading to higher consumption of reducers. Manufacturers are responding to this demand by optimizing reducers for performance, durability, and energy efficiency. Particularly in commercial and logistics applications, advanced multi-stage reducers are in high demand due to their ability to handle continuous operations while minimizing energy losses. Fleet operators are increasingly seeking high-torque, low-maintenance solutions that reduce the total cost of ownership and enhance drivetrain reliability, which further underscores the importance of efficient reducer systems.

Electric vehicles are making substantial inroads in last-mile delivery, ride-hailing services, and public transportation, expanding the scope of the EV reducer market. Suppliers are under growing pressure to innovate, producing compact, high-torque-density reducer designs that seamlessly integrate into both light-duty and heavy-duty EV platforms. The performance expectations are rising, and so is the need for scalable, modular solutions that meet the demands of various vehicle classes. As a result, major suppliers are heavily investing in R&D to improve energy efficiency and reduce mechanical losses in reducer systems, reinforcing their role in the EV value chain.

In terms of vehicle type, the market is segmented into passenger cars, commercial vehicles, off-highway vehicles, and two- and three-wheelers. In 2024, passenger vehicles led the market with USD 700 million in revenue, capturing a 40% market share. This dominance is largely due to the rapid expansion of electric car sales, especially in urban areas where clean energy vehicles offer substantial benefits in terms of emissions reduction, fuel savings, and lower maintenance costs. Automakers are embedding reducers into purpose-built EV platforms to enhance driving performance and efficiency.

The EV reducer market is also categorized by sales channels, including original equipment manufacturers (OEMs) and the aftermarket. OEMs dominated in 2024, accounting for 89% of total sales. Because reducers are core drivetrain components typically installed during vehicle assembly, OEMs play a pivotal role in market expansion. Global EV manufacturers such as Tesla, BYD, and Volkswagen are driving demand for custom-engineered reducers that meet strict performance benchmarks, fueling OEM-led growth across all regions.

The China Electric Vehicle Reducer Market contributed USD 163.9 million in 2024, reflecting the country's leadership in EV production. China's vertically integrated supply chain, massive production capabilities, and competitive pricing make it a global hub for EV component manufacturing, including reducers. The ability to fulfill high-volume orders quickly and cost-effectively positions China as a dominant player in the global market.

Key players in the global EV reducer market include ZF Friedrichshafen, BorgWarner Inc., Robert Bosch, Schaeffler AG, GKN Automotive, Magna International, and Nidec Corporation. These companies are heavily focused on technological innovation, developing next-generation reducers that deliver improved performance, longevity, and integration flexibility. Strategic collaborations with automakers allow them to tailor reducer systems for specific EV platforms, further solidifying their market position.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators and technology providers

- 3.2.4 End-users

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price analysis

- 3.7.1 By region

- 3.7.2 By EV

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rapid growth in electric vehicle sales

- 3.10.1.2 Electrification of commercial and fleet vehicles

- 3.10.1.3 Advancements in EV drivetrain technology

- 3.10.1.4 Government regulations & incentives

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Material supply constraints

- 3.10.2.2 High initial costs of EV drivetrain components

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single-stage reducers

- 5.3 Multi-stage reducers

Chapter 6 Market Estimates & Forecast, By EV, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

- 6.4 FCEV

- 6.5 HEV

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sedan

- 8.2.2 SUV

- 8.2.3 Hatchback

- 8.3 Commercial vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

- 8.4 Off highway vehicle

- 8.5 Two and three wheelers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aichi Machine Industry

- 10.2 BorgWarner

- 10.3 GKN Automotive

- 10.4 Hyundai Transys

- 10.5 Jatco

- 10.6 JTEKT

- 10.7 Magna International

- 10.8 Nidec Corporation

- 10.9 Punch Powertrain

- 10.10 Ricardo plc

- 10.11 Robert Bosch

- 10.12 RSB Global

- 10.13 Schaeffler

- 10.14 TATA Autocamp

- 10.15 Valeo

- 10.16 Vitesco Technologies

- 10.17 ZF Friedrichshafen

- 10.18 Zhejiang Wanliyang