PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740750

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740750

Flexible Packaging Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

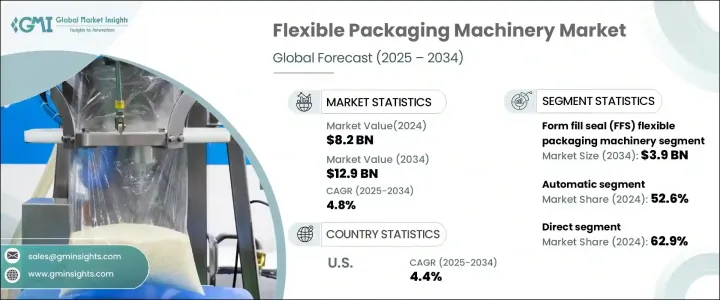

The Global Flexible Packaging Machinery Market was valued at USD 8.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 12.9 billion by 2034, fueled by shifting lifestyles, rapid urbanization, and rising consumer preferences for packaged food. Middle-income groups in emerging economies demand processed and ready-to-eat products, which drives the adoption of modern packaging technologies. Lightweight and cost-effective formats such as sachets, pouches, and bags are favored for their ease of use and transport. As production volumes continue to climb, manufacturers are turning to high-speed, automated systems that can handle a wide range of materials and packaging types efficiently. These trends reflect a growing need for flexibility and speed in production lines, encouraging the adoption of advanced machinery that meets evolving consumer expectations and regulatory demands.

Current equipment is expected to support seamless format changes, handle biodegradable and composite materials, and operate with minimal human intervention. Increased demand for customized packaging, shorter product cycles, and greater product variation have pushed the industry toward more intelligent and modular machinery. Automation not only enhances output but also ensures greater accuracy, reduced waste, and improved compliance with sustainability benchmarks. This shift enables producers to respond faster to market changes while maintaining high operational efficiency and product quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.2 billion |

| Forecast Value | $12.9 Billion |

| CAGR | 4.8% |

In 2024, the automatic packaging machines segment held a 52.6% share. Their ability to streamline workflows, improve output consistency, and reduce labor costs has made them essential for industries such as food, pharmaceuticals, and personal care. These systems integrate intelligent control features, remote diagnostics, and real-time performance monitoring, which enhances efficiency and reduces downtime. This transformation is shifting industry standards toward automated, smart packaging environments.

The market is segmented by distribution into direct and indirect channels. In 2024, the direct sales segment held 62.9% share. Selling equipment directly to end-users helps manufacturers offer customized solutions, faster support, and stronger post-sale service. By cutting out intermediaries, suppliers can maintain direct communication with clients, improving service delivery and tailoring systems to specific production needs. This also allows for easier deployment of technical upgrades and process optimization over time.

United States Flexible Packaging Machinery Market is expected to maintain a CAGR of 4.4% through 2034 backed by strong demand across multiple sectors, including food and beverage, pharmaceuticals, and personal care, where precision, hygiene, and speed are critical. Extensive R&D investments, combined with a well-established manufacturing infrastructure, give the U.S. a competitive edge in both innovation and output capacity. The country continues to be a major exporter of packaging machinery, supported by advanced automation technologies, integration of smart systems, and the ability to meet global compliance standards.

Key players such as MULTIVAC, Coesia Group, Optima Packaging Group, Ishida Co., Ltd., and Hayssen Flexible Systems use several core strategies to secure long-term growth. These include ramping up investment in AI-driven automation, expanding product lines to handle multi-format packaging, and entering strategic alliances to boost market reach. Many are enhancing their global footprints through mergers and facility expansions while optimizing machine design for sustainability, energy efficiency, and minimal waste production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.3.4 Demand-side impact (selling price)

- 3.2.3.5 Price transmission to end markets

- 3.2.3.6 Market share dynamics

- 3.2.3.7 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for packaged and processed foods

- 3.7.1.2 Technological advancements

- 3.7.1.3 Increasing focus on sustainable packaging

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial investment and maintenance costs

- 3.7.2.2 Complexity in handling diverse packaging materials

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Trade analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Form fill seal (FFS) machines

- 5.3 Bagging machines

- 5.4 Pouch packaging machines

- 5.5 Cartoning machines

- 5.6 Wrapping machines

- 5.7 Labeling machines

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Automation, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Personal care & cosmetics

- 7.5 Homecare products

- 7.6 Industrial products

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Barry-Wehmiller Companies

- 10.2 Coesia Group

- 10.3 GEA Group

- 10.4 Hayssen Flexible Systems

- 10.5 IMA Group

- 10.6 Ishida Co., Ltd.

- 10.7 KHS GmbH

- 10.8 Mespack

- 10.9 MULTIVAC

- 10.10 Optima Packaging Group

- 10.11 PFM Packaging Machinery

- 10.12 ProMach

- 10.13 Syntegon

- 10.14 TNA Solutions

- 10.15 W&H (Windmoller & Holscher)