PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740761

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740761

Needle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

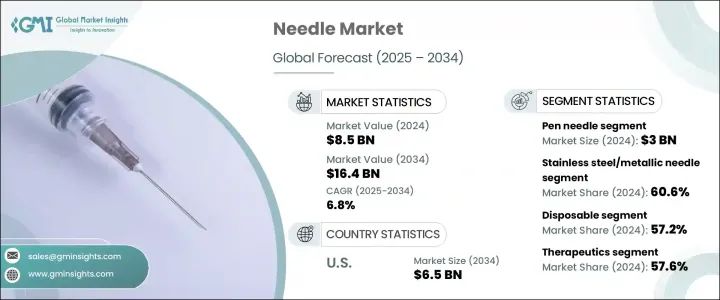

The Global Needle Market was valued at USD 8.5 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 16.4 billion by 2034, driven by the increasing prevalence of chronic health conditions such as cardiovascular diseases, cancer, respiratory complications, and neurological disorders. As the global healthcare landscape shifts toward value-based care, there's a growing emphasis on delivering better patient outcomes, enhancing procedural efficiency, and minimizing risks associated with medical interventions. The demand for high-quality, safety-engineered needles continues to rise as both healthcare providers and patients prioritize clinical precision, comfort, and safety. Modern medical practices depend on advanced needle technologies to support critical procedures, from diagnostics to drug delivery.

With innovations driving miniaturization, sharper needle tips, and integrated safety features, these devices play a central role in both hospital settings and home care environments. The market also benefits from the expanding elderly population, growing preference for minimally invasive treatments, and increasing adoption of self-administered therapies. As global awareness of infection control and healthcare worker safety intensifies, the need for smart needle systems with enhanced safety mechanisms becomes even more apparent. Surge in outpatient procedures, remote care models, and personalized medicine is further accelerating the evolution of needle products across clinical applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.5 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 6.8% |

Healthcare providers today rely on precision-engineered needles to reduce complications and streamline care delivery. Whether it's for administering medication, collecting blood samples, or closing surgical wounds, these tools are indispensable to modern medical workflows. Their designs now incorporate ultra-fine tips, silicone coatings, and built-in safety mechanisms to improve user experience and minimize pain or injury. These features significantly improve procedural accuracy and patient comfort, which is crucial in high-stress medical environments. Since most needles are used in conjunction with syringes or catheters, their compatibility and reliability are critical for ensuring seamless care delivery. With rising demand for outpatient services, chronic disease management, and home-based care, the market for advanced needle systems continues to grow. From everyday injections and blood draws to complex surgical procedures, healthcare professionals depend on reliable, sterile, and biocompatible needle solutions to meet evolving care needs.

Based on product type, the market includes pen needles, hypodermic needles, suture needles, dental needles, blood collection needles, acupuncture needles, and others. In 2024, pen needles accounted for USD 3 billion in revenue and are projected to grow at a CAGR of 6.7% through 2034. Their growth stems from their cost-efficiency, user-friendly design, and high adoption rate for insulin administration in diabetic care. Patients with limited dexterity or vision challenges, particularly elderly individuals, benefit from the ease and comfort provided by pen needles, which are specifically designed for safe self-injection.

The material type segment is led by stainless steel and metallic needles, which captured 60.6% of the market share in 2024. Their popularity comes from superior corrosion resistance, making them ideal for high-precision procedures and extended use in sterile conditions. These materials offer excellent biocompatibility, ensuring minimal adverse reactions and enhancing patient safety. Their durability under high-temperature sterilization also supports repeated usage without compromising performance, making them a reliable choice in both hospital and clinical environments.

The United States Needle Market alone is projected to reach USD 6.5 billion by 2034, fueled by continuous advancements in healthcare technologies and growing demand for personalized treatment approaches. The country's high disease burden-particularly from diabetes, cancer, and other chronic illnesses-drives strong demand for advanced needle-based systems. With a robust network of healthcare innovators, research institutions, and global manufacturers, the US leads in product development and rapid commercialization of cutting-edge medical devices. Supportive regulatory frameworks, increased government investment in healthcare infrastructure, and rising public awareness around safety and efficiency further contribute to the market's upward trajectory. As homecare and telehealth become more mainstream, the use of user-friendly, safety-optimized needle devices is expanding rapidly across various care settings.

Some of the leading players in the Global Needle Industry include Thermo Fisher Scientific, Owen Mumford, B. Braun Medical, Terumo, Merck, Hamilton, Schreiner Group, Cardinal Health, Nipro, Novo Nordisk, Smiths Medical (ICU Medical), Stryker, Becton, Dickinson and Company, and Albert David. These companies are focused on developing ergonomic, high-precision needle systems with enhanced safety features to reduce the risk of needlestick injuries. To stay competitive, key players are expanding their global reach through strategic partnerships, investing heavily in R&D, and embracing sustainable manufacturing practices. With healthcare needs evolving rapidly, market participants are actively innovating to deliver smarter, safer, and more cost-effective needle solutions across the globe.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing demand for injectable biologics

- 3.2.1.3 Technological advancements in needles design

- 3.2.1.4 Rising number of surgical procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Access to alternative drug delivery methods

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pen needles

- 5.3 Hypodermic needles

- 5.4 Suture needles

- 5.5 Blood collection needles

- 5.6 Dental needles

- 5.7 Acupuncture needles

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Material 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Glass needles

- 6.3 Plastic needles

- 6.4 Stainless steel/metallic needles

- 6.5 Polyetheretherketone (PEEK) needles

Chapter 7 Market Estimates and Forecast, By Usage Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Disposable

- 7.3 Reusable/Sterilizable

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Diagnostics

- 8.2.1 Blood collection

- 8.2.2 Biopsy

- 8.2.3 Sample transfer

- 8.2.4 Other diagnostics

- 8.3 Therapeutics

- 8.3.1 Vaccination

- 8.3.2 Drug delivery

- 8.3.3 Aesthetic procedures

- 8.3.4 Insulin administration

- 8.3.5 Dental

- 8.3.6 Surgical

- 8.3.7 Other therapeutics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Clinics

- 9.4 Diagnostic center

- 9.5 Ambulatory surgical centers

- 9.6 Home care setting

- 9.7 Research laboratories

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Albert David

- 11.2 B. Braun Medical

- 11.3 Becton, Dickinson and Company

- 11.4 Cardinal Health

- 11.5 Hamilton

- 11.6 Merck

- 11.7 Nipro

- 11.8 Novo Nordisk

- 11.9 Owen Mumford

- 11.10 Schreiner Group

- 11.11 Smiths Medical (ICU Medical)

- 11.12 Stryker

- 11.13 Terumo

- 11.14 Thermo Fisher Scientific