PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740762

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740762

De-Icing Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

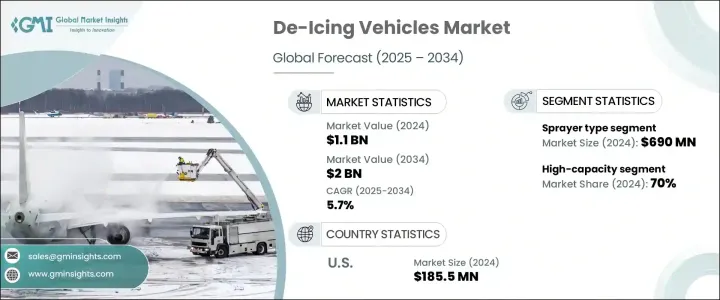

The Global De-Icing Vehicles Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 2 billion by 2034. This growth is driven by a combination of rising air traffic, expansion of airport infrastructure, and increasingly strict safety regulations in colder regions. These specialized vehicles play a vital role in ensuring the safe operation of aircraft during winter by removing ice, snow, and frost from critical surfaces. Airports, airlines, and ground handling service providers are investing heavily in modern de-icing systems to enhance regulatory compliance and minimize weather-related delays. As global air travel increases, so does the need for effective winter operations, especially in regions prone to severe weather. New-age de-icing vehicles are not only designed to be more efficient but are also built with sustainability in mind, incorporating electric drivetrains and eco-conscious fluid systems. The adoption of automation and digital integration into fleet management systems has also contributed to quicker response times and better overall efficiency, enabling operators to handle winter operations with greater precision and speed.

Technological advancements are playing a key role in redefining the landscape of de-icing operations. Emerging technologies include hybrid and electric models, as well as vehicles fitted with thermal imaging systems for more accurate detection of ice. Artificial intelligence is being employed to predict maintenance needs and reduce operational downtime. These innovations are extending vehicle lifespans and lowering maintenance costs. The focus is shifting toward vehicles that not only perform well in adverse weather but also offer long-term reliability and environmental efficiency. With airports striving to reduce their carbon footprint, the integration of smart technologies and cleaner energy sources is becoming a core component of procurement strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2 Billion |

| CAGR | 5.7% |

In terms of technology, the market is segmented into sprayer-type and spreader-type vehicles. The sprayer-type category took the lead in 2024, generating revenue of approximately USD 690 million. These vehicles are essential for aviation safety, as they apply liquid de-icing agents directly to aircraft runways and surfaces. They are widely used across civilian and military aviation hubs due to their precision and ability to operate effectively under poor visibility and freezing conditions. Sprayer-type vehicles come with high-performance features such as insulated tanks, heated booms, and adjustable spray nozzles, ensuring uniform application with minimal waste. Their integration with automated systems like GPS tracking and real-time fluid monitoring improves their efficiency and reduces manual intervention.

Based on tank capacity, the market is categorized into high, medium, and low-capacity vehicles. High-capacity de-icing vehicles held the largest market share in 2024, accounting for 70% of the overall market. These units are preferred in busy international airports due to their ability to carry and dispense larger volumes of de-icing fluid quickly. They are particularly beneficial for large-scale operations, providing broad coverage, reduced downtime, and the capability to perform under extreme conditions. Their large fluid reservoirs and efficient spraying mechanisms make them indispensable in high-traffic environments where quick turnaround is crucial.

The market is also segmented by vehicle type: self-propelled, truck-mounted, and towable units. Among these, self-propelled de-icing vehicles dominated in 2024. These vehicles offer superior mobility and speed, allowing ground crews to operate independently without the need for external towing support. Their efficiency in covering expansive runway areas and enhanced maneuverability in tight airport zones make them highly desirable, especially in major international airports. Their built-in control systems, advanced fluid management, and autonomous features provide a strong performance advantage during time-sensitive operations.

When broken down by application, the commercial airport segment led the market in 2024, securing the highest revenue share. These airports see the most significant traffic volume and demand rapid response to adverse weather to avoid flight disruptions. Efficient de-icing operations are essential for ensuring passenger safety and minimizing delays. With growing global connectivity and expanding flight routes, commercial airports are heavily investing in modern de-icing fleets capable of managing multiple aircraft efficiently during peak winter seasons. These vehicles provide fast, wide-area coverage that helps maintain operational continuity during harsh weather.

Regionally, the United States dominated the North America de-icing vehicles market with a valuation of USD 185.5 million in 2024 and is projected to grow at a CAGR of around 5.9% through 2034. This is largely due to the country's dense network of airports and the frequent winter weather conditions that demand highly reliable and efficient ground support equipment. The need for dependable, large-scale de-icing operations at regional and international airports continues to drive demand for advanced vehicle systems.

Key players in the market include JBT Corporation, Global Ground Support, Mallaghan Engineering, Polar Mobility, Oshkosh, PrimeFlight, TLD, Textron GSE, Vestergaard, and Weihai Guangtai Airport. These companies are focused on strategic growth through innovation, mergers, and enhanced production capabilities. Their efforts are centered on developing smarter, greener, and more durable de-icing solutions tailored to the changing needs of airport ground operations worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Price trend

- 3.6.1 Region

- 3.6.2 Type

- 3.7 Cost breakdown analysis

- 3.8 Key news & initiatives

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing air traffic and stringent aviation safety regulations

- 3.9.1.2 Expansion of airport infrastructure and ground handling operations

- 3.9.1.3 Technological advancements in de-icing equipment and automation

- 3.9.1.4 Demand for eco-friendly and energy-efficient de-icing solutions

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Environmental concerns over traditional de-icing fluids

- 3.9.2.2 Seasonal demand fluctuations affecting year-round profitability

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Self-propelled de-icing vehicles

- 5.3 Truck-mounted de-icing vehicles

- 5.4 Towable de-icing vehicles

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Sprayer type

- 6.3 Spreader type

Chapter 7 Market Estimates & Forecast, By Tank Capacity, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 High capacity

- 7.3 Medium capacity

- 7.4 Low capacity

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Commercial airports

- 8.3 Military airports

- 8.4 Helipads and heliports

- 8.5 Cargo airports

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aebi Schmidt

- 10.2 Bertoli

- 10.3 Douglas

- 10.4 EINSA

- 10.5 Global Ground Support

- 10.6 Ground Support Specialists

- 10.7 Hydro Engineering

- 10.8 Idrobase

- 10.9 JBT

- 10.10 Mallaghan

- 10.11 Oshkosh

- 10.12 Polar Mobility

- 10.13 PrimeFlight

- 10.14 Rheinmetall

- 10.15 Textron GSE

- 10.16 Timsan

- 10.17 Trecan Combustion

- 10.18 Vestergaard

- 10.19 Volkan Firefighting

- 10.20 Weihai Guangtai