PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740763

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740763

Industrial Sewing Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

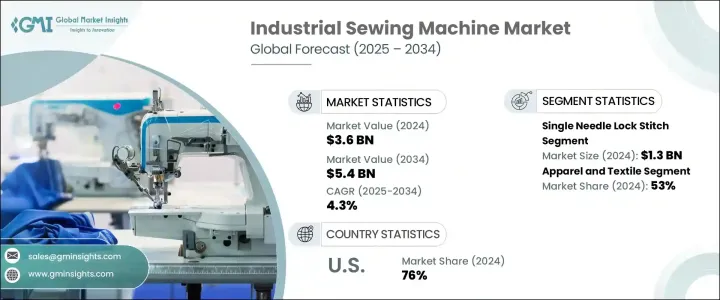

The Global Industrial Sewing Machine Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 5.4 billion by 2034. This expansion is largely driven by increasing global demand for apparel and textiles, propelled by population growth, urbanization, and evolving consumer preferences. Industrial sewing machines play a critical role in supporting high-volume textile and garment production, making them essential for manufacturers aiming for speed, precision, and efficiency. The integration of advanced technologies like robotics, IoT connectivity, and automation has significantly enhanced operational output, reduced labor dependency, and improved quality control in manufacturing environments. As businesses across emerging economies continue to industrialize, the demand for more sophisticated sewing systems continues to grow. Rapid shifts in fashion trends, the rise of fast fashion, and the need for scalable production have further intensified the need for advanced sewing equipment. Industrial sewing machines now go beyond basic functions and are developed to include intelligent systems that help streamline production, reduce downtime, and improve stitching consistency, ultimately boosting profitability for manufacturers globally.

Within the market, machine types vary to serve diverse applications. Key categories include double needle lock stitch, zigzag stitching, single needle lock stitch, overlock sewing, flatlock sewing, and other specialized systems. Among these, the single needle lock stitch segment led the category in 2024, contributing over USD 1.3 billion in revenue. Forecasts suggest this segment will witness a CAGR of around 4.8% through 2034. This machine type is particularly valued in garment manufacturing for its reliability and simplicity in performing straight-line stitching on lightweight and standard fabrics. Innovations in this segment now include features like automatic threading, advanced motor functions, and digital tension control, which simplify tasks and reduce fatigue for operators while ensuring stitch uniformity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 4.3% |

From an industry application perspective, the market is divided into apparel and textiles, automotive, furniture and upholstery, leather goods, and other industrial sectors. The apparel and textile category held the dominant position in 2024, accounting for more than 53% of the total market share. This segment continues to grow as demand rises for high-output machines that can perform multiple functions with speed and precision. Enhanced features such as automatic thread trimming, programmable stitch patterns, and sensor-based adjustments are increasingly incorporated into machines serving this industry, leading to higher productivity and lower error margins.

Regarding sales channels, the market is split into direct and indirect sales. In 2024, direct sales led the distribution landscape, fueled by the growing need for tailor-made solutions and comprehensive after-sales services. Manufacturers prefer this channel as it helps in forging long-lasting business relationships, ensuring repeat orders, and enabling a deeper understanding of client requirements. Through direct engagement, companies can also offer training, maintenance, and installation support-factors critical for large-scale industrial clients.

Nevertheless, indirect sales channels remain crucial for market expansion, particularly in reaching small to mid-sized enterprises. Distributors play a key role in delivering complete product ranges, inventory solutions, and localized technical assistance. Online platforms have also become an important part of the distribution mix, offering convenience, price competitiveness, and easy access to a wider selection of machines. This shift has notably impacted purchasing decisions for small businesses seeking flexible, budget-friendly options.

Regionally, North America plays a prominent role in global market dynamics, with the United States commanding approximately 76% of the region's market in 2024 and generating close to USD 760 million in revenue. Factors such as strong technological infrastructure, rising e-commerce activities, and growing production needs in the automotive and furniture sectors have contributed to this dominance. The U.S. textile industry is also witnessing a revival driven by a focus on reshoring production and adopting sustainable practices. These developments are fueling investments in advanced industrial sewing solutions.

Market competition remains moderately concentrated, with leading companies collectively holding a market share between 15% and 20%. These key players continue to expand through strategic acquisitions, collaborations, and facility upgrades to diversify their offerings, access new customer segments, and maintain competitive advantage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for apparel and textiles

- 3.6.1.2 Industrial growth in emerging economies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs

- 3.6.2.2 Intense competition from low-cost manufacturers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single needle lock stitch

- 5.3 Double needle lock stitch

- 5.4 Zigzag stitching

- 5.5 Overlock sewing

- 5.6 Flatlock sewing

- 5.7 Others (bartack machine, feed off the arm etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Speed, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 1000 spm

- 7.3 1000 to 2000 spm

- 7.4 2000 to 4000 spm

- 7.5 Above 4000 spm

Chapter 8 Market Estimates & Forecast, By Bobbin Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Large bobbin

- 8.3 Small bobbin

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Apparel

- 9.3 Non-apparel

- 9.3.1 Shoes

- 9.3.2 Bags

- 9.3.3 Upholstery

- 9.3.4 Others (bandages and dressings etc.)

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Apparel and textile

- 10.3 Automotive

- 10.4 Upholstery and furniture

- 10.5 Leather goods

- 10.6 Others (footwear industry, packaging etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 AMF Reece

- 13.2 Brother

- 13.3 Consew

- 13.4 Dohle

- 13.5 Jack

- 13.6 Juki

- 13.7 Kansai Special

- 13.8 Merrow

- 13.9 Miller Weldmaster

- 13.10 Pegasus

- 13.11 Seiko Industries

- 13.12 Singer

- 13.13 Usha International

- 13.14 Vetron Typical

- 13.15 Yamato