PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740770

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740770

Cosmetic Ingredients for Hair Removal Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

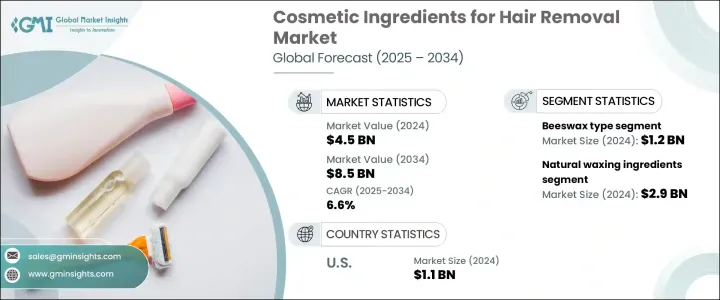

The Global Cosmetic Ingredients for Hair Removal Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 8.5 billion by 2034. This growth is largely driven by increased interest in personal grooming and wellness practices, particularly as consumers place greater importance on their skincare routines. Over the past decade, there has been notable progress in both the formulation and innovation of cosmetic ingredients used in hair removal products. Whether in creams, gels, waxes, or foams, the demand for ingredients that deliver effective hair removal while being gentle on the skin has surged. Manufacturers are consistently developing formulations that meet evolving consumer expectations, especially those preferring cleaner, safer, and more sustainable options.

The shift in consumer behavior toward natural and eco-conscious products has significantly shaped this market. Buyers are increasingly avoiding synthetic chemicals, showing a clear preference for ingredients derived from natural sources. This preference is not just about product content but extends to values like transparency, ethical sourcing, and environmental safety. As such, cosmetic brands are now focusing heavily on clean-label offerings and emphasizing product purity and regulatory compliance. The appeal of products free from artificial additives or harsh preservatives is contributing to a rise in demand for chemical-free hair removal solutions that do not compromise on performance. This evolution aligns closely with broader trends in the personal care sector, where ingredient transparency and product safety are prioritized.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 6.6% |

Among the various ingredient types, beeswax-based formulations have shown significant traction. In 2024, the market for beeswax-based cosmetic hair removal ingredients was estimated at USD 1.2 billion and is anticipated to grow at a CAGR of 6.9% during the forecast period from 2025 to 2034. Beeswax remains a preferred ingredient due to its natural origin, favorable skin properties, and ease of application. It is widely used in hard wax formulations that eliminate the need for cloth strips, making it suitable for at-home users and professionals alike. Its semi-solid consistency allows for direct application, which makes it user-friendly, especially for sensitive areas.

There is a growing preference for hair removal products made with natural waxing components. In 2024, the natural waxing ingredients segment was valued at USD 2.9 billion and is projected to grow at a CAGR of 6.9% through 2034, securing a market share of 65.4%. Consumers are turning to these alternatives due to their perceived safety, minimal side effects, and compatibility with sensitive skin. As the demand for holistic self-care rises, so does interest in products crafted from naturally derived materials that align with wellness-focused lifestyles. The push for organic, sustainable, and preservative-free formulations has become a major driving force behind product development and purchasing decisions. Clean labeling, organic certifications, and environmental claims are playing an essential role in how brands position themselves in the market.

In the United States, the cosmetic ingredients for hair removal market reached USD 1.1 billion in 2024, with projections suggesting a 6.9% CAGR from 2025 to 2034. This regional growth is fueled by a noticeable change in consumer attitudes toward personal wellness and hygiene. Americans are seeking more effective, skin-friendly solutions for hair removal that align with their active lifestyles and heightened awareness around self-care. This demand is fostering innovation in ingredient sourcing and formulation processes, encouraging brands to deliver solutions that meet the dual need for safety and efficacy.

The global landscape features a competitive group of companies that hold significant influence over the value chain. Major participants have centered their efforts around research, development, and product differentiation to meet rising expectations for ingredient integrity and sustainability. While pricing battles are relatively uncommon in this segment, the emphasis on innovation and regulatory readiness has become a cornerstone of competitive strategy. Leading companies are investing in eco-certifications and expanding their sourcing capabilities through partnerships and acquisitions. Brand reputation, access to high-quality raw materials, and the ability to meet B2B formulation demands are central to sustaining a strong market presence.

As digital engagement grows, brands are leaning on targeted marketing and technical support to build B2B relationships and expand reach. Consumer demand for transparency, safety, and long-lasting effectiveness continues to push the market forward, prompting ongoing investment in formulation technology and clinical testing to ensure product claims are both credible and appealing.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 Global regulatory framework overview

- 3.7.2 Fda regulations

- 3.7.3 Eu cosmetics regulation

- 3.7.4 China's csar (cosmetic supervision and administration regulation)

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising consumer demand for at-home hair removal products

- 3.8.1.2 Increasing preference for natural and organic cosmetic ingredients

- 3.8.1.3 Expanding personal care markets in emerging economies

- 3.8.1.4 Regulatory support for safer, skin-friendly formulations

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Stringent regulations around chemical ingredient usage

- 3.8.2.2 Skin sensitivity and allergy concerns related to active depilatory agents

- 3.8.1 Growth drivers

- 3.9 Market opportunities

- 3.9.1 Development of natural and organic formulations

- 3.9.2 Expanding e-commerce channels

- 3.9.3 Untapped markets in developing economies

- 3.9.4 Innovation in odor-neutralizing technologies

- 3.9.5 Multi-functional hair removal products

- 3.10 Market entry and expansion strategies

- 3.10.1 Market entry barriers and challenges

- 3.10.1.1 Regulatory hurdles and compliance costs

- 3.10.1.2 Intellectual property constraints

- 3.10.1.3 Established player dominance

- 3.10.1.4 Technical expertise requirements

- 3.10.2 Market entry strategies

- 3.10.2.1 Joint ventures and strategic alliances

- 3.10.2.2 Licensing and technology transfer

- 3.10.2.3 Acquisition and brownfield entry

- 3.10.2.4 Greenfield investment and organic growth

- 3.10.3 Geographic expansion opportunities

- 3.10.3.1 High-growth regional markets

- 3.10.3.2 Untapped market potential assessment

- 3.10.3.3 Cultural and regulatory considerations

- 3.10.3.4 Localization and adaptation strategies

- 3.10.4 Product portfolio expansion strategies

- 3.10.4.1 Line extensions and product variants

- 3.10.4.2 Cross-category expansion

- 3.10.4.3 Premium and value segment targeting

- 3.10.4.4 Customization and personalization approaches

- 3.10.1 Market entry barriers and challenges

- 3.11 Risk assessment and mitigation strategies

- 3.11.1 Market risks

- 3.11.1.1 Demand volatility and cyclicality

- 3.11.1.2 Competitive intensity and price pressure

- 3.11.1.3 Substitute products and technologies

- 3.11.1.4 Consumer preference shifts

- 3.11.2 Operational risks

- 3.11.2.1 Supply chain disruptions

- 3.11.2.2 Quality control and product safety

- 3.11.2.3 Manufacturing and formulation challenges

- 3.11.2.4 Workforce and talent management

- 3.11.3 Regulatory and compliance risks

- 3.11.3.1 Changing regulatory landscape

- 3.11.3.2 Non-compliance penalties and recalls

- 3.11.3.3 Ingredient restrictions and bans

- 3.11.3.4 Labeling and marketing claim risks

- 3.11.1 Market risks

- 3.12 Future outlook and market projections

- 3.12.1 Short-term market outlook (1-2 years)

- 3.12.1.1 Immediate growth opportunities

- 3.12.1.2 Near-term challenges

- 3.12.1.3 Competitive landscape evolution

- 3.12.2 Medium-term market outlook (3-5 years)

- 3.12.2.1 Emerging market segments

- 3.12.2.2 Technology adoption curves

- 3.12.2.3 Supply-demand balance projections

- 3.12.3 Long-term market outlook (5-10 years)

- 3.12.3.1 Disruptive technologies and innovations

- 3.12.3.2 Sustainability-driven market transformation

- 3.12.3.3 Consumer behavior evolution

- 3.12.3.4 Industry consolidation and restructuring scenarios

- 3.12.4 Scenario analysis and contingency planning

- 3.12.4.1 Best-case growth scenario

- 3.12.4.2 Base-case market evolution

- 3.12.4.3 Worst-case market contraction

- 3.12.4.4 Disruptive scenario analysis

- 3.12.1 Short-term market outlook (1-2 years)

- 3.13 Investment opportunities and strategic recommendations

- 3.13.1 Investment attractiveness assessment

- 3.13.1.1 High-growth market segments

- 3.13.1.2 Technology investment opportunities

- 3.13.1.3 Geographic investment hotspots

- 3.13.1.4 M&a and partnership opportunities

- 3.13.2 Strategic recommendations for ingredient manufacturers

- 3.13.2.1 Product development and innovation focus areas

- 3.13.2.2 Market positioning and differentiation strategies

- 3.13.2.3 Sustainability and compliance roadmap

- 3.13.2.4 Partnership and collaboration opportunities

- 3.13.2.5 Strategic recommendations for end-product manufacturers

- 3.13.2.6 Formulation and product development priorities

- 3.13.2.7 Consumer engagement and marketing strategies

- 3.13.2.8 Distribution and channel optimization

- 3.13.2.9 Sustainability and brand positioning

- 3.13.3 Strategic recommendations for investors and financial stakeholders

- 3.13.3.1 High-potential investment targets

- 3.13.3.2 Risk assessment and mitigation approaches

- 3.13.3.3 Portfolio diversification strategies

- 3.13.3.4 Exit strategy considerations

- 3.13.1 Investment attractiveness assessment

- 3.14 Growth potential analysis

- 3.15 Porter’s analysis

- 3.16 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Glyceryl rosinate (rosin)/gum rosin

- 5.3 Hydrogenated rosin

- 5.4 Beeswax

- 5.5 Essential oils

- 5.6 Thioglycolic acid

- 5.7 Lanolin

- 5.8 Glycerin

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Category, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural waxing ingredients

- 6.3 Synthetic waxing ingredients

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Soft wax

- 7.3 Hard wax

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aadra International

- 9.2 Arjun Bees Wax Industries

- 9.3 Ataman Chemical

- 9.4 BRM Chemicals

- 9.5 DKSH Holding Ltd.

- 9.6 Making Cosmetics Inc.

- 9.7 Guangzhou ECOPOWER

- 9.8 Gustav Heess Oleochemische Erzeugnisse GmbH

- 9.9 JKB Infotech PVT LTD

- 9.10 Koster Keunen

- 9.11 Koster Keunen LLC

- 9.12 Knowde

- 9.13 Mishra Chemical Works

- 9.14 Rimpro-india

- 9.15 SpecialChem Arkema Global

- 9.16 SOPHIM IBERIA S.L

- 9.17 Strahl and Pitsch

- 9.18 Synthomer

- 9.19 Unicorn petroleum industries pvt. Ltd

- 9.20 Zoic Cosmetics