PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740793

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740793

Dried Baby Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

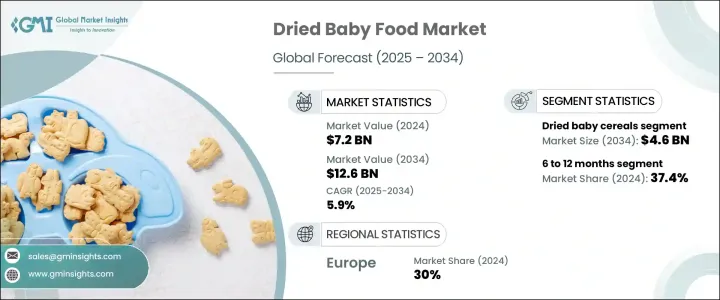

The Global Dried Baby Food Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 5.9 % to reach USD 12.6 billion by 2034, driven by the increasing preference for easy-to-prepare and nutritionally balanced infant meals. Busy lifestyles, rising disposable incomes, and growing parental awareness about infant health are pushing demand across developed and developing regions. Parents choose dried baby food for its long shelf life, convenience, and nutritional value. The market's historic expansion can be linked to the evolving perception of baby nutrition, particularly in urban centers where time-saving and safe feeding options are critical.

With an increasing number of nuclear families and working parents, there's also a noticeable shift toward compact, travel-friendly food options for infants. Convenience and portability have become essential factors for time-constrained caregivers who prioritize both nutrition and ease of use. As a result, manufacturers are focusing on lightweight, resealable, and single-serve packaging that fits seamlessly into busy lifestyles. These formats reduce preparation time, minimize waste, and offer greater hygiene, making them ideal for modern parenting needs. The trend toward organic, non-GMO, and clean-label products is reshaping buyer preferences and supporting sustained demand across global markets. Parents are becoming increasingly cautious about what goes into their children's food, leading to a surge in demand for transparent ingredient sourcing and minimally processed formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $12.6 Billion |

| CAGR | 5.9% |

Among product categories, the dried baby cereals segment is expected to reach USD 4.6 billion by 2034, growing at a CAGR of 6.1% influenced by the surge in demand for fortified, allergen-free, and easily digestible cereals that contain probiotics, vitamins, and essential minerals. New formulations now focus on clean ingredients and enhanced nutritional profiles to address growing concerns about early childhood health. The market witness's innovation through gluten-free and organic options catering to specific dietary needs.

Based on age-based preferences, the 6 to 12-month category held the largest share in 2024 at 37.4% and is expected to grow at a 6.5% CAGR through 2034. This stage of infant development requires the introduction of more complex food textures and nutritional content, fueling demand for convenient, pre-portioned meals. Packaging innovation, such as resealable containers and single-use pouches, makes these products even more practical for working parents. The rise in dual-income households and the increasing popularity of ready-to-eat products are also driving forces in this segment. Although the market is expanding, pricing concerns may temper growth slightly, especially in more cost-sensitive regions.

Europe Dried Baby Food Market held the largest share of 30% in 2024, driven by high nutritional awareness and regulatory support for infant food safety. Increased demand for premium and organic baby food options continues to shape product development across the region. Market expansion is also supported by strong purchasing power and the rising popularity of clean-label offerings in European households. In addition to a strong regulatory framework, Europe benefits from high purchasing power, which fuels the demand for high-quality baby food products.

Companies such as Abbott Laboratories, The Hain Celestial Group, Sprout Foods Inc., Meiji Holdings Co. Ltd., Nestle S.A., Hero Group, Holle Baby Food GmbH, Arla Foods amba, Ella's Kitchen Limited, Plum PBC, Danone S.A., FrieslandCampina, Bellamy's Organic Pty Ltd, Riri Baby Food Co. Ltd., Gerber Products Company, The Kraft Heinz Company, Beech-Nut Nutrition Corporation, Topfer GmbH, and HiPP International are actively working to enhance market presence. Leading brands invest in product diversification, sustainable sourcing, and clean-label innovation. Many are expanding organic lines, partnering with local distributors, and enhancing packaging for greater shelf appeal. Additionally, companies are increasing digital engagement and e-commerce channels to strengthen global outreach and improve customer convenience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Manufacturers

- 3.1.4 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.6 Strategic industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Supply Chain and Distribution Analysis

- 3.4.1 Raw Material Sourcing

- 3.4.2 Manufacturing Processes

- 3.4.2.1 Dehydration Technologies

- 3.4.2.2 Freeze-Drying Methods

- 3.4.2.3 Quality Control

- 3.4.3 Packaging Innovations

- 3.4.3.1 Sustainable Packaging

- 3.4.3.2 Smart Packaging

- 3.4.3.3 Convenience Features

- 3.4.4 Distribution Network

- 3.4.4.1 Traditional Retail

- 3.4.4.2 E-commerce

- 3.4.4.3 Direct-to-Consumer

- 3.4.5 Supply Chain Challenges

- 3.4.5.1 Raw Material Availability

- 3.4.5.2 End-to-End Quality Control

- 3.4.5.3 Logistics

- 3.4.6 Supply Chain Optimization

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 Global Regulatory Standards

- 3.7.2 Regional Guidelines

- 3.7.2.1 FDA (U.S.)

- 3.7.2.2 EFSA (EU)

- 3.7.2.3 FSSAI (India)

- 3.7.2.4 CFDA (China)

- 3.7.2.5 Other Regional Regulations

- 3.7.3 Quality and Safety Standards

- 3.7.3.1 Heavy Metals and Contaminants

- 3.7.3.2 Nutritional Requirements

- 3.7.3.3 Labeling and Claims

- 3.7.3.4 Packaging Safety

- 3.7.4 Organic Certification Standards

- 3.7.5 Regulatory Challenges and Strategies

- 3.7.6 Future Regulatory Trends

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising Female Workforce Participation

- 3.8.1.2 Increasing Awareness of Infant Nutrition

- 3.8.1.3 Urbanization and Changing Lifestyles

- 3.8.1.4 Convenience and Longer Shelf Life

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Preference for Homemade Baby Food

- 3.8.2.2 Stringent Regulatory Standards

- 3.8.2.3 Price Sensitivity in Emerging Markets

- 3.8.2.4 Supply Chain Disruptions

- 3.8.3 Market opportunities

- 3.8.3.1 Organic and Clean Label Products

- 3.8.3.2 Fortified and Functional Dried Baby Food

- 3.8.3.3 Expansion in Emerging Markets

- 3.8.3.4. E-commerce and D2 C Models

- 3.8.4 Market Challenges

- 3.8.4.1 Heavy Metal Contamination Concerns

- 3.8.4.2 Competitive Pricing Pressure

- 3.8.4.3 Changing Consumer Preferences

- 3.8.4.4 Sustainability Concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer Behavior and Preferences

- 3.12.1 Consumer Demographics

- 3.12.2 Purchase Decision Factors

- 3.12.2.1 Nutritional Value

- 3.12.2.2 Brand Trust

- 3.12.2.3 Price Sensitivity

- 3.12.2.4 Convenience

- 3.12.2.5 Organic and Natural Ingredients

- 3.12.3 Consumer Buying Patterns

- 3.12.3.1 Online vs. Offline

- 3.12.3.2 Subscription Models

- 3.12.3.3 Bulk Purchases

- 3.12.4 Consumer Awareness and Education

- 3.12.5 Cultural and Regional Preferences

- 3.12.6 Impact of Social Media and Influencers

- 3.13 Technological Innovations and Product Development

- 3.13.1 Processing Technologies

- 3.13.1.1 Advanced Dehydration

- 3.13.1.2 Nutrient Preservation

- 3.13.1.3 Clean Label Methods

- 3.13.2 Ingredient Innovations

- 3.13.2.1 Superfoods

- 3.13.2.2 Alternative Proteins

- 3.13.2.3 Natural Preservatives

- 3.13.3 Packaging Innovations

- 3.13.3.1 Biodegradable/Compostable Materials

- 3.13.3.2 Active and Intelligent Packaging

- 3.13.3.3 Portion Control

- 3.13.4 Digital Integration

- 3.13.4.1 QR Codes and Traceability

- 3.13.4.2 Mobile Apps

- 3.13.4.3 E-commerce Optimization

- 3.13.5 R&D and Future Trends

- 3.13.1 Processing Technologies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dried baby cereals

- 5.3 Dried baby meals

- 5.4 Dried baby snacks and finger foods

- 5.5 Dried fruit and vegetable purees

- 5.6 Freeze-dried baby food

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 4–6 Months

- 7.3 6–12 Months

- 7.4 12–24 Months

- 7.5 Above 24 Months

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets and hypermarkets

- 8.3 Specialty stores

- 8.4 Convenience stores

- 8.5 Online retail

- 8.6 Pharmacies and drugstores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Pouches

- 9.3 Jars and bottles

- 9.4 Cans

- 9.5 Boxes and cartons

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Nestle S.A.

- 11.2 Danone S.A.

- 11.3 Abbott Laboratories

- 11.4 Hero Group

- 11.5 Mead Johnson Nutrition Company

- 11.6 The Hain Celestial Group, Inc.

- 11.7 HiPP International

- 11.8 The Kraft Heinz Company

- 11.9 Plum, PBC

- 11.10 Ella's Kitchen Limited

- 11.11 Gerber Products Company

- 11.12 Sprout Foods, Inc.

- 11.13 Beech-Nut Nutrition Corporation

- 11.14 Bellamy's Organic Pty Ltd

- 11.15 Arla Foods amba

- 11.16 FrieslandCampina

- 11.17 Meiji Holdings Co., Ltd.

- 11.18 Topfer GmbH

- 11.19 Holle Baby Food GmbH

- 11.20 Riri Baby Food Co., Ltd.