PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740798

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740798

Specialty Pharmaceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

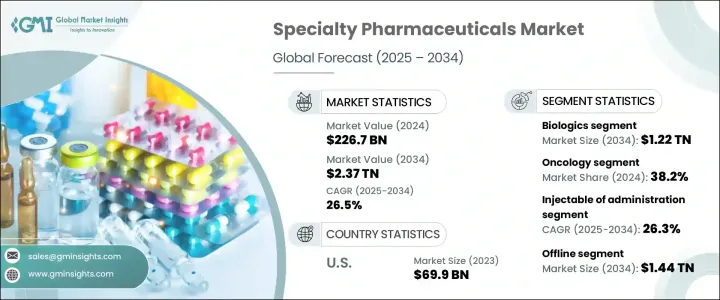

The Global Specialty Pharmaceuticals Market was valued at USD 226.7 billion in 2024 and is estimated to grow at a CAGR of 26.5% to reach USD 2.37 trillion by 2034, driven by groundbreaking advancements in biologics, targeted therapies, and precision medicine. Specialty pharmaceuticals are quickly transforming healthcare by offering highly tailored treatments for chronic and rare diseases that previously had limited options. The rise in chronic conditions like cancer, autoimmune disorders, and rare genetic illnesses continues to intensify the demand for these sophisticated therapies. As biotechnology advances, new drug delivery systems and precise diagnostics are reshaping treatment protocols, delivering better patient outcomes with fewer side effects.

The focus on personalized healthcare is accelerating, with pharmaceutical companies investing heavily in gene-based solutions, biologics, and customized therapies that align with patient-specific needs. Governments worldwide are supporting innovation through incentives and streamlined regulatory pathways, particularly for orphan drugs targeting rare diseases. In developing regions, expanding healthcare infrastructure is opening new opportunities for specialty therapies to enter emerging markets. As healthcare systems evolve, specialty pharmaceuticals are no longer confined to niche segments; they are becoming an integral part of mainstream treatment strategies, establishing themselves as a crucial growth engine within the pharmaceutical landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $226.7 Billion |

| Forecast Value | $2.37 Trillion |

| CAGR | 26.5% |

The market by drug type spans biologics, biosimilars, orphan drugs, small molecules, and other specialty formulations. In 2024, the biologics segment generated USD 118.8 billion, with projections indicating a strong surge to USD 1.22 trillion by 2034. This remarkable growth stems from the therapeutic precision biologics offer, enabling highly targeted treatments for complex conditions like autoimmune diseases, various cancers, and rare genetic disorders. With fewer side effects and higher success rates, biologics have gained rapid adoption in clinical practices worldwide. Advances in biological manufacturing technologies and supportive regulatory frameworks are helping companies accelerate the development and launch of innovative biologic therapies.

By therapeutic area, oncology continues to dominate, capturing a 38.2% market share in 2024, and is poised to grow at a CAGR of 26.7% through 2034. Rising global cancer incidence rates are fueling massive investments in oncology drug pipelines, with a steady flow of regulatory approvals for new therapies. Breakthroughs in immunotherapies, companion diagnostics, and combination therapies are reshaping the future of cancer care and reinforcing oncology's leadership in the specialty pharmaceutical sector.

The U.S. Specialty Pharmaceuticals Market generated USD 69.9 billion in 2023, reflecting its leadership and innovation-driven healthcare environment. Strong funding support, favorable reimbursement systems, and public-private collaborations position the U.S. at the forefront of specialty drug development. High demand for personalized medicine, accelerated FDA approval pathways, and a focus on breakthrough innovations ensure the market's sustained growth trajectory.

Key companies operating in the Global Specialty Pharmaceuticals Market include United Therapeutics, Amgen, AbbVie, Novartis, Pfizer, Genentech, Kamada, Biocon Biologics, TAIHO PHARMACEUTICAL, Eli Lilly, Knight Therapeutics, Incyte, Merck & Co., and GlaxoSmithKline. These players are strengthening their positions by investing in targeted R&D, forming strategic partnerships, acquiring innovative biotech firms, and emphasizing biosimilars and personalized therapies to drive long-term growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic and rare diseases

- 3.2.1.2 Increasing advancements in biologics and gene therapies

- 3.2.1.3 Increasing supportive policies and exclusivity rights for orphan drugs

- 3.2.1.4 Growing in research and development fundings and activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Hight cost of drugs

- 3.2.2.2 Necessity of specialized storge and handling

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biologics

- 5.3 Biosimilars

- 5.4 Orphan drugs

- 5.5 Small molecules

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology

- 6.3 Autoimmune diseases

- 6.4 Neurology

- 6.5 Infectious diseases

- 6.6 Rare genetic disorders

- 6.7 Other therapeutic areas

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

- 8.3.1 Hospital pharmacies

- 8.3.2 Retail pharmacies

- 8.3.3 Other offline channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Biocon Biologics

- 10.4 Eli Lilly

- 10.5 Genentech

- 10.6 GlaxoSmithKline

- 10.7 Incyte

- 10.8 Kamada

- 10.9 Knight Therapeutics

- 10.10 Merck & Co.

- 10.11 Novartis

- 10.12 Pfizer

- 10.13 Taiho Pharmaceutical

- 10.14 United Therapeutics