PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740818

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740818

Steering Tie Rod Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

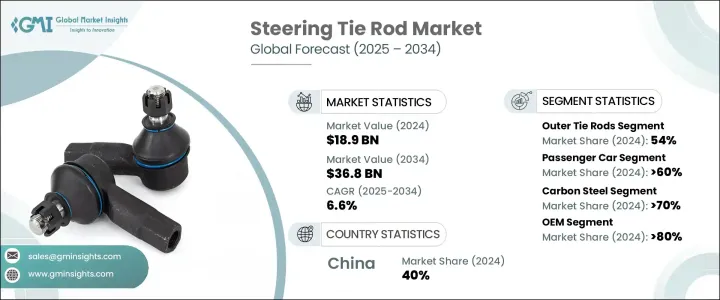

The Global Steering Tie Rod Market was valued at USD 18.9 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 36.8 billion by 2034. This growth is primarily fueled by the rapid expansion of the automotive industry, especially in regions undergoing fast-paced industrialization and urban development. As more people gain access to higher disposable incomes and infrastructure improves, the demand for vehicles rises significantly. The surge in vehicle production naturally translates into higher demand for crucial components like steering tie rods, which are essential for maintaining proper vehicle control and ensuring safety on the road. With growing expectations for vehicle performance and longevity, automakers and consumers alike are demanding advanced, durable steering systems that can withstand modern driving conditions.

The steering system is undergoing a notable transformation as innovations in vehicle technology continue to reshape the automotive sector. Modern advancements such as electric power steering, steer-by-wire configurations, and the incorporation of sensors are becoming more widespread. These developments are not just enhancing vehicle performance-they are also making cars more fuel-efficient and safer to drive. As vehicles become smarter and more reliant on electronics, the demand for precisely engineered parts like steering tie rods becomes even more important. These components must now meet higher standards of accuracy and reliability to ensure optimal integration with advanced steering systems. The shift toward automation and electronic driving assistance has intensified the need for parts that can deliver precision, minimal mechanical complexity, and improved handling.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.9 Billion |

| Forecast Value | $36.8 Billion |

| CAGR | 6.6% |

In terms of product segmentation, the market is divided into inner and outer tie rods. Outer tie rods held the dominant position in 2024, accounting for around 54% of the market, and are projected to grow at a CAGR of 7.2% throughout the forecast period. These components face more frequent replacements due to their external position, which makes them more vulnerable to environmental exposure and wear. Being constantly subjected to road debris, moisture, and harsh elements leads to quicker degradation. When not replaced in time, worn-out outer tie rods can contribute to poor steering response and uneven tire wear. This naturally increases demand within the automotive aftermarket, making outer tie rods a crucial revenue-driving segment.

When examining the market by vehicle type, passenger cars represented more than 60% of total sales in 2024 and are expected to continue expanding at a CAGR of approximately 6% through 2034. Passenger vehicles tend to remain in service longer and require ongoing maintenance as they age, leading to consistent demand for replacement parts. Steering tie rods, being critical to safe vehicle handling, often need periodic inspection and substitution, especially in high-mileage or rough-road driving scenarios. The growing number of passenger cars in operation globally ensures a sustained need for both OEM and aftermarket tie rod products, reinforcing this segment's leading position in the overall market.

Material-wise, carbon steel emerged as the preferred choice for manufacturing steering tie rods in 2024, accounting for over 70% of the market share. Its popularity stems from a combination of high strength and durability, allowing it to endure continuous stress and road shocks over time. Carbon steel also offers a cost advantage over alternative materials like aluminum or titanium, enabling manufacturers to deliver high-performance parts at competitive pricing. This balance of quality and cost-effectiveness makes carbon steel a practical option for both OEMs and aftermarket suppliers, especially in a price-sensitive market like automotive components.

From a sales channel perspective, OEMs captured more than 80% of the steering tie rod market in 2024. The strong presence of OEMs can be attributed to the need for original parts during vehicle assembly. OEM components are designed to match the exact specifications of new vehicles and come with warranties that assure performance and compatibility. Automakers prefer these components for their consistency, quality assurance, and the ability to support the vehicle's original engineering design. The growth in global vehicle production has significantly driven demand from this segment.

Geographically, China led the market in 2024 with nearly 40% of the global share, generating around USD 16.4 billion in revenue. This leadership is supported by the country's high volume of vehicle production and a well-established supply chain for automotive components. China benefits from a strong base of manufacturers and suppliers, enabling efficient production and widespread distribution of steering tie rods. Competitive pricing, combined with high-quality standards, has allowed local producers to meet both domestic and international demands effectively.

Global players continue to invest in expanding their product lines and integrating advanced technologies. Strategic partnerships and R&D initiatives are being used to enhance product performance and durability. These companies are embracing innovations like steer-by-wire and electric steering systems, ensuring their offerings align with the evolving demands of the modern automotive market. Meanwhile, regional manufacturers focus on tailoring their products to local requirements, offering customized solutions that resonate with specific vehicle types and driving environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automotive OEMs

- 3.1.2 Suppliers

- 3.1.3 Material and forging companies

- 3.1.4 Aftermarket distributors and retailers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Impact of trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Price trend

- 3.4.1 Region

- 3.4.2 Product

- 3.5 Cost breakdown analysis

- 3.6 Profit margin analysis

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising global automotive production

- 3.10.1.2 Technological advancements in steering systems

- 3.10.1.3 Emphasis on vehicle safety and regulatory compliance

- 3.10.1.4 Growth in electric and autonomous vehicles

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Disruption from electric and autonomous vehicle technologies

- 3.10.2.2 Fluctuating raw material prices and supply chain disruptions

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034, ($Bn, Units)

- 5.1 Key trends

- 5.2 Inner tie rods

- 5.3 Outer tie rods

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021-2034, ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicle (LCV)

- 6.3.2 Medium commercial vehicle (MCV)

- 6.3.3 Heavy commercial vehicle (HCV)

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034, ($Bn, Units)

- 7.1 Key trends

- 7.2 Carbon steel

- 7.3 Stainless steel

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021-2034, ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ACDelco

- 10.2 APA Industries

- 10.3 BorgWarner

- 10.4 Bosch Group

- 10.5 Crown Automotive Sales

- 10.6 CTR

- 10.7 Delphi Technologies

- 10.8 Dorman Products

- 10.9 First Line

- 10.10 HL Mando

- 10.11 Ingalls Engineering

- 10.12 JTEKT

- 10.13 Mando

- 10.14 Moog

- 10.15 Motorcraft

- 10.16 Nexteer Automotive Group Limited

- 10.17 NSK

- 10.18 Sankei Industry

- 10.19 Synergy Manufacturing

- 10.20 ZF Friedrichshafen