PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740825

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740825

Vacuum Sealed Fish Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

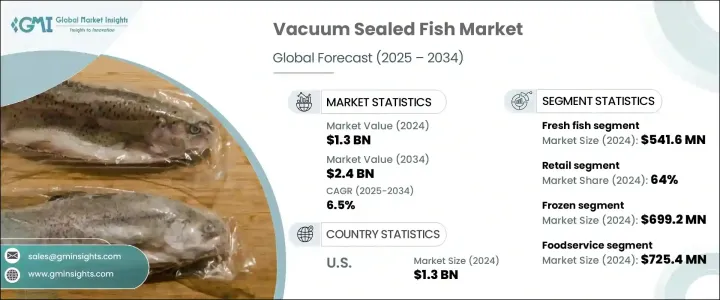

The Global Vacuum Sealed Fish Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 2.4 billion by 2034, driven by rising consumer demand for convenience, longer shelf life, and improved food safety. Vacuum sealing technology removes air and encloses fish in high-barrier packaging, preserving freshness, flavor, texture, and nutritional value while significantly reducing spoilage and bacterial growth. With busy lifestyles becoming the norm, more consumers are looking for quick, healthy, and high-quality food options, boosting the popularity of vacuum-sealed seafood. Health-conscious buyers are especially drawn to this packaging method for its ability to retain natural qualities without the need for preservatives. Growing environmental awareness has also pushed demand higher, with many consumers prioritizing sustainable packaging and minimal food waste. Retailers and brands are capitalizing on these trends by expanding their vacuum-sealed product lines, promoting wild-caught and organic fish varieties, and introducing eco-friendly packaging innovations. With international trade expanding and cold chain logistics advancing, the global vacuum-sealed fish industry is poised for robust growth over the next decade.

The growth of the vacuum-sealed fish market is further supported by the expansion of retail distribution channels, rising disposable incomes, and an increasing appetite for ready-to-eat or easy-to-cook seafood meals. Sustainable food choices are becoming more mainstream, fueling the demand for vacuum-sealed products. Companies continue to innovate with biodegradable and recyclable materials while widening their portfolios with organic and wild-caught options. Changing consumer preferences toward convenience, safety, and quality opens new avenues for market players, setting the stage for significant expansion in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 6.5% |

The market is segmented into shellfish, fresh fish, cooked fish, and other products. The fresh fish segment, valued at USD 541.6 million in 2024, holds the largest market share because of its high perceived quality, nutritional benefits, and longer shelf life. Vacuum-sealed packaging locks in flavor and tenderness, offering a reliable choice for consumers who prioritize hygiene and convenience. Popular species like salmon, tuna, and cod are commonly vacuum sealed to maintain optimal freshness during transport and storage.

The shellfish segment, valued at USD 307.6 million in 2024, is expected to generate USD 525.3 million by 2034, demonstrating strong growth potential. Highly perishable shellfish like shrimp, lobster, oysters, and mussels benefit from vacuum sealing, which extends shelf life and preserves natural taste and texture without chemical preservatives. This appeals to health-focused consumers and supports global exports by ensuring product integrity.

U.S. Vacuum Sealed Fish Market generated USD 1.3 billion in 2024, driven by a growing preference for value-driven, eco-friendly, and convenient seafood options. The vacuum-sealing process preserves freshness, minimizes spoilage, and aligns with sustainability trends by reducing food waste, attracting eco-conscious consumers.

Key players in the global vacuum-sealed fish industry include Bumble Bee Foods, Blue Circle Foods, Dongwon Industries, Icelandic Group, Mowi ASA, Gorton's, Pacific Seafood Group, Thai Union Group, Stolt-Nielsen Limited, and Trident Seafood Corporation. Companies are innovating with sustainable packaging, expanding organic and wild-caught offerings, and forming partnerships with retailers to broaden distribution and capture growing consumer interest.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-Side impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: The above trade statistics will be provided for key countries only

- 3.4 Profit margin analysis

- 3.5 Key news and initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing consumer demand for convenient, long-lasting, and safe seafood options.

- 3.7.1.2 Rising awareness of health benefits and nutritional value of vacuum-sealed fish.

- 3.7.1.3 Growing seafood consumption in emerging markets driven by urbanization and rising incomes.

- 3.7.2 Industry pitfalls and challenges

- 3.7.2.1 Volatility in fish supply due to overfishing and climate change.

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Freshfish

- 5.3 Shellfish

- 5.4 Cooked fish

- 5.5 Others (marinated products & etc.)

Chapter 6 Market Estimates and Forecast, By Packaging type, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Retail

- 6.3 Bulk

Chapter 7 Market Estimates and Forecast, By Preservation, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Frozen

- 7.3 Fresh

- 7.4 Smoked

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Foodservice

- 8.3 Industrial

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Online sales

- 9.3 Supermarket / hypermarket

- 9.4 Specialty stores

- 9.5 Wholesale distributors

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Blue circle foods

- 11.2 Bumble bee foods

- 11.3 Dongwon industries

- 11.4 Gorton's

- 11.5 Icelandic group

- 11.6 Mowi ASA (formerly Marine Harvest)

- 11.7 Pacific seafood group

- 11.8 Stolt-Nielsen limited

- 11.9 Thai union group

- 11.10 Trident seafood corporation