PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740833

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740833

Automotive Wheel Spindle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

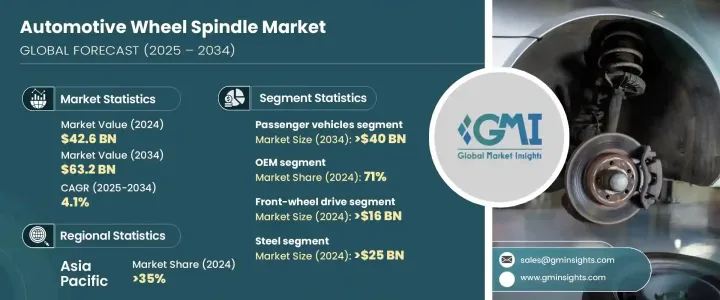

The Global Automotive Wheel Spindle Market was valued at USD 42.6 billion in 2024 and is estimated to grow at 4.1% CAGR to reach USD 63.2 billion by 2034 driven by the recovery of the automotive sector, particularly in developing nations, which is increasing vehicle production. As manufacturers scale production to meet the rising consumer demand, the need for essential components like wheel spindles grows correspondingly. The shift toward electric and hybrid vehicles is also helpful in driving this market. Electric vehicles (EVs) require new designs for wheel assemblies due to different torque patterns produced by electric motors and the added weight from batteries. This transition creates strong demand for lightweight, high-strength wheel spindles, as manufacturers look to optimize performance and efficiency.

Moreover, the aftermarket segment is experiencing significant growth due to the increasing preference for vehicle refurbishment over purchasing new models, particularly in regions like North America and Europe. As vehicles age, many consumers and fleet operators choose to replace or upgrade parts, such as wheel spindles, to extend the lifespan of their vehicles while avoiding the high costs of new purchases. This trend is particularly prevalent in markets with large vehicle populations and strong vehicle maintenance cultures, where cost-effectiveness and sustainability are prioritized. The rising demand for replacement parts in these regions is driving the growth of the aftermarket segment, making it an essential part of the overall market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.6 Billion |

| Forecast Value | $63.2 Billion |

| CAGR | 4.1% |

The passenger vehicle segment accounted for USD 28 billion in 2024 and is expected to reach USD 40 billion by 2034 attributed to the high global demand for passenger cars compared to commercial vehicles. Manufacturers adopt innovative spindle designs to meet growing consumer expectations for ride comfort, safety, and handling precision. The rise of electric and hybrid automobiles contributes to the demand for advanced spindles with improved performance and lightweight characteristics.

Based on end-use, the market is divided into original equipment manufacturers (OEM) and aftermarket segments. The OEM segment accounted for 71% share in 2024 and is expected to continue growing throughout the forecast period. OEMs are the primary drivers of wheel spindle demand, as spindles are integrated into new vehicles during the assembly process. The growing focus on lightweight spindles for electric vehicles pushes OEMs to rely more heavily on skilled spindle suppliers. These long-term contracts provide stability while encouraging innovation in spindle technology and design.

Asia Pacific Automotive Wheel Spindle Market held a 35% share in 2024, with China leading the region. The country's automotive industry is expanding rapidly, driven by a strong manufacturing base and the increasing production of electric vehicles. Government policies that promote electric vehicle adoption are further driving demand for high-performance, low-weight spindles. Local supplier clusters, along with investments in research and development, are fueling innovation in spindle technology.

The leading companies in the Global Automotive Wheel Spindle Industry include ZF Friedrichshafen AG, Hyundai Mobis, ThyssenKrupp AG, Hitachi Astemo, Magna International, Schaeffler AG, and JTEKT Corporation. To strengthen their market presence, companies in the automotive wheel spindle industry focus on several strategies. These include forming strategic partnerships with OEMs, advancing research and development in lightweight and high-performance materials, and expanding their manufacturing capabilities in emerging markets. Additionally, companies are investing heavily in innovation to meet the specific needs of electric vehicle manufacturers, which are seeking tailored solutions to enhance the efficiency of their vehicles. Furthermore, many players are improving their supply chain networks to ensure timely delivery of spindles and minimize production delays, helping them to maintain a competitive edge in a fast-growing market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Aftermarket suppliers and distributors

- 3.2.4 End users

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Cost analysis

- 3.8 Pricing analysis

- 3.8.1 Product

- 3.8.2 Region

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising global vehicle production

- 3.11.1.2 Shift toward Electric Vehicles (EVs)

- 3.11.1.3 Growing aftermarket demand

- 3.11.1.4 Rapid advancements in vehicle technologies such as ADAS, autonomous systems

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Raw material price volatility

- 3.11.2.2 Supply chain disruptions

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicle (LCV)

- 5.3.2 Medium Commercial Vehicle (MCV)

- 5.3.3 Heavy Commercial Vehicle (HCV)

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Front spindle

- 6.3 Rear spindle

- 6.4 Steering knuckle spindle

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Composite materials

Chapter 8 Market Estimates & Forecast, By Wheel Drive, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Front-Wheel Drive (FWD)

- 8.3 Rear-Wheel Drive (RWD)

- 8.4 All-Wheel Drive (AWD)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Suspension system

- 9.3 Steering system

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 American Axle & Manufacturing Holdings

- 12.2 Benteler Automotive

- 12.3 Bharat Forge

- 12.4 BRIST Axle Systems

- 12.5 Cardone Industries

- 12.6 Dana

- 12.7 GKN Automotive

- 12.8 Hitachi Astemo

- 12.9 Hyundai Mobis

- 12.10 JTEKT

- 12.11 Linamar

- 12.12 Magna International

- 12.13 MAT Foundry Group

- 12.14 Meritor

- 12.15 MevoTech

- 12.16 NSK

- 12.17 NTN

- 12.18 Schaeffler

- 12.19 ThyssenKrupp

- 12.20 ZF Friedrichshafen