PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740834

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740834

Road Speed Limiter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

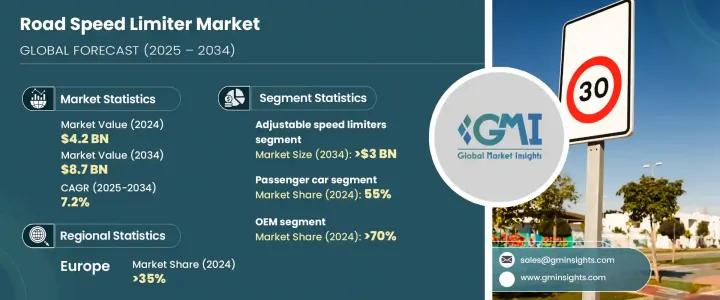

The Global Road Speed Limiter Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 8.7 billion by 2034. This growth is being driven by a combination of regulatory enforcement, rising road safety concerns, and technological innovation. Governments around the world are enforcing stricter safety laws that mandate the installation of speed limiting systems in both commercial and passenger vehicles. These regulations aim to reduce traffic accidents, minimize emissions, and promote safer driving habits. As vehicle production continues to climb globally, manufacturers are increasingly incorporating advanced speed limiter systems to meet compliance and consumer expectations. Simultaneously, rising urbanization and growing vehicle ownership have intensified the need for speed control mechanisms to reduce road congestion and support environmental goals. Moreover, the evolution of smart mobility and vehicle telematics is transforming speed limiters from simple control devices to intelligent, data-driven systems.

The rapid advancement in automotive technology has significantly improved the efficiency and intelligence of speed limiters. New-generation systems are now integrated with GPS, Artificial Intelligence (AI), and various driver assistance technologies, allowing real-time speed adjustments based on road conditions, vehicle location, and traffic patterns. This makes speed limiting more adaptive, responsive, and user-friendly. Vehicle manufacturers are embracing these upgrades, making such systems a standard feature in many new models. As the automotive industry continues its shift toward connected and automated vehicles, the relevance of intelligent speed control is becoming more pronounced. Consumers are also showing a growing preference for safety-oriented features, further pushing the demand for sophisticated speed limiters.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 7.2% |

Based on product type, the road speed limiter market is segmented into adjustable speed limiters, intelligent speed limiters (ISL), electronic speed limiters (ESL), GPS-based systems, and mechanical speed limiters. Adjustable speed limiters held the dominant share in 2024, accounting for over 50% of the total market, and are projected to surpass USD 3 billion by 2034. These systems provide the flexibility needed to adapt to different regional driving conditions, legal requirements, and vehicle classes. Their ability to be modified quickly and easily makes them especially useful for fleets operating across various jurisdictions. This adaptability plays a crucial role in enhancing compliance and preventing violations, making them a preferred solution for commercial operators and logistics providers.

By vehicle type, the market is categorized into passenger cars and commercial vehicles. In 2024, passenger vehicles captured 55% of the global share. A significant portion of this growth can be credited to heightened regulatory pressures targeting passenger safety and the overall increase in personal vehicle ownership worldwide. As automotive safety standards continue to tighten, especially in densely populated regions, demand for embedded speed limiter systems in passenger vehicles is gaining strong momentum. These systems are becoming essential components of modern safety packages, helping to reduce the incidence of speeding and encouraging responsible driving behavior.

On the basis of end use, the market is divided into OEMs (Original Equipment Manufacturers) and aftermarket. In 2024, OEMs held more than 70% of the global market. With rising consumer interest in built-in safety technologies and intelligent driving features, automotive manufacturers are integrating speed limiter systems directly at the production stage. This proactive approach aligns with the growing demand for environmentally friendly and tech-savvy vehicles. OEMs are increasingly embedding adjustable and intelligent speed limiting technologies as part of advanced driver assistance ecosystems, ensuring compliance with evolving legal standards and improving overall vehicle performance and safety.

Geographically, Europe emerged as the leading regional market, commanding over 35% of the global share in 2024. The region's leadership is fueled by its rigorous automotive safety laws and widespread adoption of vehicle safety technologies. Strong policy frameworks and industry-wide standards continue to encourage manufacturers to implement cutting-edge speed control systems. This regulatory support is creating a unified landscape for speed limiter deployment and solidifying the region's dominance in the global market.

Key players in the road speed limiter space include AVS, Autoliv, Continental, Remote Control Technologies (RCT), Denso Corporation, Robert Bosch, Valeo SA, Vodafone Automotive, SABO Electronic Technology, and ZF Friedrichshafen. These companies are investing heavily in R&D and strategic collaborations to develop advanced solutions that combine safety, fuel efficiency, and environmental performance. With vehicle connectivity and automation on the rise, the future of speed limiters lies in smart integrations that ensure safer, cleaner, and more responsible mobility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Speed limit device manufacturers

- 3.2.3 Software & AI-based telematics providers

- 3.2.4 Hardware component suppliers

- 3.2.5 Regulatory and safety technology providers

- 3.2.6 End Use

- 3.3 Profit margin analysis

- 3.4 Trump administrative tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Cross-border compliance disruptions

- 3.4.1.2 Regional regulatory divergence

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (component & tech suppliers)

- 3.4.2.1.1 Electronic component price fluctuations

- 3.4.2.1.2 Sourcing and assembly chain adjustments

- 3.4.2.2 Demand-side impact (OEMs & fleet operators)

- 3.4.2.2.1 Increased vehicle cost and price sensitivity

- 3.4.2.2.2 Changes in fleet procurement dynamics

- 3.4.2.1 Supply-side impact (component & tech suppliers)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Vertical integration and component localization

- 3.4.4.2 Strategic partnerships with OEMs and regulators

- 3.4.4.3 Adaptive pricing and product positioning

- 3.4.5 Outlook and Future Considerations

- 3.4.1 Impact on trade

- 3.5 Profit margin analysis

- 3.6 Technology & innovation landscape

- 3.7 Patent analysis

- 3.8 Price trend

- 3.8.1 Region

- 3.8.2 Vehicle

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 1.1 Case studies

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Stringent government regulations and safety standards

- 3.11.1.2 Technological advancements in vehicle systems

- 3.11.1.3 Rising awareness of road safety and fuel efficiency

- 3.11.1.4 Growth in commercial fleet operations

- 3.11.2 Industry pitfalls & challenges

- 3.11.3 High installation and maintenance costs

- 3.11.4 Resistance from drivers and operators

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Adjustable Speed Limiters

- 5.3 Intelligent speed limiters (ISL)

- 5.4 Electronic speed limiters (ESL)

- 5.5 Gps-based speed limiting systems

- 5.6 Mechanical speed limiters

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Aptiv

- 9.2 Autograde International

- 9.3 AutoKontrol

- 9.4 Autoliv

- 9.5 AVS LTD

- 9.6 Continental

- 9.7 Denso

- 9.8 Elson

- 9.9 Highway Digital (Nigeria) Limited

- 9.10 MKP Parts

- 9.11 Pricol Limited

- 9.12 Remote Control Technologies (RCT)

- 9.13 Robert Bosch

- 9.14 Rosmerta Technologies

- 9.15 SABO Electronic Technology

- 9.16 Sturdy

- 9.17 Transtronix India

- 9.18 Valeo

- 9.19 Vodafone Automotive

- 9.20 ZF Friedrichshafen