PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740836

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740836

Composite Textile Production Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

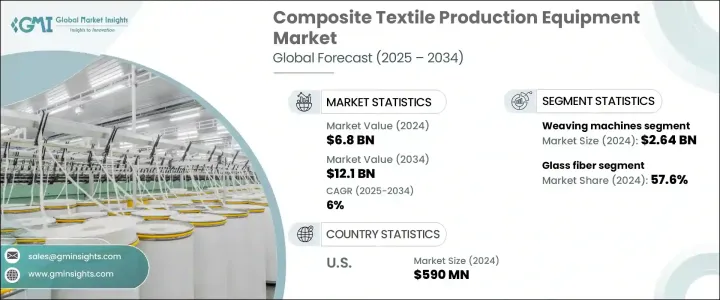

The Global Composite Textile Production Equipment Market was valued at USD 6.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 12.1 billion by 2034. Increasing focus on improving fuel efficiency and reducing structural weight across multiple industries is driving the demand for composite textiles, which, in turn, fuels the growth of production equipment. Industries like aerospace, automotive, wind energy, and sports are adopting these advanced materials due to their exceptional strength-to-weight ratio and resistance to corrosion. These characteristics help manufacturers enhance performance, improve energy efficiency, and reduce emissions. In sectors like transportation and aviation, lighter materials are directly tied to better fuel economy and lower carbon emissions, making composite textiles a critical component in modern manufacturing. The equipment used to manufacture these materials is also evolving rapidly, integrating automation and smart technologies that improve productivity and precision.

Modern composite textile machinery increasingly incorporates CNC capabilities and automated robotics. These systems reduce human error, boost output efficiency, and maintain consistent product quality. They also support quick transitions between different textile patterns or structures, enabling manufacturers to adapt quickly to shifting production needs. This agility is especially important as demand for customized and complex composite materials continues to rise. As industries prioritize precision and scalability, automated solutions are becoming essential for meeting market expectations. The ability to fine-tune operations in real-time makes these systems vital in scaling production without sacrificing consistency or efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $12.1 Billion |

| CAGR | 6% |

In terms of equipment type, the market is segmented into weaving machines, knitting machines, braiding machines, prepreg machines, and others. Weaving machines emerged as the dominant segment in 2024, accounting for USD 2.64 billion in revenue and projected to grow at a CAGR of approximately 6.4% through 2034. Weaving remains one of the core processes in composite textile production due to its ability to transform yarn into high-strength, structurally stable fabric. Compared to knitted or nonwoven methods, woven textiles offer better durability and stress resistance, making them ideal for demanding applications. Their capability to handle complex fiber interlacing patterns using materials like carbon, glass, and aramid reinforces their importance in performance-critical environments. The need for advanced weaving equipment that ensures accuracy and speed is growing, particularly for producing high-performance composite fabrics.

The market is also categorized based on fiber type into carbon fiber, glass fiber, aramid fiber, natural fibers, and others. Glass fiber dominated this segment in 2024, representing 57.6% of the market share. It continues to be widely used due to its affordability and reliable performance across a range of applications. Unlike more expensive fibers, glass fiber offers an ideal combination of cost-efficiency, strength, and endurance. It suits large-scale production in sectors such as automotive, marine, and construction. Its adaptability to various textile processing techniques-such as weaving, knitting, and nonwoven formats-adds to its appeal. Manufacturers benefit from its compatibility with existing machinery, reducing the need for specialized production equipment and minimizing capital investment.

From an end-use perspective, the transportation sector led the market in 2024 and is expected to maintain its leadership through 2034. Demand for lightweight, high-strength composite materials is particularly high in this industry, where structural efficiency translates directly into improved fuel economy and safety performance. Vehicles, trains, and ships are incorporating fiber-reinforced textiles more extensively, favoring materials that offer corrosion resistance and energy absorption. As emissions regulations tighten globally, manufacturers in the transportation sector are increasingly turning to composite materials and the specialized machinery required to produce them at scale.

In North America, the United States led the regional market with a valuation of USD 590 billion in 2024, growing at a CAGR of 5.9%. The rise in lightweight composite applications across defense, automotive, and aerospace sectors continues to drive domestic innovation in textile production technologies. Investments in automation, sustainability, and digitalization are supporting the development of next-generation equipment designed for minimal energy use and waste reduction.

Industry players are focusing on energy-efficient processes such as solvent-free systems and precision-based fiber placement. Efforts are also being made to enhance the recyclability of inputs and integrate eco-friendly materials. Growing emphasis on transparency, traceability, and compliance with international environmental standards is influencing the purchasing decisions of manufacturers, pushing the market toward cleaner, more responsible production methods.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Trade Analysis

- 3.5 Profit margin analysis

- 3.6 Technological overview

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for lightweight and fuel-efficient materials

- 3.9.1.2 Advancements in automation and smart technologies

- 3.9.1.3 Expansion in aerospace and defense applications

- 3.9.1.4 Increasing use in renewable energy sector

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial capital investment

- 3.9.2.2 Environmental and regulatory pressures

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Weaving machines

- 5.3 Knitting machines

- 5.4 Braiding machines

- 5.5 Prepreg machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Fiber Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Carbon fiber

- 6.3 Glass fiber

- 6.4 Aramid fiber

- 6.5 Natural fibers

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Aerospace & defense

- 7.3 Transportation

- 7.4 Construction

- 7.5 Sports & leisure

- 7.6 Medical

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Technology Level, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Manual equipment

- 8.3 Semi-automated systems

- 8.4 Fully automated equipment

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd.

- 11.2 Cygnet Texkimp

- 11.3 Dashmesh Jacquard And Powerloom Pvt. Ltd.

- 11.4 Griffith Textile Machines

- 11.5 Hangzhou Dengte Textile Machinery Co., Ltd

- 11.6 IMESA S.r.l.

- 11.7 Itema Group

- 11.8 KARL MAYER Holding SE & CO2 KG

- 11.9 Lamiflex S.p.A.

- 11.10 Lindauer DORNIER GmbH

- 11.11 McCO2 Machinery Company, Inc.

- 11.12 Optima3D Ltd

- 11.13 Sino Textile Machinery

- 11.14 Trutzschler Nonwovens GmbH

- 11.15 TSUDAKOMA Europe s.r.l.