PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740839

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740839

Udder Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

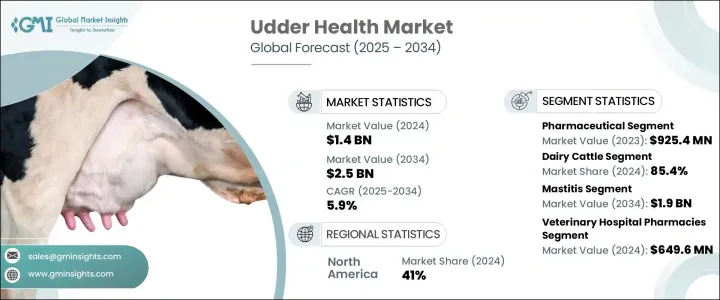

The Global Udder Health Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 2.5 billion by 2034, driven by rising concerns over udder diseases, especially mastitis, along with the surging global demand for dairy products. As dairy farming operations expand and intensify worldwide, the importance of proactive udder health management is becoming more critical than ever. Mastitis remains one of the most common and costly diseases affecting dairy cows, leading to significant losses in milk production, increased veterinary expenses, and long-term herd health issues. Farmers are focusing more on early detection and prevention to maintain profitability and animal welfare. Moreover, the global push for sustainable farming practices is transforming the udder health market, encouraging the adoption of alternatives to traditional antibiotics.

Regulatory bodies across major dairy-producing nations are enforcing stricter controls on antimicrobial use, further accelerating the demand for innovative treatments, vaccines, probiotics, and immune-boosting solutions. Technologies such as AI-driven health monitoring, precision treatment platforms, and advanced herd management systems are reshaping how farmers approach udder health. With consumer demand rising for ethically sourced and antibiotic-free dairy products, the market is set to experience robust growth over the next decade, supported by a combination of technological innovations, evolving farming practices, and increasing awareness about animal welfare and food safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 5.9% |

Mastitis, a frequent concern in dairy herds, continues to drive demand for effective diagnostic, therapeutic, and preventive solutions. As dairy farming grows more intensive, new treatments such as targeted antibiotics and non-invasive therapies are being developed to minimize antimicrobial resistance. Breakthroughs in vaccines, probiotics, and immunotherapies are significantly improving herd health by reducing chronic infections and boosting milk yields. Modern vaccines are becoming highly effective at preventing mastitis and other udder infections, while probiotics and immune-stimulant therapies are proving crucial for maintaining a healthy microbiome in dairy cows. These advancements are not only enhancing animal welfare but are also promoting more sustainable dairy farming by lowering antibiotic reliance.

The market is segmented into pharmaceutical products and supplements. The pharmaceutical segment generated USD 925.4 million in 2023, fueled by the growing incidence of udder infections and heightened concerns over antimicrobial resistance. The rising adoption of AI-powered prescription systems is enhancing treatment precision and herd health, further supporting growth in the pharmaceutical sector.

In terms of animal type, dairy cattle dominated the market with an 85.4% share in 2024. Rising investments in early diagnostic technologies, genetics, and disease resistance are reshaping herd management practices. Farmers are increasingly adopting probiotics and immunotherapy drugs amid global antibiotic restrictions, with AI-driven monitoring and automated milking systems gaining traction.

North America Udder Health Market accounted for 41% of global revenue in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Strong milk production across the U.S. is fueling the demand for advanced udder health solutions, including precision tools and sustainable management strategies. Regulatory pushes to reduce antibiotic use, led by the FDA and USDA, are further boosting the uptake of vaccines, probiotics, and immune-stimulant therapies.

Major players in the global udder health industry include Merck, BouMatic, AHV International, Albert Kerbl, Boehringer Ingelheim, Ceva Sante Animale, Ecolab, Elanco Animal Health, DeLaval, G Shepherd Animal Health, Virbac, and Zoetis. These companies are investing in innovative treatments to address antimicrobial resistance concerns, expanding AI and automation capabilities for diagnostics, partnering with veterinary clinics and farmers to improve product adoption, and enhancing sustainability efforts through eco-friendly product development and farmer education initiatives.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising dairy consumption and production globally

- 3.2.1.2 Increased awareness about udder health management

- 3.2.1.3 Advancements in veterinary diagnostics and treatment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulations on antibiotic use in dairy industry

- 3.2.2.2 High cost of udder health treatments and diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Antibiotics

- 5.2.2 Vaccines

- 5.2.3 Anti-inflammatory drugs

- 5.2.4 Teat disinfectants

- 5.2.5 Intramammary infusions

- 5.2.6 Other pharmaceuticals

- 5.3 Supplement

- 5.3.1 Vitamins and minerals

- 5.3.2 Probiotics and prebiotics

- 5.3.3 Other supplements

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dairy cattle

- 6.3 Other animal types

Chapter 7 Market Estimates and Forecast, By Disease Type, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Mastitis

- 7.2.1 Clinical mastitis

- 7.2.2 Sub-clinical mastitis

- 7.3 Other disease types

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AHV International

- 10.2 Albert Kerbl

- 10.3 Boehringer Ingelheim

- 10.4 BouMatic

- 10.5 Ceva Sante Animale

- 10.6 DeLaval

- 10.7 Ecolab

- 10.8 Elanco Animal Health

- 10.9 G Shepherd Animal Health

- 10.10 Merck

- 10.11 Virbac

- 10.12 Zoetis