PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740842

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740842

Specialty Carbon Black Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

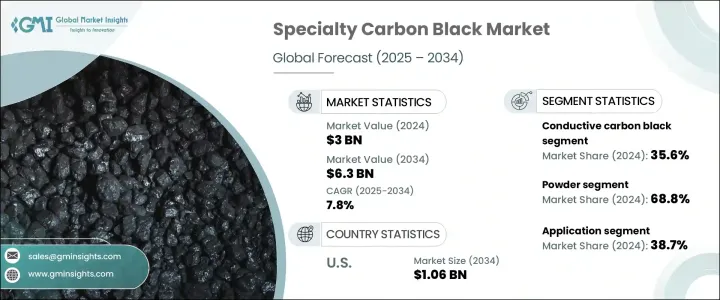

The Global Specialty Carbon Black Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 6.3 billion by 2034. The market is witnessing steady momentum due to increasing utilization across several industries demanding high-performance additives with specific attributes like electrical conductivity, ultraviolet resistance, and enhanced mechanical durability. One of the primary growth drivers is the rising adoption of specialty carbon black in advanced battery technologies, particularly in energy storage systems where consistent performance and stability are critical. A parallel growth trend is observed in the plastics and polymer industries, which are incorporating specialty carbon black for its reinforcing and conductive properties in packaging materials and various high-performance plastic components. This demand is further supported by increased interest in sustainable and efficient material solutions across sectors ranging from automotive to agriculture. The use of specialty carbon black in agricultural films and industrial sacks adds another layer of demand in outdoor applications, where UV protection and physical resilience are essential. Market participants are also recognizing its potential in the ongoing development of next-generation materials, which positions specialty carbon black as a vital component in the innovation pipeline.

In terms of form, the specialty carbon black market in 2024 was segmented into powder and granules, with a combined market value of USD 3 billion. Powder-based specialty carbon black dominated the segment, accounting for 68.8% of the total share. This form is widely used in the production of conductive materials, high-efficiency coatings, and lithium-ion battery components, where fine particle dispersion and material compatibility are essential for performance. The plastics sector is also a key consumer of powder specialty carbon black, particularly in precision applications where visual uniformity and structural integrity are required. Although the granule form currently holds a smaller portion of the market, it is gradually gaining traction due to its dust-free properties and improved processing performance, making it a desirable option for clean and efficient industrial environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $6.3 Billion |

| CAGR | 7.8% |

The market is also categorized by grade, with the major segments including conductive carbon black, fiber carbon black, food-grade carbon black, and others. In 2024, conductive carbon black emerged as the leading segment, representing 35.6% of the overall market. The preference for this grade is largely driven by its effectiveness in enhancing electrical conductivity, improving charge retention, and extending the operational life of components in critical applications. It continues to gain popularity in the evolving energy sector and advanced material development for electronic applications. Fiber carbon black follows closely in the segment breakdown, maintaining strong relevance in high-durability material production.

By application, the rubber industry held the largest market share in 2024, accounting for 38.7% of the global demand. This dominance stems from its broad use in both tire and non-tire rubber products, where reinforcement and environmental resistance are essential. The integration of specialty carbon black in rubber compounds improves product lifespan, surface stability, and protective functionality, making it a cornerstone material in the production cycle of various rubber-based goods.

Geographically, the United States accounted for a significant share of the global specialty carbon black market, capturing 16.1% of the total market in 2024. This share translates to a market value of USD 490 million, with projections indicating growth to approximately USD 1.06 billion by 2034. The strong market performance in the U.S. is closely linked to its advanced manufacturing ecosystem, demand from the automotive and energy storage sectors, and ongoing investments in sustainable material innovations. Government-backed initiatives promoting bio-based alternatives are also contributing to a steady increase in adoption and domestic production capabilities.

The competitive structure of the specialty carbon black industry is shaped by the presence of several global players actively working to expand their market share through strategic alliances, product innovations, and regional expansions. Companies are focusing on enhancing their supply chains, improving product quality, and addressing sustainability goals to differentiate themselves in a rapidly evolving market landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Supplier landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for conductive applications

- 3.8.1.2 Expanding automotive sector and lightweighting trend

- 3.8.1.3 Growth in plastics and polymers industry

- 3.8.1.4 Booming electric vehicle (EV) and energy storage market

- 3.8.1.5 Increasing use in high-performance coatings and paints

- 3.8.1.6 Advancements in polymer composite materials

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High raw material costs and supply chain volatility

- 3.8.2.2 Stringent environmental regulations on carbon emissions

- 3.8.2.3 Competition from alternative materials (graphene, silica, and nanotubes)

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Granules

Chapter 6 Market Estimates and Forecast, By Grade, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conductive carbon black

- 6.3 Fiber carbon black

- 6.4 Food-grade carbon black

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Rubber

- 7.3 Plastics

- 7.4 Printing inks & toners

- 7.5 Paints & coatings

- 7.6 Battery electrodes

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Asahi Carbon Co. Ltd.

- 9.2 Atlas Organics Private Limited

- 9.3 Birla Carbon

- 9.4 Black Bear Carbon B.V.

- 9.5 Cabot Corporation

- 9.6 Continental Carbon Company

- 9.7 Denka Company Limited

- 9.8 Himadri Specialty Chemical Ltd

- 9.9 Omsk Carbon Group

- 9.10 Orion Engineered Carbons GmbH

- 9.11 Phillips Carbon Black Limited

- 9.12 Ralson

- 9.13 Tokai Carbon Co., Ltd.