PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740845

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740845

Graphene Coated Fishing Gear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

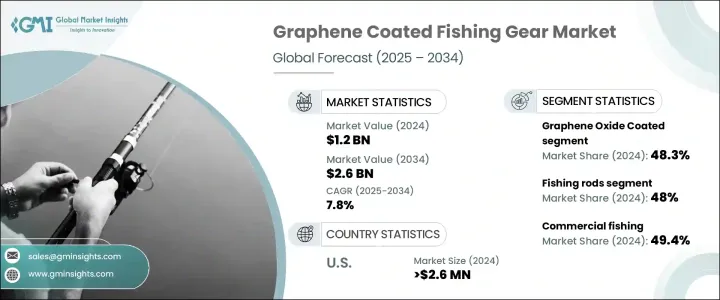

The Global Graphene Coated Fishing Gear Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 2.6 billion by 2034. This growth trajectory is largely driven by the increasing demand for advanced fishing equipment in both recreational and commercial sectors. Anglers and commercial fishers alike are seeking lightweight, high-performance tools that offer strength without sacrificing sensitivity or flexibility. Graphene-based coatings, known for their superior mechanical attributes, are meeting these needs by offering exceptional weight-to-strength ratios. This results in gear that is not only more durable but also highly responsive-qualities that are becoming essential for users demanding long-lasting and performance-driven fishing equipment.

Increased interest from recreational and competitive fishing communities has amplified the appeal of graphene coatings. As more users become aware of the benefits offered by graphene-infused gear, the demand continues to expand. The push for innovation and durability has driven many manufacturers to incorporate graphene into fishing tools as a strategic product upgrade. These coatings enhance sensitivity, reduce fatigue during prolonged use, and significantly increase the product lifespan. With anglers often seeking precision, durability, and responsiveness, graphene-coated gear is quickly becoming the preferred choice. Moreover, as commercial fishing operations continue to scale, the requirement for robust and corrosion-resistant tools is growing. This alignment between product capability and market demand has fueled substantial investments and product developments in the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 7.8% |

In 2024, the market was segmented by product type into fishing rods, reels, lines, nets & traps, and others. Among these, fishing rods accounted for the largest share, contributing 48% to the total market value. Their dominance is due to their extensive use in both sport and leisure fishing. Graphene coatings are being increasingly adopted in rod manufacturing to reinforce strength and flexibility without increasing weight. This makes them highly desirable for anglers looking for equipment that can endure repeated use and perform reliably across various fishing conditions. Enhanced durability and mechanical resilience, paired with increased sensitivity, are positioning graphene-coated rods as a premium offering in the market.

Based on material type, the market in 2024 was segmented into Graphene Oxide Coated, Graphene Nanoplatelets (GNPs), Reduced Graphene Oxide (rGO), and others. Graphene Oxide Coated products held the largest market share at 48.3%, followed by rGO-based coatings. The preference for graphene oxide coatings stems from their excellent dispersion characteristics in polymer matrices, along with robust mechanical properties and barrier functions. These coatings are particularly suitable for rods, reels, and lines, where protection from moisture and corrosion is essential. Another significant advantage is the ease with which graphene oxide materials can be integrated into current manufacturing systems, offering producers a cost-effective path to product enhancement without large-scale operational changes.

By application, the 2024 market was broken down into sports fishing, commercial fishing, recreational, and others. Commercial fishing led the segment with a share of 49.4%. The primary reason for this dominance is the heavy equipment usage and demanding environments common in commercial operations. Gear used in this segment must withstand prolonged exposure to harsh marine conditions and frequent handling. Graphene coatings extend equipment life and reduce the need for replacements or repairs, thereby cutting operational costs. This has made them an increasingly popular choice for commercial fleet operators looking to streamline maintenance cycles and enhance gear longevity.

In the United States, demand for graphene-coated fishing gear has seen notable growth. This is attributed to the rising awareness about the advantages of using high-performance materials that offer both strength and long-term durability. Both the commercial and recreational fishing sectors in the US are showing a growing inclination toward adopting advanced gear that ensures reliability, efficiency, and superior user experience. The market's competitive environment continues to encourage innovation, with numerous companies focusing on expanding their graphene-enhanced product lines to capture evolving consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (hs code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for durable and long-lasting fishing equipment

- 3.7.1.2 Technological advancements and r&d funding

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High production and material costs

- 3.7.2.2 Lack of industry awareness and adoption

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fishing rods

- 5.3 Fishing reels

- 5.4 Fishing lines

- 5.5 Nets & traps

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Graphene oxide coated

- 6.3 Reduced graphene oxide (rGO)

- 6.4 Graphene nanoplatelets (GNPs)

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial fishing

- 7.3 Sports fishing

- 7.4 Recreational

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Century Fishing

- 9.2 Garware Technical Fibres Ltd.

- 9.3 mackenzieflyfishing

- 9.4 MITO Materials

- 9.5 Moonshine Rod Company

- 9.6 St. Croix Fly

- 9.7 Vision Group Oy