PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740847

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740847

Automotive Boot Release Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

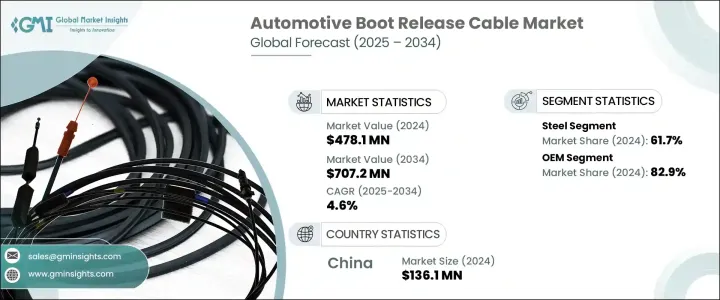

The Global Automotive Boot Release Cable Market was valued at USD 478.1 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 707.2 million by 2034, fueled by rising global vehicle production and the growing demand for advanced vehicle access solutions. As vehicle designs evolve and consumers demand more seamless interactions with their automobiles, trunk access systems have seen a notable transformation. Boot release cables, once simple mechanical components, are now playing a vital role in enabling smarter, more secure, and more efficient trunk access across a wide range of vehicle categories. As automakers continue to embrace smart mobility and electric vehicle technologies, the integration of intelligent trunk systems is becoming a critical feature in vehicle design. Consumers expect convenience and speed, and vehicle manufacturers are responding by deploying high-performance cable systems that blend mechanical reliability with cutting-edge electronics.

The increasing preference for connected, tech-savvy vehicles is shaping how automakers design access features like trunk openings. From gesture-based triggers to mobile app-based functionalities, today's consumers want more than manual levers-they want systems that work in harmony with their digital lifestyles. This demand is driving innovation in automotive boot release cable systems that offer enhanced security, comfort, and user experience. These developments are especially visible in electric and hybrid vehicles, where efficiency, lightweight design, and smart integration are at the forefront of innovation. Automakers are now leveraging technologies that can support high durability and performance even under frequent usage and challenging environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $478.1 Million |

| Forecast Value | $707.2 Million |

| CAGR | 4.6% |

To meet the evolving standards, manufacturers are shifting toward the use of advanced materials and smarter engineering practices. Lightweight, corrosion-resistant, and high-tensile materials are becoming standard in boot release cable production. These materials not only improve product longevity but also enhance vehicle efficiency by reducing overall weight. Steel remains the top choice among materials, capturing nearly 61.7% share of the market in 2024 and projected to grow at a CAGR of 5% through 2034. Its strength, affordability, and resistance to fatigue make it ideal for parts subject to repetitive mechanical stress, especially in commercial and passenger electric vehicles that require frequent trunk access.

In terms of distribution, the OEM segment dominated the global landscape in 2024, accounting for an 82.9% market share, and is expected to maintain its lead through the forecast period. Vehicle manufacturers now treat advanced boot release systems as standard components, integrating them during production to enhance both security and convenience. OEMs are increasingly investing in hybrid mechanical-electronic solutions that align with the future of vehicle access-offering smarter, safer, and more intuitive features for the end user. This shift is particularly prominent among global automotive brands that aim to stay competitive by improving user experience from the first point of interaction.

China is emerging as the most influential regional market, representing 57.6% of global revenue in 2024, with projections hitting USD 136.1 million by 2034. The country's high volume of vehicle production, combined with its robust automotive components ecosystem, gives it a strategic edge in the global market. Leading suppliers in China are focusing on manufacturing high-precision, corrosion-resistant, and safety-enhanced cable systems to meet international standards and demand. Continuous investments in R&D and smart manufacturing practices further strengthen China's position as a global hub for advanced automotive cable technologies.

To stay ahead in this competitive space, major players like THB Group, Universal Cable, Leoni AG, Nexans Auto Electric, Birla Cable, Kei Industry, TE Connectivity, Polycab, Sumitomo Electric Industries, and Sterlite Technologies are focusing on designing lightweight, multi-functional boot release cable systems. These companies are expanding their global presence through strategic alliances and improving their manufacturing capabilities with automation and next-gen materials. Their collective focus on performance, durability, and compatibility with smart vehicle platforms ensures they remain aligned with the evolving needs of the automotive industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End-use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing emphasis on vehicle security & access systems

- 3.10.1.2 Easy installation and low maintenance

- 3.10.1.3 OEM preference for modular components

- 3.10.1.4 Global vehicle production growth

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Shift towards electronic & smart trunk systems

- 3.10.2.2 Low replacement frequency

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Steel

- 5.3 Aluminium

- 5.4 Plastic

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchbacks

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light duty

- 6.3.2 Medium duty

- 6.3.3 Heavy duty

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric

- 7.5 PHEV

- 7.6 HEV

- 7.7 FCEV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Auto7

- 10.2 Birla Cable

- 10.3 Chuhatsu

- 10.4 CMA

- 10.5 Dorman Products

- 10.6 Dura Automotive Systems

- 10.7 GEMO

- 10.8 HI-LEX

- 10.9 Infac Corporation

- 10.10 Kei Industries

- 10.11 Kongsberg Automotive

- 10.12 L&P Automotive Group

- 10.13 Leoni AG

- 10.14 Nexans Auto Electric

- 10.15 Polycab

- 10.16 Sterlite Technology

- 10.17 Sumitomo Electric Industries

- 10.18 TE connectivity

- 10.19 THB Group

- 10.20 Universal Cable