PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740851

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740851

Frozen Potatoes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

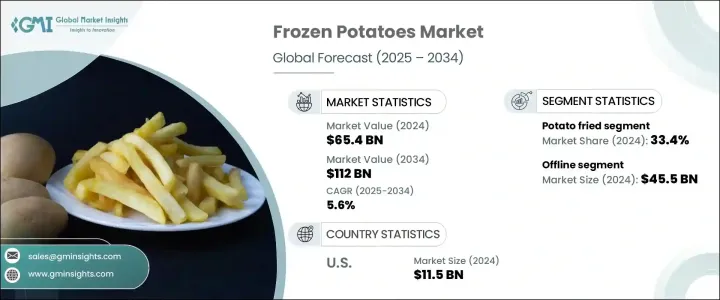

The Global Frozen Potatoes Market was valued at USD 65.4 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 112 billion by 2034, fueled by changing consumer lifestyles and an ever-increasing demand for convenient, ready-to-cook food options. As consumers juggle fast-paced routines and tighter schedules, frozen potatoes have become a staple in both household kitchens and professional food service settings. The category's steady rise reflects a broader shift toward convenient meal solutions that don't compromise on taste, quality, or nutritional value. Frozen potato products are no longer limited to traditional French fries-they now span an array of innovative offerings including wedges, baked options, and gluten-free varieties, each tailored to meet the evolving expectations of modern consumers.

Growing awareness around healthier eating habits, combined with advances in freezing technologies, is reshaping the market landscape. Enhanced supply chain logistics, a surge in quick-service restaurant consumption, and increasing penetration into emerging economies further strengthen the market's outlook. With global dining habits leaning toward speed, flavor, and variety, frozen potato products are set to dominate freezer aisles, menus, and food delivery platforms worldwide. This upward trend is underpinned by strategic manufacturer investments in product innovation, clean-label development, and enhanced distribution channels that make frozen potatoes more accessible than ever before.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $65.4 Billion |

| Forecast Value | $112 Billion |

| CAGR | 5.6% |

Busy urban lifestyles and the surging popularity of fast-casual dining are major factors driving the growth of frozen potato products. As people look for quick meal solutions that are both tasty and satisfying, the demand for long shelf-life options is rising. The food service industry plays a critical role in boosting sales, offering frozen potato products that deliver consistency and ease of preparation at scale. Operators rely on these items to streamline kitchen operations, reduce prep time, and meet fluctuating customer demands without sacrificing flavor or quality. At the same time, retail channels are thriving as more consumers stock their freezers with versatile potato items for at-home convenience.

Health-focused innovations are adding a new dimension to market growth. Low-fat, air-fried, and preservative-free options are catching the attention of health-conscious buyers who want indulgence with fewer compromises. Clean-label trends are gaining traction, prompting manufacturers to introduce products with reduced sodium, gluten-free attributes, and natural ingredients. These alternatives don't just appeal to individual consumers-they're also seeing increased uptake in institutional settings like schools, hospitals, and corporate cafeterias where balanced nutrition and dietary compliance are top priorities. As taste and texture continue to improve, and as labels become more transparent, these better-for-you options are penetrating both mainstream and niche markets alike.

Fried potatoes currently hold the largest share of the market, accounting for 33.4% in 2024, and are projected to grow at a CAGR of 4.8% through 2034. Their popularity remains strong due to the demand from fast-food chains and the enduring consumer love for crisp, golden textures. Beyond fries, other formats such as wedges, stuffed varieties, slices, dice, chunks, and baked alternatives are gaining momentum. These products cater to different cooking preferences and dietary needs, with chunks working well in hearty stews, and baked versions offering a lighter, oil-free option that aligns with wellness trends.

In terms of distribution, the food service segment held a 39.6% market share in 2024 and is set to grow at a CAGR of 5.2% through 2034. Restaurants, catering services, and institutional kitchens depend heavily on frozen potato offerings to maintain efficiency and deliver consistent dishes. Retail is also a key growth driver, with consumers increasingly purchasing ready-to-cook potato products from supermarkets, neighborhood stores, and online platforms.

The United States Frozen Potatoes Market alone generated USD 11.5 billion in 2024 and is forecasted to expand steadily at a CAGR of 4.8% through 2034. The nation's strong fast-food culture and well-established network of food service providers ensure consistent demand. Menu innovations across restaurant chains, coupled with the widespread availability of frozen products in grocery stores, club warehouses, and specialty retailers, contribute to the market's sustained momentum.

Key players in the global frozen potatoes space include McCain Foods Limited, J.R. Simplot Company, Farm Frites International B.V., Lamb Weston Holdings, Inc., and Cavendish Farms. These companies are actively investing in gourmet-style product lines, partnering with foodservice operators, expanding into high-growth regions, and embracing automation to enhance production efficiency. With a growing focus on digital marketing and e-commerce, leading brands are reaching consumers more directly and effectively-ensuring strong visibility, accessibility, and customer loyalty across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for convenience and ready-to-eat foods

- 3.8.1.2 Expansion of quick service restaurants (QSRs) globally

- 3.8.1.3 Growth in frozen food retail infrastructure

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Health concerns over processed and fried foods

- 3.8.2.2 Volatility in raw potato prices due to climate impact

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Potato fried

- 5.3 Potato wedges

- 5.4 Stuffed potatoes

- 5.5 Potato slices

- 5.6 Potato chunks

- 5.7 Potato dices

- 5.8 Baked potato

- 5.9 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Foodservice

- 6.3 Retail

- 6.4 Quick service restaurants

- 6.5 Households

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Offline

- 7.2.1 Supermarkets & hypermarkets

- 7.2.2 Convenience stores

- 7.2.3 Specialty stores

- 7.3 Online

- 7.3.1 E-commerce platforms

- 7.3.2 Company-owned websites

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agristo

- 9.2 Aviko B.V.

- 9.3 Bart’s Potato Company

- 9.4 Cavendish Farms

- 9.5 Farm Frites International B.V.

- 9.6 J.R. Simplot Company

- 9.7 Lamb Weston Holdings, Inc.

- 9.8 McCain Foods Limited

- 9.9 Mydibel Group

- 9.10 Pohjolan Peruna Oy