PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740861

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740861

Insect-based Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

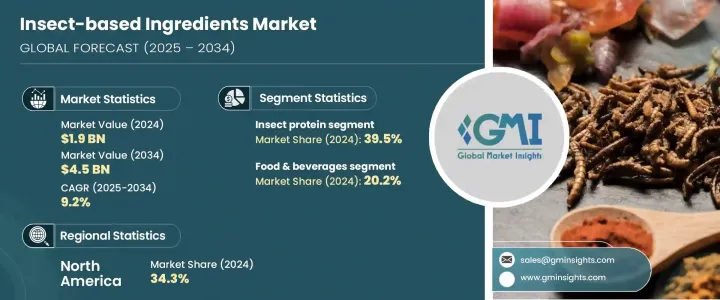

The Global Insect-Based Ingredients Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 4.5 billion by 2034. A growing awareness of environmental sustainability, food security, and resource efficiency is pushing insect-based ingredients into the global spotlight. Consumers and industries are increasingly seeking alternatives that can meet rising protein demands without exacerbating climate change or depleting natural resources. Insects, with their minimal land and water needs, low greenhouse gas emissions, and impressive protein yield, offer a compelling solution.

Unlike conventional livestock farming, insect farming provides a more scalable, cost-effective model that aligns with global goals for sustainable food systems. Advances in processing technologies, expanded applications across diverse sectors, and shifting regulatory frameworks are accelerating market momentum. As investment pours into food tech innovations and consumer acceptance broadens, insect-based ingredients are moving rapidly from a niche product to a mainstream necessity. Growing media coverage, strategic marketing initiatives, and endorsements from nutritionists and sustainability advocates are further validating the role of insects as a viable and essential protein source for the future.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 9.2% |

Based on ingredient types, the market is divided into insect protein, insect powder, insect oils, and insect chitin. Insect protein led the segment in 2024, capturing 39.5% of the overall market share. Its superior amino acid profile, rapid absorption, and dense nutrient concentration make it highly desirable across industries that require high-performance ingredients. Sectors like pet food, aquafeed, and sports nutrition are particularly driving demand, given the need for sustainable yet potent protein alternatives.

Based on application, the market includes the cosmetics industry, food and beverages industry, agriculture, pharmaceutical industry, animal feed industry, and others. The food and beverages category accounted for 20.2% of the market in 2024 and is projected to expand at a CAGR of 9.6%. Rising consumer interest in clean-label, eco-friendly food products is fueling demand for insect-derived flours and high-protein formulations. A growing emphasis on sustainable diets and carbon footprint reduction is encouraging more consumers to experiment with insect-based food options, signaling a broader shift in dietary preferences.

North America Insect-Based Ingredients Market held a 34.3% share in 2024, driven by favorable regulations, a surge in venture capital investments in food tech, and a cultural shift toward sustainability and wellness. Regulatory approvals for specific insect species in food and feed have accelerated commercialization efforts, opening the door for innovative startups and large-scale producers alike. A strong focus on clean-label, high-protein, and environmentally responsible nutrition continues to fuel market expansion across the United States and Canada.

Leading players shaping the market include EnviroFlight, Ynsect, Entomo Farms, AgriProtein, and Protix. These companies are investing heavily in R&D, scaling production capacities, securing regulatory certifications, and forming strategic supply chain alliances. Consumer education campaigns and transparent labeling practices are playing a crucial role in building trust and driving the adoption of insect-based ingredients worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Impact on trade

- 3.1.8 Trade volume disruptions

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.1 Impact on trade

- 3.3 Impact on the industry

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.4 Demand-Side impact (Selling Price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and Future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 Impact forces

- 3.12.1 Growth drivers

- 3.12.1.1 Technological innovations in insect farming and processing

- 3.12.1.2 Supportive regulatory frameworks and policy advancements

- 3.12.1.3 Shifting consumer preferences toward sustainable and nutrient-rich foods

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 Consumer perception and cultural barriers

- 3.12.2.2 Supply chain and scaling limitations

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Insect Protein

- 5.2.1 Crude protein

- 5.2.2 Insect meal

- 5.2.3 Isolated protein

- 5.3 Insect Oils

- 5.3.1 Fatty acids

- 5.3.2 Omega-3 and Omega-6 fatty acids

- 5.4 Insect Powder

- 5.4.1 Dried insect powder

- 5.4.2 Protein powder

- 5.5 Insect Chitin

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverages industry

- 6.3 Animal feed industry

- 6.4 Cosmetics Industry

- 6.5 Pharmaceutical Industry

- 6.6 Agriculture (bioplastics, fertilizers, etc.)

- 6.7 Others (textile, biochemical)

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Ynsect

- 8.2 Protix

- 8.3 AgriProtein

- 8.4 EnviroFlight

- 8.5 Entomo Farms

- 8.6 Six Foods

- 8.7 Bugsolutely

- 8.8 AgriProtein

- 8.9 Beta Hatch Source