PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740862

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740862

STD Self-testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

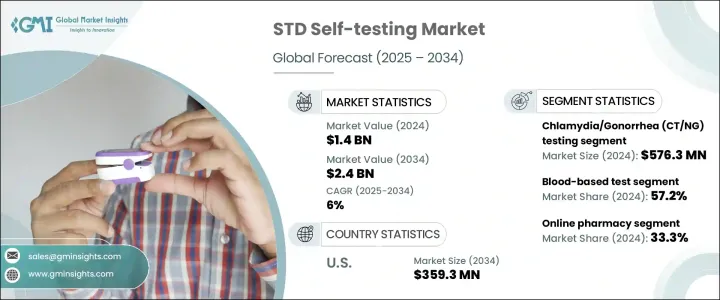

The Global STD Self-Testing Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 2.4 billion by 2034. STD self-testing involves individuals collecting their biological samples-such as blood, saliva, or urine-and using a home-based testing kit to screen for sexually transmitted infections. As the global incidence of sexually transmitted diseases continues to rise, the demand for accessible and discreet testing methods is increasing rapidly. People are becoming more proactive about monitoring their sexual health, and self-testing kits offer a private, convenient alternative to traditional clinic-based diagnostics. With STDs such as chlamydia, gonorrhea, syphilis, and HIV becoming more prevalent, there is a growing need for user-friendly solutions that reduce the stigma and barriers associated with visiting healthcare facilities. Individuals are now seeking tools that allow them to manage their health without judgment, long waiting times, or the need for physical consultations. This shift in behavior is driving investments in technology and the development of reliable home diagnostic kits that deliver accurate results while maintaining user confidentiality.

The market, based on application, is segmented into chlamydia/gonorrhea (CT/NG) testing, syphilis testing, HIV testing, and other testing types. The CT/NG testing segment emerged as the highest revenue contributor in 2024, generating USD 576.3 million. This segment is expected to grow at a CAGR of 6.1% through the forecast period. The increasing number of infections caused by chlamydia and gonorrhea has made self-testing solutions more essential than ever. As these infections often go undetected due to a lack of symptoms, early diagnosis through accessible testing becomes critical in reducing the overall disease burden. Self-testing kits tailored for CT/NG detection enable users to screen themselves with greater ease and discretion, significantly supporting the market's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 6% |

By sample type, the STD self-testing market is categorized into blood-based, urine-based, and oral-based tests. Among these, blood-based tests led the market with a 57.2% share in 2024. These tests are known for their high sensitivity and ability to detect various STDs with greater accuracy compared to urine or oral sample kits. Their ability to deliver reliable results with minimal false negatives has made them a preferred choice among consumers. As these kits provide early detection, they facilitate timely treatment and minimize the risk of transmission, which has fueled their widespread adoption in both clinical and at-home settings. The growing emphasis on early and accurate diagnosis has further positioned blood-based testing kits as the most trusted option among end users. These kits also undergo rigorous regulatory scrutiny, ensuring high standards of quality and safety, which enhances their acceptance in global markets.

When evaluated by distribution channel, the market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. The online pharmacy segment is showing the fastest growth, holding a 33.3% market share in 2024. A key factor driving this growth is the increasing demand for discreet purchasing channels that offer convenience and privacy. Online platforms allow consumers to order test kits directly from home, avoiding in-person visits and long queues. These digital channels often provide detailed product guides and user instructions, improving the overall user experience and encouraging more people to choose self-testing as a viable option. Competitive pricing and package deals offered by online pharmacies also make them an attractive choice for budget-conscious buyers.

In terms of regional performance, the U.S. STD self-testing market is projected to reach USD 359.3 million by 2034. A surge in awareness around early diagnosis, coupled with the growing emphasis on privacy in healthcare, is driving greater adoption of self-test kits across the country. People are increasingly turning to home-based solutions that offer fast results without the discomfort of traditional testing processes. The expansion of digital health services has further improved access to testing solutions and virtual support, which continues to drive market growth in developed economies.

The competitive landscape of the market is shaped by both long-established players and emerging brands. Leading companies such as bioLytical Laboratories, OraSure Technologies, LetsGetChecked, Everlywell, Biosure, and Wondfo currently hold around 35% of the global revenue share. These firms are actively investing in R&D to develop user-centric, high-accuracy products that deliver results quickly and reliably. Product innovation remains a key growth strategy, with companies striving to simplify usage and enhance user confidence. At the same time, newer market entrants are focusing on affordability and cost-effective pricing strategies to attract a broader consumer base, particularly in price-sensitive regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry impact forces

- 3.1.1 Growth drivers

- 3.1.1.1 Rising incidence of sexually transmitted diseases

- 3.1.1.2 Growth in awareness and screening programs

- 3.1.1.3 Convenience and privacy associated to self-testing

- 3.1.1.4 Technological advancements in STD diagnostics

- 3.1.2 Industry pitfalls and challenges

- 3.1.2.1 Concerns related to quality control and accuracy

- 3.1.2.2 Stringent regulatory scenario

- 3.1.1 Growth drivers

- 3.2 Growth potential analysis

- 3.3 Regulatory landscape

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (Raw materials)

- 3.4.2.2 Price volatility in key materials

- 3.4.2.3 Supply chain restructuring

- 3.4.2.4 Production cost implications

- 3.4.3 Demand-side impact (Selling price)

- 3.4.3.1 Price transmission to end markets

- 3.4.3.2 Market share dynamics

- 3.4.3.3 Consumer response patterns

- 3.4.4 Key companies impacted

- 3.4.5 Strategic industry responses

- 3.4.5.1 Supply chain reconfiguration

- 3.4.5.2 Pricing and product strategies

- 3.4.5.3 Policy engagement

- 3.4.6 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Chlamydia/Gonorrhea (CT/NG) testing

- 5.3 Syphilis testing

- 5.4 HIV testing

- 5.5 Other applications

Chapter 6 Market Estimates and Forecast, By Sample Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Blood based test

- 6.3 Urine based test

- 6.4 Oral based test

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Online pharmacies

- 7.4 Retail pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Atomo diagnostics

- 9.2 autotest VIH

- 9.3 bioLytical Laboratories

- 9.4 BioSure

- 9.5 Everlywell

- 9.6 JAL Medical

- 9.7 LetsGetChecked

- 9.8 MedMira

- 9.9 Meril Life Sciences

- 9.10 My Lab Box

- 9.11 NOWDiagnostics

- 9.12 OraSure Technologies

- 9.13 Selfdiagnostics

- 9.14 Viatris

- 9.15 Wondfo