PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740872

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740872

Alternative Protein Production Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

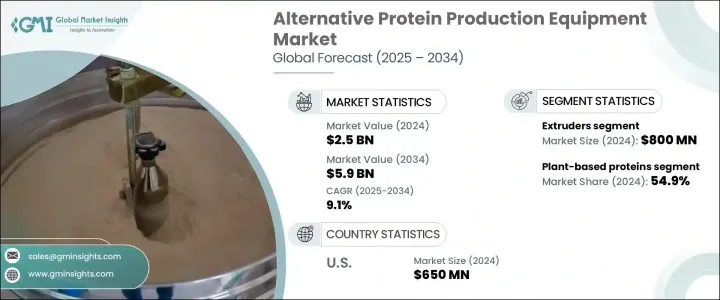

The Global Alternative Protein Production Equipment Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 5.9 billion by 2034. This growth is largely driven by a major shift in global eating habits as consumers increasingly seek food alternatives that align with modern values around health, sustainability, and ethical consumption. With population growth accelerating and income levels rising across key markets, the demand for scalable, reliable, and clean food production technologies is gaining momentum. Traditional food systems are under pressure, prompting the industry to invest in advanced processing equipment that supports alternative proteins. These solutions are becoming critical in transforming how food is produced, offering a viable substitute to conventional meat without compromising on nutrition or taste.

The growing awareness around healthy living is another driving force behind the rise in demand for equipment capable of producing non-traditional protein sources. Consumers today are far more selective about what they eat, actively avoiding foods linked to chronic diseases while embracing options that fuel a more energetic lifestyle. This shift in mindset is encouraging food manufacturers to explore protein alternatives that are leaner, richer in fiber, and free from additives like hormones or antibiotics. As a result, there is increased pressure on producers to invest in advanced machinery capable of efficiently manufacturing these high-demand protein formats. This is reshaping the industry landscape and establishing new standards in food production and equipment design.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 9.1% |

In terms of equipment types, extruders led the market by generating USD 800 million in revenue in 2024. This segment is expected to grow at a CAGR of approximately 9.4% through 2034. These machines are essential for shaping protein ingredients into textures that appeal to consumers seeking substitutes for conventional meat. High-moisture extrusion technology, in particular, is being used to replicate the fibrous structure found in animal tissue, enhancing the eating experience for plant-based protein consumers and helping to drive broader adoption of alternative food products.

Application-wise, plant-based proteins accounted for 54.9% of the total market share in 2024 and are projected to grow at a CAGR of about 9.6% during the forecast period. This segment has captured early market attention thanks to its cost advantages, market readiness, and consumer acceptance. Products derived from various plant sources are finding a strong foothold in grocery aisles and foodservice menus, appealing to a growing group of health-conscious consumers and those interested in more sustainable food systems. The push for improved processing capabilities has led to new investments in equipment such as separators, mixers, dryers, and extruders, tailored to handle plant-derived inputs and optimize output quality.

The food industry continues to dominate the market in terms of end use, holding the largest share in 2024, and is expected to maintain this lead through 2034. As companies race to cater to evolving consumer preferences, they are investing heavily in precision-engineered equipment that supports large-scale production of alternative protein products. Both established food brands and emerging companies are directing capital toward upgrading their manufacturing lines to stay competitive. Demand for fermenters, hoppers, bioreactors, and high-volume extruders is rising, driven by the need to meet quality standards and production scalability. Enhanced retail interest and increased consumer spending on health-driven and environmentally friendly products are further accelerating this trend.

Regionally, the United States led the North American market with a valuation of USD 650 million in 2024 and is set to grow at a CAGR of 9.5% through 2034. Interest in sustainable eating practices and plant-forward diets is encouraging manufacturers to set up or expand facilities geared toward alternative protein production. The shift in consumer preferences is pushing demand for innovative food processing technologies and reinforcing the importance of advanced, automated machinery in this space. This rise in demand has created new opportunities for equipment manufacturers to offer more specialized solutions tailored to the needs of food producers.

Key players actively shaping the alternative protein production equipment market include ANDRITZ AG, Alfa Laval AB, BAK Food Equipment, Buhler AG, FAM STUMABO, Bepex International LLC, GEA Group Aktiengesellschaft, Middleby Corporation, JBT Marel Corporation, MULTIVAC Sepp Haggenmuller SE & Co. KG, Robert Reiser & Co., Inc., Rockwell Automation, Paul Mueller Company, Scansteel Foodtech A/S, and SPX FLOW. These companies are at the forefront of designing and delivering advanced machinery systems that meet the evolving needs of modern protein production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-Side impact (Selling Price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Trade analysis

- 3.5 Profit margin analysis

- 3.6 Technological overview

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rapidly growing global population

- 3.9.1.2 Growing emphasis on health and wellness

- 3.9.1.3 Rising consumer demand for sustainable proteins

- 3.9.1.4 Expansion of plant-based protein production

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial capital investment

- 3.9.2.2 Complexity of integration with existing systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Extruders

- 5.3 Homogenizers

- 5.4 Mixers

- 5.5 Dryers

- 5.6 Filtration units

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Plant-Based proteins

- 7.3 Cultured meat

- 7.4 Insect proteins

- 7.5 Egg replacements

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food industry

- 8.3 Animal feed

- 8.4 Nutraceuticals

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Processing Technology, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Texturization

- 9.3 Fermentation

- 9.4 Emulsification

- 9.5 Spray drying

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alfa Laval AB

- 11.2 ANDRITZ AG

- 11.3 BAK Food Equipment

- 11.4 Bepex International LLC

- 11.5 Buhler AG

- 11.6 FAM STUMABO

- 11.7 GEA Group Aktiengesellschaft

- 11.8 JBT Marel Corporation

- 11.9 Middleby Corporation

- 11.10 MULTIVAC Sepp Haggenmuller SE & Co. KG

- 11.11 Paul Mueller Company

- 11.12 Robert Reiser & Co., Inc.

- 11.13 Rockwell Automation

- 11.14 Scansteel Foodtech A/S.

- 11.15 SPX FLOW