PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740881

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740881

Aluminum Sheets and Coils Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

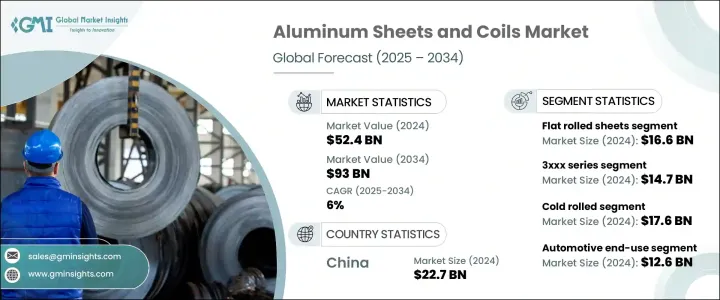

The Global Aluminum Sheets And Coils Market was valued at USD 52.4 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 93 billion by 2034. This growth stems largely from the ongoing rise in industrial productivity and the increasing preference for sustainable materials. Aluminum's lightweight properties make it ideal for sectors aiming to improve energy efficiency and reduce emissions. As industries embrace electrification and advanced technologies, aluminum is becoming more integral due to its ability to contribute to lower product weight without compromising strength. The accelerating shift toward cleaner energy and transportation, especially the rising demand for electric mobility, is also fueling market expansion. Alongside this, evolving manufacturing techniques, such as automation and digitalization, are enabling faster, more precise production to match growing global demand. These efficiencies are critical as producers race to meet the needs of industries prioritizing lightweight, durable, and recyclable materials. The market is also shaped by fierce competition and the increasing push for low-emission production solutions across regions, reinforcing the need for cost-effective, high-performance aluminum solutions that align with global sustainability goals.

Flat rolled aluminum sheets and coils commanded a market size of USD 16.6 billion in 2024 and are expected to grow at a CAGR of 5.7% from 2025 to 2034. Their adaptability and economic feasibility make them a top choice across core industries, especially where durability, flexibility, and lightweight characteristics are valued for mass production. These materials are commonly favored due to their ease of handling and compatibility with multiple manufacturing processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.4 Billion |

| Forecast Value | $93 Billion |

| CAGR | 6% |

Clad and anodized sheets continue to attract interest for applications requiring corrosion resistance, visual appeal, and surface durability. These aluminum variants are preferred in precision-demanding sectors and are prompting innovation in coating technologies and alloy compositions to improve surface integrity. Their increased adoption is intensifying competition in specialized product categories.

Textured variants like patterned, corrugated, and perforated aluminum sheets find relevance in aesthetic and industrial applications, reflecting a trend towards functional design that also enhances performance and structure. These types are gaining attention for their versatility in structural reinforcement and architectural detailing.

Among alloy types, the 3xxx series reached a valuation of USD 14.7 billion in 2024 and is forecasted to grow at a CAGR of 6.1% through 2034. This series, along with the 1xxx group, dominates market share due to its corrosion resistance, electrical conductivity, and cost-effectiveness. These grades are especially popular in sectors where functional performance and affordability are key factors, and producers are focused on maintaining high output efficiency and consistent quality while keeping costs competitive.

Meanwhile, the 5xxx and 6xxx series continue to find steady demand in sectors requiring high-strength, weldable aluminum, notably in infrastructure and heavy-duty applications. Higher-grade aluminum from the 2xxx, 7xxx, and 8xxx series fulfills the need for performance in technologically advanced markets, where durability and precision are crucial.

In terms of processing methods, the cold rolled aluminum segment held a market value of USD 17.6 billion in 2024 and is anticipated to grow at a CAGR of 6.4% through 2034. This category benefits from superior surface finish, tight tolerances, and enhanced mechanical properties, contributing to its extensive use across critical applications. While hot rolled variants are less precise, they are often chosen for their strength and reliability in demanding environments.

Aluminum sheets and coils used in the automotive sector accounted for USD 12.6 billion in 2024, representing a 24% market share and are poised to grow at 6.1% CAGR through the forecast period. These materials are integral in modern vehicle design, particularly for reducing vehicle weight and achieving better fuel efficiency. Their application spans structural components and energy storage systems, as manufacturers continue to incorporate more aluminum into mainstream vehicle architecture.

The building and construction industry also contributes significantly to demand, leveraging aluminum's resilience, light weight, and aesthetic properties for structural, roofing, and insulation needs. In packaging and electronics, aluminum remains a reliable choice due to its safety, recyclability, and resistance to contamination. The global emphasis on recycling further enhances its value in consumer packaging applications.

In regional terms, China led the market with a valuation of USD 22.7 billion in 2024, and it is expected to expand at a CAGR of 5.9% through 2034. With high domestic demand and the world's most extensive aluminum production capacity, China remains a dominant force. Meanwhile, the United States continues to register stable consumption patterns, bolstered by policy shifts supporting infrastructure development and energy transformation. However, both nations navigate complex global trade dynamics, which are shaping sourcing strategies and encouraging localized supply chains.

Major market participants include Alcoa Corporation, China Hongqiao Group, Rusal, Rio Tinto, and Norsk Hydro ASA. These companies are advancing production capabilities through low-emission technologies and strategic investments in sustainable aluminum manufacturing. Industry leaders are focusing on digital innovation, high-grade alloys, and expanding recycling operations to remain competitive in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for lightweight materials in automotive industry

- 3.7.1.2 Government initiatives for sustainable infrastructure

- 3.7.1.3 Growth in aerospace and defense sector

- 3.7.1.4 Expanding demand in consumer electronics

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Environmental impact of aluminum production

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Flat rolled sheets

- 5.3 Coiled sheets

- 5.4 Clad sheets

- 5.5 Anodized sheets

- 5.6 Patterned sheets

- 5.7 Corrugated sheets

- 5.8 Perforated sheets

Chapter 6 Market Estimates & Forecast, By Grade/Alloy Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 1xxx series

- 6.3 2xxx series

- 6.4 3xxx series

- 6.5 5xxx series

- 6.6 6xxx series

- 6.7 7xxx series

- 6.8 8xxx series

Chapter 7 Market Estimates & Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cold rolled

- 7.3 Hot rolled

- 7.4 Continuous casting

- 7.5 Direct chill (DC) casting

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Building & construction

- 8.4 Aerospace

- 8.5 Electrical & electronics

- 8.6 Food & beverage

- 8.7 Machinery & equipment

- 8.8 Consumer durables

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alcoa Corporation

- 10.2 Novelis Inc.

- 10.3 Arconic Corporation

- 10.4 Kaiser Aluminum

- 10.5 Hindalco Industries

- 10.6 Constellium SE

- 10.7 UACJ Corporation

- 10.8 Norsk Hydro ASA

- 10.9 JW Aluminum

- 10.10 Aleris Corporation

- 10.11 Hindalco Industries Ltd.

- 10.12 BALCO (Bharat Aluminium)

- 10.13 China Hongqiao Group