PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740886

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740886

Automotive Gas Charged Shock Absorber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

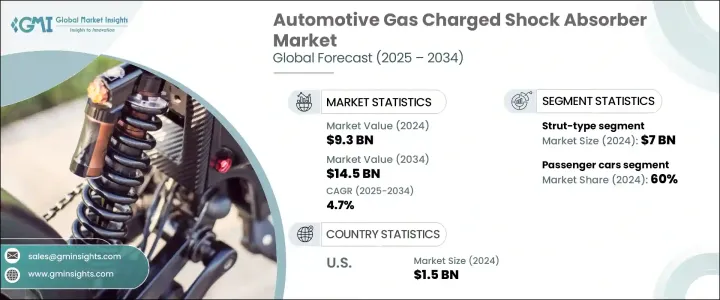

The Global Automotive Gas Charged Shock Absorber Market was valued at USD 9.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 14.5 billion by 2034, supported by rising consumer expectations for enhanced ride comfort, superior vehicle handling, and safer driving experiences across diverse terrains. As automakers continue to shift toward advanced suspension systems, the demand for high-performance components like gas-charged shock absorbers is gaining significant traction. These absorbers play a key role in reducing vibrations, enhancing vehicle stability, and delivering smoother rides, especially in high-speed and off-road conditions.

With evolving automotive technologies, consumers now expect their vehicles to offer both comfort and performance, which has placed advanced damping systems at the forefront of vehicle engineering. The global expansion of premium vehicle segments, growing urban traffic congestion, and a surge in long-distance driving habits are collectively fueling the need for better shock management systems. Gas-charged shock absorbers provide a crucial advantage over traditional hydraulic shocks by offering resistance to aeration and foaming, which ensures consistent performance under continuous or aggressive driving. As the automotive sector leans more into electrification and smart vehicle systems, these absorbers are being tailored to support dynamic loads without compromising energy efficiency or battery range.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $14.5 Billion |

| CAGR | 4.7% |

With the rapid adoption of performance-focused vehicle platforms, particularly SUVs and crossovers, gas-charged shock absorbers are becoming a standard component in both passenger and commercial vehicle categories. Their ability to deliver advanced damping efficiency and maintain optimal balance under varying loads and conditions makes them indispensable in today's suspension systems. These shock absorbers are engineered to meet the growing consumer need for better handling, reduced body roll, improved pitch control, and overall smoother rides. Automakers are integrating gas-charged absorbers into newer models to differentiate performance features and meet the demand for premium ride quality. This growing preference is evident in both urban and rural settings, where road conditions and driving expectations vary significantly, further validating the versatility of gas-charged systems.

The passenger vehicle segment commanded a dominant 60% share in 2024, driven by the increasing rate of personal car ownership, rising disposable incomes, and an expanding middle-class demographic. Consumers are prioritizing vehicles that offer improved comfort, stability, and handling-particularly for daily commutes and longer journeys. In emerging economies, where car sales are booming, the focus on premium suspension components is intensifying as buyers look for vehicles that deliver a seamless driving experience. Gas-charged shock absorbers meet this demand by providing better damping characteristics, making them a preferred choice in modern vehicle platforms aimed at comfort, control, and safety.

Based on mounting type, strut-type gas charged shock absorbers led the market with a valuation of USD 7 billion in 2024. These components are widely adopted due to their integrated construction, which combines the coil spring and shock absorber into one compact unit. This configuration supports space efficiency in front suspension layouts and helps reduce the vehicle's overall weight, contributing to fuel efficiency and lower emissions. The design also offers ease of installation and simplified maintenance, making strut-type shock absorbers a cost-effective solution for large-scale automotive manufacturing.

The North America Automotive Gas Charged Shock Absorber Market accounted for USD 1.5 billion in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2034. This growth is backed by strong regional vehicle production, the presence of major OEMs, and a rising preference for larger vehicles like pickups and crossovers that demand high-durability suspension systems. The region's push toward electrification is also boosting demand for advanced shock absorbers that align with modern drivetrain requirements while supporting weight reduction and energy efficiency.

Leading companies such as Hitachi Astemo, HL Mando, Gabriel India, KYB, Showa, ZF Friedrichshafen, Chassis Brakes, Endurance Technologies, Cofap, and Tenneco are actively strengthening their market positions through innovation and strategic collaborations. These players are investing heavily in R&D to enhance shock absorber performance, expand their manufacturing footprint globally, and form key partnerships with OEMs. Many are also diversifying their offerings by developing electronically controlled damping systems that provide real-time adaptability based on road feedback and driving behavior, aligning with the future of smart and autonomous vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Price trend

- 3.7.1 Region

- 3.7.2 Vehicle

- 3.8 Key news & initiatives

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for ride comfort & handling stability

- 3.9.1.2 Rising adoption of electric and hybrid vehicles

- 3.9.1.3 Technological advancements in suspension systems

- 3.9.1.4 Expansion of global automotive production

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Higher cost compared to hydraulic shock absorbers

- 3.9.2.2 Stringent environmental & safety regulations

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Twin-tube gas

- 5.3 Monotube gas

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Mount, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Strut-type

- 7.3 Telescopic

Chapter 8 Market Estimates & Forecast, By Sales Channel 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AL-KO Fahrzeugtechnik

- 10.2 Bilstein

- 10.3 Chassis Brakes

- 10.4 Cofap

- 10.5 Endurance

- 10.6 Gabriel

- 10.7 Hitachi Astemo

- 10.8 ITW

- 10.9 Jiangsu Huachuan

- 10.10 KYB

- 10.11 Liuzhou Shuangfei

- 10.12 Magneti Marelli

- 10.13 Mando

- 10.14 Ride Control

- 10.15 S&T Motiv

- 10.16 Showa

- 10.17 Tenneco

- 10.18 Tokico

- 10.19 YSS Suspension

- 10.20 ZF Friedrichshafen