PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740889

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740889

Low-density Polyethylene Packaging (LDPE) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

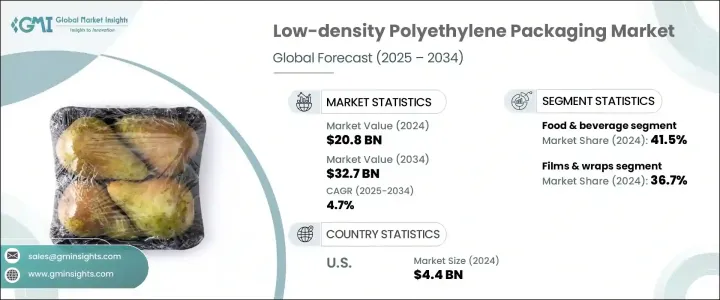

The Global Low-Density Polyethylene Packaging Market was valued at USD 20.8 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 32.7 billion by 2034, driven by robust demand across food, pharmaceutical, and personal care industries. This growth reflects the expanding applications of LDPE packaging in both consumer and industrial sectors. With the global packaging industry rapidly evolving, LDPE remains a preferred material due to its flexibility, durability, low production cost, and high resistance to moisture. As businesses and consumers alike prioritize product safety and shelf-life, LDPE packaging plays a key role in ensuring product integrity across various supply chains.

The rising trend of e-commerce and digital shopping platforms also fuels the demand for flexible packaging materials that can withstand shipping and handling stress while keeping products intact. In addition, the shift toward lightweight, space-saving packaging that helps reduce transportation costs is making LDPE a go-to material for manufacturers. Growing regulatory focus on food safety and packaging hygiene is further enhancing the market potential. Amid ongoing efforts toward sustainability, manufacturers are now working on producing recyclable and eco-friendly LDPE packaging solutions, which are gaining traction among environmentally conscious consumers and regulators. Innovation in packaging formats and materials, aimed at boosting operational efficiency and brand appeal, is shaping the strategic direction of many packaging firms globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.8 billion |

| Forecast Value | $32.7 billion |

| CAGR | 4.7% |

LDPE is widely used in the food and beverage sector due to its moisture resistance and flexibility, making it ideal for packaging perishable products. The increasing demand for convenience food, driven by changing lifestyles and urbanization, is significantly boosting the use of LDPE-based packaging. Consumers are leaning heavily toward ready-to-eat meals and single-serve food products, especially in developing economies, which rely on LDPE films and containers to maintain freshness and safety. With its hygienic attributes, LDPE ensures an extended shelf life for food items, aligning with modern consumption habits and distribution models.

In the pharmaceutical and personal care segments, LDPE packaging continues to gain traction due to rising healthcare awareness, an aging global population, and higher spending on personal wellness. The heightened focus on hygiene and contamination prevention, particularly in the post-pandemic landscape, is accelerating the shift toward single-use and tamper-proof packaging formats. LDPE, being cost-effective and easy to process, is playing a central role in helping manufacturers meet stringent safety and packaging standards. From ointment tubes and medicine pouches to personal care sachets, LDPE is proving its versatility and effectiveness across multiple product categories.

However, the market has faced headwinds in the form of trade-related disruptions. Tariffs on steel, aluminum, and Chinese components introduced during the Trump administration caused a ripple effect throughout the packaging supply chain. These policies led to increased costs for LDPE resins and finished packaging materials, putting upward pressure on production expenses and ultimately raising consumer prices. Trade tensions with key partners like Mexico and Canada also restricted raw material flow, challenging the availability of essential components and adding to logistical complexity for manufacturers.

In terms of product segmentation, the films and wraps category accounted for a 36.7% market share in 2024. These products are widely used in food packaging, industrial wrapping, and e-commerce shipping due to their adaptability and moisture barrier properties. Their affordability and ease of use make them a preferred choice for businesses looking to optimize packaging costs while ensuring product safety. As the need for protective packaging grows across sectors, this segment continues to thrive.

The food and beverage industry emerged as the dominant end-use segment in 2024, holding a 41.5% market share. LDPE packaging is extensively used to safeguard freshness and hygiene, making it indispensable for frozen foods, snacks, dairy, and processed meals. As consumers embrace fast-paced, on-the-go lifestyles, the reliance on flexible and durable packaging like LDPE is only expected to grow, especially in emerging markets where packaged food consumption is surging.

The United States Low-Density Polyethylene (LDPE) Packaging Market was valued at USD 4.4 billion in 2024. Growth here is primarily driven by consistent demand from the food, pharmaceutical, and e-commerce sectors. Technological advancements in processing and the rising focus on safety, hygiene, and regulatory compliance are driving innovation. At the same time, increased interest in sustainable packaging is pushing manufacturers to invest in recycled LDPE solutions. These efforts are enabling businesses to meet customer expectations while aligning with global sustainability goals.

Major players in the global LDPE packaging market include Constantia Flexibles, Berry Global Inc., Sealed Air, and Amcor plc. These companies are leveraging technological upgrades and sustainable practices to stay competitive. Key strategies involve expanding product lines, improving supply chain resilience, and enhancing the recyclability of LDPE products to address environmental concerns and evolving regulatory frameworks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key raw material

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth in packaged food & beverage sector

- 3.3.1.2 Rising demand in pharmaceuticals & personal care

- 3.3.1.3 Expansion of e-commerce & retail distribution

- 3.3.1.4 Increased adoption in industrial and agricultural applications

- 3.3.1.5 Lightweighting and material efficiency

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Environmental concerns and regulatory pressure

- 3.3.2.2 Low recycling rate and limited circularity

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Bags & pouches

- 5.3 Bottles & containers

- 5.4 Films & wraps

- 5.5 Tubes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Food and beverages

- 6.3 Personal care & cosmetics

- 6.4 Electricals & electronics

- 6.5 Consumer goods

- 6.6 Pharmaceuticals

- 6.7 E-commerce

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Amcor plc

- 8.2 BENZ Packaging

- 8.3 Berry Global Inc.

- 8.4 Constantia Flexibles

- 8.5 EPL Limited

- 8.6 FKuR

- 8.7 Inteplast Group

- 8.8 Origin Pharma Packaging

- 8.9 RKW Group

- 8.10 SABIC

- 8.11 Sealed Air

- 8.12 Silgan Holdings

- 8.13 Sirane Group

- 8.14 Sonoco Products Company

- 8.15 Strobel GmbH

- 8.16 TC Transcontinental

- 8.17 Thermo Fisher Scientific Inc.

- 8.18 Westlake Corporation