PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740896

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740896

Cabin Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

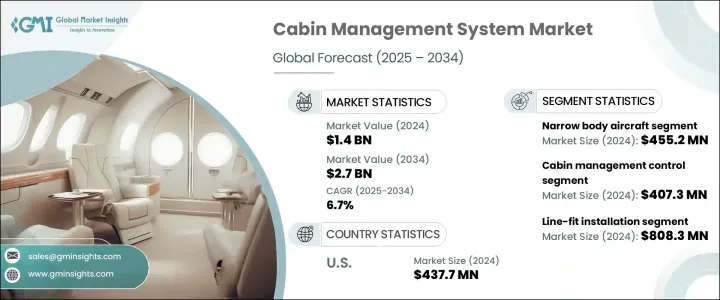

The Global Cabin Management System Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 2.7 billion by 2034. This market's growth is primarily driven by a rising emphasis on enhancing passenger comfort, combined with the expansion of high-end aircraft fleets. As air travel continues to recover and expand globally, airline operators are placing a greater focus on offering a premium in-flight experience, which is fueling the need for advanced CMS technologies. These systems enable seamless control over various cabin features, including lighting, temperature, entertainment, and communication interfaces, all of which significantly improve passenger satisfaction and brand loyalty. Enhanced CMS solutions are also evolving to support wireless technology, real-time adaptability, and intelligent automation, allowing smarter and more personalized cabin settings.

In recent years, shifting global trade policies have impacted the CMS market. Tariff regulations imposed on imports from certain countries raised production costs for manufacturers relying on foreign components. These cost hikes, in turn, led to increased prices of CMS products, affecting both suppliers and airline buyers. This situation encouraged many manufacturers to reevaluate their supply chain strategies, with several opting for domestic production or sourcing alternatives from other regions. Although this change supported local manufacturing ecosystems, it also contributed to a broader shift in CMS pricing and global product availability. Airlines, particularly those focused on cost management, have faced increased operational costs due to the higher expense of CMS installations and upgrades. Nevertheless, these developments are gradually fostering a more resilient and localized supply structure for the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 6.7% |

With rising global air passenger numbers and competitive pressures in the aviation sector, the demand for innovative CMS solutions continues to surge. Airlines are increasingly adopting smart and intuitive technologies that align with growing consumer expectations. CMS platforms now feature integrations with Internet of Things (IoT) sensors, app-based control systems, voice recognition tools, and AI-based customization, all designed to deliver a seamless onboard experience. These enhancements support airlines in delivering consistent, premium service while meeting modern regulatory standards in terms of energy efficiency, noise control, and system reliability.

In terms of aircraft types, the narrow-body aircraft segment led the market with a valuation of USD 455.2 million in 2024. The popularity of these aircraft in cost-conscious and short-haul operations is propelling the need for lightweight, efficient, and affordable CMS installations. Growing domestic air travel in emerging markets has also intensified demand for advanced yet cost-effective CMS setups that offer enhanced passenger control without increasing aircraft weight or operational expense.

By component, cabin management controllers accounted for the largest share in 2024, generating USD 407.3 million. The demand for centralized control units capable of managing multiple cabin functionalities has surged, particularly with the rise in smart sensors and automated cabin technologies. Airlines and manufacturers are prioritizing modular, compact, and low-power controllers that can be easily upgraded or replaced, helping reduce downtime and maintenance efforts.

Based on installation type, the line-fit segment emerged as the market leader with a value of USD 808.3 million in 2024. The increasing number of new aircraft deliveries has led to a growing preference for factory-installed CMS setups. Buyers of premium aircraft are especially keen on fully integrated systems that support advanced multimedia functions, dynamic lighting, and smart control capabilities, delivering a high-end cabin environment straight from production.

Regionally, the United States dominated the CMS market with a valuation of USD 437.7 million in 2024. The country's strong demand for luxurious CMS upgrades and advanced connectivity options, particularly in private and business aviation, continues to drive market growth. In addition, the presence of major OEMs and maintenance providers supports both retrofit and new installation activities, reinforcing the U.S.'s position as a key market.

The cabin management system landscape remains highly fragmented, with a mix of established global players and innovative startups. The top three companies collectively control over 29.7% of the market, focusing heavily on next-generation solutions. These advancements reflect a wider transition from isolated hardware systems to fully integrated digital cabin ecosystems. The industry is rapidly moving toward intelligent, modular architectures that offer enhanced personalization and operational efficiency, reflecting the broader trend toward more electric and connected aviation platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for in-flight passenger comfort

- 3.3.1.2 Expansion of business jet and vip aircraft fleets

- 3.3.1.3 Growth in long-haul flights

- 3.3.1.4 Increase in aircraft production

- 3.3.1.5 Integration with smart devices

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High installation and maintenance costs

- 3.3.2.2 System compatibility issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Aircraft Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Narrow-body aircraft

- 5.3 Wide-body aircraft

- 5.4 Regional jets

- 5.5 Business jets

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Cabin management controllers

- 6.3 Control displays and user interfaces

- 6.4 Audio/video interface modules

- 6.5 Cabin management software

- 6.6 Connectivity modules

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Installation Type, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Line-fit installation

- 7.3 Retrofit installation

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alto Aviation

- 9.2 Astronics

- 9.3 BAE Systems

- 9.4 Bombardier

- 9.5 Collins

- 9.6 Diehl Aviation

- 9.7 Gogo Business Aviation

- 9.8 Heads Up Technologies

- 9.9 Honeywell

- 9.10 KID Systeme

- 9.11 Lufthansa Technik

- 9.12 Rosen Aviation

- 9.13 Safran Cabin

- 9.14 Satcom Direct

- 9.15 STG Aerospace

- 9.16 Thales