PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740897

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740897

Advanced Combat Helmet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

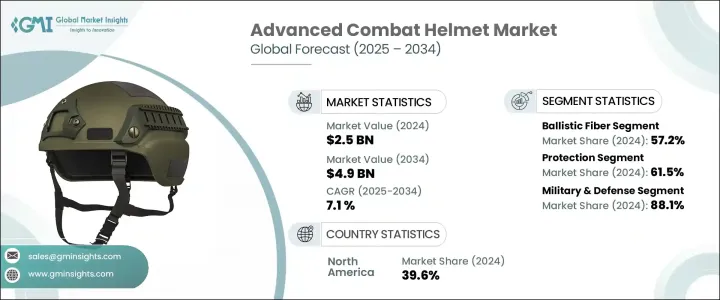

The Global Advanced Combat Helmet Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 4.9 billion by 2034. This expansion is largely driven by increased military expenditures across various regions as defense forces prioritize upgrading soldier protection gear to meet evolving battlefield threats. Advanced combat helmets are no longer just about head protection; they now serve as platforms for communication, situational awareness, and integration with other combat systems. As governments aim to enhance the survivability and operational readiness of their armed forces, demand for technologically advanced helmets continues to rise. These helmets are being reimagined to include features such as integrated heads-up displays, modular add-ons, and compatibility with augmented reality systems.

Geopolitical tensions and unpredictable conflict zones have further compelled military agencies to invest in next-generation protective headgear. However, external economic factors have also influenced market dynamics. Trade policy shifts, especially the imposition of tariffs on imported raw materials, have disrupted the supply chain and increased the cost of essential components used in manufacturing helmets. These disruptions have led to longer production timelines and rising procurement costs. Inflationary pressures add another layer of complexity, potentially slowing acquisition cycles and placing added strain on defense budgets. Despite these challenges, the market is expected to maintain steady growth, with companies focusing on innovation and fulfilling new defense contracts to maintain momentum. Customization and performance optimization for specific combat scenarios are becoming a key focus area as defense agencies seek gear tailored to diverse operational environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 7.1% |

Based on material, the market is segmented into ballistic fiber, thermoplastic, and metal. In 2024, ballistic fiber accounted for 57.2% of the market share. This material remains the preferred choice for many manufacturers due to its superior impact resistance, lightweight properties, and reliability under extreme conditions. Manufacturers continue to explore new ways to improve the strength-to-weight ratio of these fibers, ensuring the final product offers maximum protection without compromising soldier agility.

By application, the market is divided into protection, communication, and visual assistance. The protection category dominated the segment in 2024, holding a 61.5% share. Rising concerns over ballistic threats and asymmetric warfare have intensified the demand for helmets offering robust defense mechanisms. Modern combat helmets are now being designed to withstand various types of ammunition and explosive impacts while also remaining functional in different terrains. Comfort, wearability, and multi-functionality are core to their development, supporting soldiers in unpredictable and high-risk operations.

End-use segmentation includes military and defense, and law enforcement agencies. Military and defense made up the majority of the market, with an 88.1% share in 2024. The need to improve soldier survivability and ensure mission success underlies this dominance. Helmets are being equipped with features like noise-canceling communication systems, night vision readiness, and real-time data transmission to enhance battlefield awareness and responsiveness. Agencies continue to demand gear that not only offers protection but also enhances operational efficiency through integrated systems.

Regionally, North America led the market with a 39.6% share in 2024, supported by high defense spending and a strong inclination toward early adoption of cutting-edge technologies. Regional defense bodies are actively investing in advanced headgear that improves situational awareness and battlefield coordination. Helmets in development often feature mounted displays, environmental sensors, and upgraded ergonomics to meet the demands of modern warfare.

The market in the United States alone is projected to reach USD 1.8 billion by 2034. Continuous investment in defense modernization remains a key driver, with a focus on developing state-of-the-art helmets that combine comfort, protection, and technological enhancement. Military equipment upgrades are prioritized to ensure forces are well-equipped for evolving threats.

The competitive landscape remains intense, with the top five companies accounting for roughly 55-60% of the total market. Key players are channeling efforts into research and development to offer helmets that address the expanding list of requirements from global defense sectors. Strategic alliances and long-term supply contracts with international military organizations are being formed to secure consistent order volumes and enhance market positioning. As battlefield requirements become more complex, helmet manufacturers are keeping pace by delivering high-performance products that offer both safety and strategic advantages.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs Analysis

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact (Raw material)

- 3.2.2.1.1 Price Volatility

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact (Raw material)

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on Trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing adoption of advanced materials for combat helmets

- 3.3.1.2 Rising demand from special operations and law enforcement units

- 3.3.1.3 Increased global military expenditure

- 3.3.1.4 Increased soldier safety standards and regulations

- 3.3.1.5 Growing military modernization programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and procurement costs

- 3.3.2.2 Complex integration with C4ISR systems

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Ballistic fiber

- 5.3 Thermoplastic

- 5.4 Metal

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Protection

- 6.3 Communication

- 6.4 Visual assistance

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Military & defense

- 7.3 law enforcement agencies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 ArmorSource LLC

- 9.3 DuPont de Nemours Inc.

- 9.4 Galvion

- 9.5 Gentex Corporation

- 9.6 HARD SHELL

- 9.7 Honeywell International Inc.

- 9.8 Indian Armour Systems Pvt. Ltd.

- 9.9 MKU Limited

- 9.10 Point Blank Enterprises

- 9.11 Revision Military Inc.