PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740908

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740908

Thermoplastic Adhesive Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

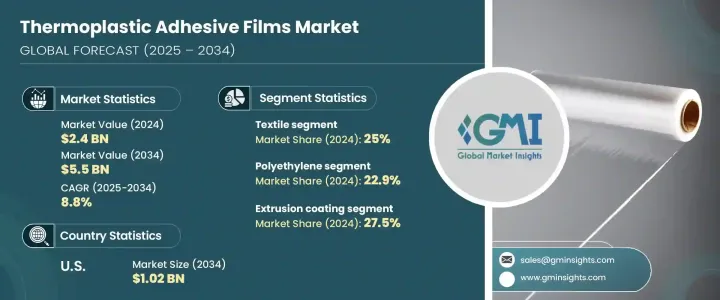

The Global Thermoplastic Adhesive Films Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 5.5 billion by 2034. This upward trend is largely fueled by the growing preference for lightweight materials across several end-use industries, especially in automotive and electronics manufacturing. Thermoplastic adhesive films are being increasingly used to bond components while significantly reducing overall product weight. Their ability to support fuel efficiency goals and contribute to reduced emissions aligns well with tightening environmental regulations and sustainability benchmarks globally.

In compact electronics and wearable devices, these films offer excellent thermal resistance, which is essential for maintaining performance in miniature, high-density product designs. They allow for clean processing and reliable bonding in space-constrained applications such as smartphones, flexible gadgets, and next-gen consumer devices. Additionally, the medical technology sector is emerging as a high-potential area, where biocompatibility, chemical resistance, and easy sterilization are vital. These films are used in a variety of medical wearables and disposable healthcare products, delivering durable yet non-invasive adhesion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 8.8% |

Sustainability is becoming a central theme in shaping demand. Thermoplastic adhesive films are seen as an eco-conscious solution due to their solvent-free nature and recyclability, making them suitable for industries seeking to minimize VOC emissions. Manufacturers are increasingly adopting environmentally friendly adhesive alternatives to align with regulatory frameworks and environmental, social, and governance (ESG) goals. Advances in processing technologies like film casting and hot melt applications have improved the thermal behavior, sealing ability, and tack properties of adhesive films, expanding their use in areas that demand high precision, such as industrial laminates and optical systems.

In terms of material segmentation, the market in 2024 includes polyethylene, polyamide, thermoplastic polyurethane, polyester, polypropylene, polyolefins, and other material types. With the market valued at USD 2.4 billion in 2024, it is forecast to grow substantially and reach USD 5.5 billion by 2034. Among these, polyethylene accounted for 22.9% of the total share in 2024, primarily due to its affordability, flexibility, and ability to bond well with various substrates. It is used in sectors like packaging and automotive, although its growth rate remains modest as industries shift toward more advanced performance films. Thermoplastic polyurethane is experiencing significant momentum thanks to its elasticity, transparency, and superior abrasion resistance. The growing need for miniaturized and flexible components is supporting its adoption across emerging applications.

From a technology standpoint, the 2024 market is segmented into extrusion coating, hot melt adhesives, resin blending, film casting, and other processing techniques. The extrusion coating method led the segment with a 27.5% market share due to its high-speed production capability and consistent coating quality across various substrates. Hot melt adhesives are expanding quickly, especially in electronics and hygiene-related products, driven by their solvent-free, environmentally sound properties and dependable bond strength. Resin blending, while advantageous for customizing film characteristics like tack and heat resistance, faces constraints due to complex formulation requirements and elevated production costs. Film casting is finding preference in high-precision environments where smooth, defect-free films are essential, particularly for optical and medical-grade applications.

When analyzed by end use in 2024, the market is divided into textiles, automotive, electrical and electronics, medical, ballistic protection, construction, and other sectors. The textile industry led with a 25% share, as demand rises for seamless lamination in garments, home furnishings, and smart textiles. Adhesive films are playing a key role in solvent-free textile bonding solutions. In the automotive domain, the push for lighter vehicles and the need to mitigate noise, vibration, and harshness (NVH) have reinforced the relevance of these films. Medical uses are also advancing rapidly, particularly in skin-sensitive and sterilizable films for health-monitoring devices and diagnostic tools. Ballistic and defense applications leverage high-strength films for layering purposes in protective composites.

Regionally, the United States held a 17.8% share in the global market in 2024, valued at approximately USD 430 million, and is projected to grow to USD 1.02 billion by 2034. This dominance is attributed to the increasing penetration of thermoplastic adhesive films in advanced manufacturing sectors like automotive, aerospace, medical, and electronics. The country's focus on solvent-free adhesives and its supportive policy environment, including adjustments in trade regulations and domestic sourcing strategies, are boosting local production and innovation.

Major players driving competition in the industry include companies like Dow Inc., 3M Company, BASF SE, Henkel AG, and Covestro AG, each adopting different approaches to strengthen their market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand in automotive lightweighting

- 3.6.1.2 Growth in consumer electronics and wearables

- 3.6.1.3 Expansion of the medical device industry

- 3.6.1.4 Increasing preference for sustainable adhesives

- 3.6.1.5 Technological advancements in film casting and hot melt

- 3.6.1.6 Rising textile industry innovations (e.g., smart textiles)

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High raw material costs (e.g., TPU, polyamide)

- 3.6.2.2 Limited heat and chemical resistance compared to thermosets

- 3.6.2.3 Complex recyclability of multi-layer structures

- 3.6.1 Growth drivers

- 3.7 Impact of trump administration tariffs – structured overview

- 3.7.1 Impact on trade

- 3.7.1.1 Trade volume disruptions

- 3.7.1.2 Retaliatory measures

- 3.7.2 Impact on the industry

- 3.7.2.1 Supply-side impact (raw materials)

- 3.7.2.1.1 Price volatility in key materials

- 3.7.2.1.2 Supply chain restructuring

- 3.7.2.1.3 Production cost implications

- 3.7.2.2 Demand-side impact (selling price)

- 3.7.2.2.1 Price transmission to end markets

- 3.7.2.2.2 Market share dynamics

- 3.7.2.2.3 Consumer response patterns

- 3.7.2.1 Supply-side impact (raw materials)

- 3.7.3 Key companies impacted

- 3.7.4 Strategic industry responses

- 3.7.4.1 Supply chain reconfiguration

- 3.7.4.2 Pricing and product strategies

- 3.7.4.3 Policy engagement

- 3.7.4.4 Outlook and future considerations

- 3.7.1 Impact on trade

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene

- 5.3 Polyamide

- 5.4 Thermoplastics polyurethane

- 5.5 Polyester

- 5.6 Polypropylene

- 5.7 Polyolens

- 5.8 Other materials

Chapter 6 Market Estimates and Forecast, By Technologies, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Extrusion coating

- 6.3 Hot melt adhesive

- 6.4 Resin blending

- 6.5 Film casting

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Textile

- 7.3 Automotive

- 7.4 Electrical and electronics

- 7.5 Medical

- 7.6 Ballistic protection

- 7.7 Construction

- 7.8 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Arkema SA

- 9.3 Ashland Global

- 9.4 Avery Dennison

- 9.5 BASF SE

- 9.6 Covestro AG

- 9.7 Dow Inc.

- 9.8 DuPont

- 9.9 EMS-Chemie Holding AG

- 9.10 H.B. Fuller

- 9.11 Henkel AG

- 9.12 Huntsman Corporation

- 9.13 Mitsui Chemicals Inc.

- 9.14 Sika AG