PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740909

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740909

Composite Cardboard Tube Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

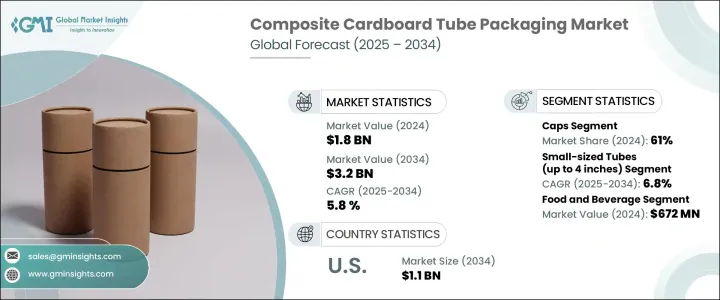

The Global Composite Cardboard Tube Packaging Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 3.2 billion by 2034, driven by the growing demand for eco-friendly packaging and the rise in e-commerce activity. Businesses across industries are making conscious shifts toward sustainable solutions, and composite cardboard tubes are gaining strong traction as they check off all the right boxes-durability, recyclability, and an attractive visual appeal that enhances product presentation. From beauty and personal care to food and industrial goods, brands are turning to tube packaging not just for function but for differentiation. The market's evolution is also being fueled by changing consumer behaviors that favor minimal waste, reusable packaging, and a better unboxing experience. As demand for environmentally responsible solutions climbs, the market is expected to witness greater innovation, with manufacturers focusing on customizing designs, improving material strength, and aligning with circular economy models. The growth of D2C (direct-to-consumer) retail, rising subscription box services, and the widespread popularity of gifting products in cylindrical packaging formats are collectively shaping the momentum. Composite cardboard tubes serve as a practical and stylish solution for brands looking to leave a positive environmental impact while boosting shelf appeal. As companies double down on ESG commitments and sustainability metrics, this packaging format is fast becoming a preferred option across global supply chains.

That said, the market still faces hurdles that can't be ignored. Tariffs on imported raw materials and components, originally introduced under earlier U.S. trade policies, have led to a noticeable spike in production costs. Manufacturers are at a crossroads-either absorb the added costs, increase prices for consumers, or pivot to local suppliers to avoid high import duties. This shift has intensified the focus on optimizing supply chains, finding domestic or alternative raw material sources, and reevaluating supplier partnerships. On top of that, ongoing disruptions in international trade and logistics continue to test the resilience of inventory strategies. Companies are increasingly investing in agile inventory systems and diversifying sourcing methods to ensure stability. Innovation in material sourcing, automation, and operational efficiency has emerged as a critical differentiator in staying ahead of the competition and maintaining margins in a volatile market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.8% |

In terms of product type, the caps segment led the global composite cardboard tube packaging market with a dominant 61% share in 2024. Their popularity is largely due to secure closure features that ensure product safety during shipping while maintaining ease of use for consumers. Lightweight caps also support cost-effective transportation and align well with sustainability goals by minimizing material usage. Additionally, brands are leveraging this format to enhance customer experience through tactile finishes, embossed logos, QR codes, and smart labeling technologies. The ability to blend functional security with high-end design elements gives caps an edge across multiple verticals-particularly in food, cosmetics, and personal care-where both protection and branding are equally critical.

Small-sized tubes measuring up to 4 inches are gaining traction as the fastest-growing segment, projected to expand at a CAGR of 6.8% through 2034. What is fueling this demand is the consumer shift toward compact, travel-friendly packaging options, especially in skincare, beauty, and on-the-go food products. These tubes are not only portable and user-friendly but also provide durability and a premium touch that elevates brand experience. As consumers seek packaging that combines minimalism with eco-conscious appeal, small tubes are delivering on both fronts-functionality and form.

The United States Composite Cardboard Tube Packaging Market is expected to reach USD 1.1 billion by 2034, driven by heightened awareness of sustainable packaging and a robust e-commerce ecosystem. Domestic manufacturers are stepping up by investing in recyclable, biodegradable tube innovations that meet regulatory benchmarks while enhancing shelf visibility. These new designs are helping brands cut down on transportation emissions by optimizing weight and volume and are boosting product safety with better structural design. As regulations around plastic usage become more stringent, businesses are gravitating toward cardboard tubes as a reliable, compliant, and brand-friendly solution.

Leading players such as Sonoco, Smurfit Kappa Group, Paper Tubes & Sales, Visican Ltd, and Marshall Paper Tube Co., Inc. are actively deploying strategies to strengthen their footprint in the market. These include embracing automated production lines to ramp up output and cut labor costs, partnering for secure raw material access, expanding product customization to serve niche markets, and integrating higher percentages of recycled content. To stay relevant and ahead, they are banking heavily on innovation-blending design, sustainability, and performance into a single packaging solution that resonates with both brands and end users.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analyisis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.4 Supply-side impact (raw materials)

- 3.2.1.4.1.1 Price volatility in key materials

- 3.2.1.4.1.2 Supply chain restructuring

- 3.2.1.4.1.3 Production cost implications

- 3.2.1.5 Demand-side impact (selling price)

- 3.2.1.5.1.1 Price transmission to end markets

- 3.2.1.5.1.2 Market share dynamics

- 3.2.1.5.1.3 Consumer response patterns

- 3.2.1.6 Key companies impacted

- 3.2.1.7 Strategic industry responses

- 3.2.1.7.1.1 Supply chain reconfiguration

- 3.2.1.7.1.2 Pricing and product strategies

- 3.2.1.7.1.3 Policy engagement

- 3.2.1.8 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing consumer preference for sustainable and recyclable packaging solutions

- 3.3.1.2 Rising e-commerce penetration driving demand for protective shipping tubes

- 3.3.1.3 Increasing customization needs for premium brands seeking unique brand differentiation

- 3.3.1.4 Expanding applications in cosmetics, pharmaceuticals and specialty food sectors

- 3.3.1.5 Increasing focus on sustainable packaging

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Volatility in raw material prices impacting manufacturing margins

- 3.3.2.2 Competition from alternative packaging solutions

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Closure Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Caps

- 5.3 Lids

Chapter 6 Market Estimates and Forecast, By Size, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Small-sized tubes (up to 4 inches)

- 6.3 Medium-sized tubes (4 to 10 inches)

- 6.4 Large-sized tubes (over 10 inches)

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Food and Beverage

- 7.3 Pharmaceuticals

- 7.4 Cosmetics and Personal Care

- 7.5 Chemicals

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Australia

- 8.4.4 South Korea

- 8.4.5 Japan

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 U.A.E.

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Ace Paper Tube Corp

- 9.2 CBT Packaging

- 9.3 Chicago Mailing Tube Co.

- 9.4 Darpac P/L

- 9.5 Hansen Packaging

- 9.6 Heartland Products Group

- 9.7 Marshall Paper Tube Co., Inc.

- 9.8 Paper Tubes & Sales

- 9.9 Smurfit Kappa Group

- 9.10 Sonoco

- 9.11 Valk Industries

- 9.12 Visican Ltd