PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740926

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740926

Polyethylene (PE) Transparent Barrier Packaging Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

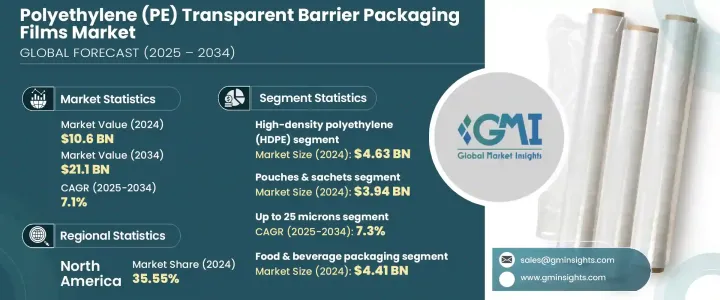

The Global Polyethylene Transparent Barrier Packaging Films Market was valued at USD 10.6 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 21.1 billion by 2034, driven by the rising demand for convenient, durable packaged goods that require high-performance packaging solutions. Growing consumer preference for sustainable, lightweight, and cost-effective packaging is accelerating the transition toward polyethylene (PE) transparent barrier films across industries. With businesses across food, cosmetics, and pharmaceuticals placing a stronger emphasis on shelf life extension and product integrity, the demand for advanced packaging solutions is rapidly escalating. PE transparent barrier films deliver excellent protection against moisture, oxygen, and contaminants while maintaining product visibility and flexibility.

Unlike traditional materials like metal and glass, these films offer significant advantages such as lower transportation costs, reduced environmental footprint, and better recyclability, making them a top choice for forward-looking brands. In addition, stricter global regulations promoting the use of eco-friendly and recyclable materials are pushing industries to innovate packaging designs in line with circular economy goals. As sustainability continues to dominate corporate agendas, manufacturers are increasingly focused on delivering mono-material solutions that are both high-performing and easily recyclable. The growing awareness among consumers about environmental issues is also a major catalyst, propelling the market's robust growth trajectory through the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 7.1% |

The market is segmented by type into metallocene polyethylene (mPE), linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), and high-density polyethylene (HDPE). HDPE led the segment in 2024 with a market value of USD 4.63 billion. Known for its excellent durability and superior barrier resistance, HDPE is a preferred material for packaging sensitive products, especially in the food and pharmaceutical sectors. Its chemical and oxygen barrier capabilities make it vital for enhancing food safety and shelf stability. As the market leans heavily toward sustainability, the trend of adopting co-extruded HDPE films is gaining momentum, offering better recyclability and supporting material simplification efforts.

In terms of thickness, the market includes above 100 microns, 50-100 microns, 25-50 microns, and up to 25 microns. The up to 25 microns category is projected to grow at a CAGR of 7.3% from 2025 to 2034. These ultra-thin films are increasingly favored for packaging snacks, baked goods, and pharmaceuticals due to their exceptional moisture and gas barrier properties. Companies are rapidly moving toward adopting mono-material films in this thickness range to align with strict environmental standards while ensuring cost-effectiveness and product freshness.

Germany's Polyethylene Transparent Barrier Packaging Films Market is projected to expand at a staggering CAGR of 32.77% by 2034, emerging as one of the fastest-growing regional markets. This impressive growth is fueled by the country's progressive recycling laws under the German Packaging Act, driving widespread adoption of mono-material polyethylene films that simplify sorting and recycling. Germany's leadership in sustainable industrial practices and strong regulatory push is setting the pace for the market's future.

Leading players in the Global Polyethylene Transparent Barrier Packaging Films Market include Berry Global Inc., Jindal Poly Films Ltd., Sealed Air Corporation, and Amcor Plc. These companies are investing heavily in advanced manufacturing technologies, expanding their portfolios with recyclable and biodegradable films, and forming strategic partnerships to drive innovation. A sharp focus on developing high-performance mono-material films and optimizing production processes through co-extrusion techniques is helping them strengthen global market positions while meeting evolving regulatory demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable packaging

- 3.2.1.2 Stringent environmental regulations

- 3.2.1.3 Technological advancements improving barrier properties and recyclability

- 3.2.1.4 Increasing adoption of food & beverage, cosmetics, and pharmaceutical industries

- 3.2.1.5 Increasing awareness of plastic pollution.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & limited scalability compared to traditional plastics

- 3.2.2.2 Recycling complexities due to multilayer film structures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Low-density polyethylene (LDPE)

- 5.3 High-density polyethylene (HDPE)

- 5.4 Linear low-density polyethylene (LLDPE)

- 5.5 Metallocene polyethylene (mPE)

Chapter 6 Market Estimates and Forecast, By Packaging Format, 2021 - 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Pouches & sachets

- 6.3 Wraps & lidding films

- 6.4 Bags & liners

- 6.5 Shrink & stretch films

- 6.6 Clamshells & blister packs

- 6.7 Vacuum & modified atmosphere packaging (MAP) films

Chapter 7 Market Estimates and Forecast, By Thickness, 2021 - 2034 ($ Mn & Kilo Tons)

- 7.1 Up to 25 microns

- 7.2 25–50 microns

- 7.3 50–100 microns

- 7.4 Above 100 microns

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage packaging

- 8.3 Pharmaceutical & medical packaging

- 8.4 Personal care & cosmetics packaging

- 8.5 Industrial packaging

- 8.6 Electronics packaging

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Amcor Plc

- 10.2 Arena Products, Inc.

- 10.3 Berry Global Inc.

- 10.4 BIO Packaging Films

- 10.5 Celplast Metallized Products Ltd.

- 10.6 Cosmo Films Ltd.

- 10.7 Dai Nippon Printing Co., Ltd.

- 10.8 DuPont Teijin Films USA

- 10.9 Glenroy, Inc.

- 10.10 Innovia Films

- 10.11 Jindal Poly Films Ltd.

- 10.12 Mondi Plc

- 10.13 Plastissimo Film Co.

- 10.14 ProAmpac

- 10.15 Schur Flexibles Group

- 10.16 Sealed Air Corporation

- 10.17 SUDPACK Verpackungen GmbH & Co. KG

- 10.18 Toray Plastics (America), Inc.

- 10.19 UFlex Limited

- 10.20 Winpak Ltd.