PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740931

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740931

Side Loader Refuse Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

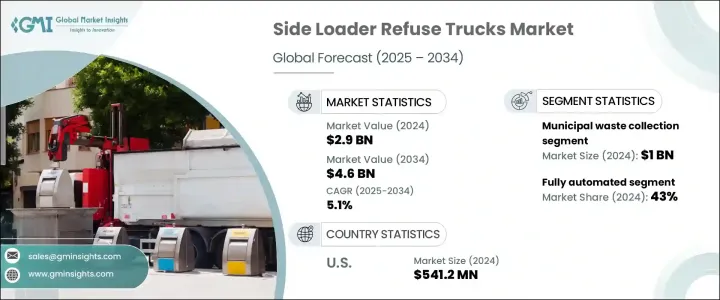

The Global Side Loader Refuse Trucks Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 4.6 billion by 2034. As cities around the world continue to expand, the demand for efficient and space-conscious waste collection vehicles has surged. Urban development naturally brings with it higher population densities and increased volumes of solid waste, creating an urgent need for systems that can handle waste collection in tight spaces. Side loader refuse trucks have become the go-to solution in urban areas, thanks to their ability to maneuver through narrow roads and busy streets. Their compatibility with standardized waste bins also makes them a preferred option for municipalities aiming to streamline collection processes. Urban centers are moving towards cleaner and more efficient waste management practices, which has significantly accelerated the adoption of side loader trucks.

Government regulations are also playing a critical role in the growing adoption of these vehicles. Stricter environmental and safety standards are pushing local authorities and private firms to invest in modern, low-emission technologies. Side loaders powered by electric and hybrid systems are gaining traction as cities aim to improve air quality and reduce carbon emissions. These vehicles not only help meet environmental goals but also improve operational performance by consuming less fuel and reducing maintenance time.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 5.1% |

In terms of application, the market is divided into industrial waste, municipal waste, commercial waste, and construction and demolition waste. Municipal waste collection dominated in 2024, with a market value of around USD 1 billion, representing over 45% of the market share. With rapid urbanization, waste generated in city areas continues to rise, and this increase is reflected in the higher demand for municipal collection services. As waste volumes grow, municipalities are turning to side loader trucks to handle rising pressure on their sanitation systems.

The automated design of these trucks has proven to be especially valuable for city governments looking to reduce labor costs. With automated arms and bin-lifting mechanisms, side loaders require fewer operators, making them more cost-effective and efficient. These trucks allow consistent and uninterrupted waste collection with minimal human intervention, leading to better workforce management and productivity gains. City governments are increasingly adopting such technologies, often supported by public funding or grants, to improve the effectiveness of their waste management systems.

When it comes to loading mechanisms, the market is segmented into fully automated, semi-automated, and manual systems. Fully automated side loader trucks led the market in 2024, holding around 43% of the total share. These trucks are capable of performing all core functions - including lifting, loading, and emptying bins - with just one operator. This automation not only helps reduce the labor force but also speeds up collection processes, minimizes downtime, and increases accuracy. As technology continues to advance, these fully automated systems are becoming more reliable and essential in large urban settings.

Fuel type is another critical segmentation, with diesel, electric, CNG, hybrid, and other fuel types in the mix. Diesel-powered trucks led the market in 2024. Despite the growing popularity of alternative fuels, diesel remains the most practical and cost-effective choice for many municipalities and private operators. Diesel trucks are known for their durability, easier maintenance, and well-established refueling infrastructure. For long-haul routes and heavy-duty operations, diesel continues to offer unmatched reliability and lower upfront costs compared to electric or CNG-powered alternatives.

In terms of end users, the market is segmented into municipal services, specialized waste handlers, private waste management companies, and others. Municipal services took the lead in 2024. Local governments handle the majority of waste collection in urban areas, especially in densely populated neighborhoods. Side loader trucks serve these regions efficiently due to their compact design and automated capabilities. With access to government subsidies and budget allocations, municipalities are better positioned to invest in updated and cost-efficient waste collection technologies that support their environmental goals.

Geographically, North America held a major share of the market, accounting for over 35% in 2024. The U.S. alone reached a market value of approximately USD 541.2 million. The country's high urban population, combined with strict state-level regulations, has made automated and clean waste collection technologies a necessity. Waste collection authorities are increasingly investing in electric and hybrid models to comply with emission mandates while reducing overall operating costs.

Major manufacturers in this space are now focusing heavily on sustainability, competing by offering models with smart automation, electric drivetrains, and diagnostic features. Companies that can provide low or zero-emission vehicles are finding more opportunities in regions with green procurement policies, especially in North America and Europe. The competitive edge lies in offering vehicles that balance performance, fuel efficiency, safety, and environmental compliance in a cost-effective package.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material and component supplier

- 3.2.2 Truck and equipment manufacturer

- 3.2.3 Technology and telematics providers

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Impact of trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price analysis

- 3.7.1 Region

- 3.7.2 Propulsion

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Urbanization and population growth

- 3.10.1.2 Regulatory push for clean and efficient waste collection

- 3.10.1.3 Growth of private waste management companies

- 3.10.1.4 Technological advancements in refuse trucks

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost

- 3.10.2.2 High maintenance and repair costs

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Loading Mechanism, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Fully automated

- 5.3 Semi-automated

- 5.4 Manual

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Less than 10,000 lbs

- 6.3 10,000 to 20,000 lbs

- 6.4 20,000 to 30,000 lbs

- 6.5 More than 30,000 lbs

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Electric

- 7.4 CNG

- 7.5 Hybrid

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Municipal waste collection

- 8.3 Industrial waste collection

- 8.4 Commercial waste collection

- 8.5 Construction and demolition waste

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Municipal services

- 9.3 Private waste management companies

- 9.4 Specialized waste handlers

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amrep

- 11.2 Autocar

- 11.3 Bridgeport Manufacturing

- 11.4 Bucher Municipal

- 11.5 BYD

- 11.6 Curbtender

- 11.7 Dennis Eagle

- 11.8 FAUN Zoeller (UK)

- 11.9 Foton Motor

- 11.10 Freightliner (Daimler)

- 11.11 Fujian Longma Environmental Sanitation Equipment

- 11.12 Heil

- 11.13 Isuzu

- 11.14 Labrie Trucks

- 11.15 Mack Trucks

- 11.16 McNeilus Truck and Manufacturing

- 11.17 New Way Refuse Trucks

- 11.18 NTM

- 11.19 Pak-Mor

- 11.20 Peterbilt Motors Company