PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740932

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740932

Angiography Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

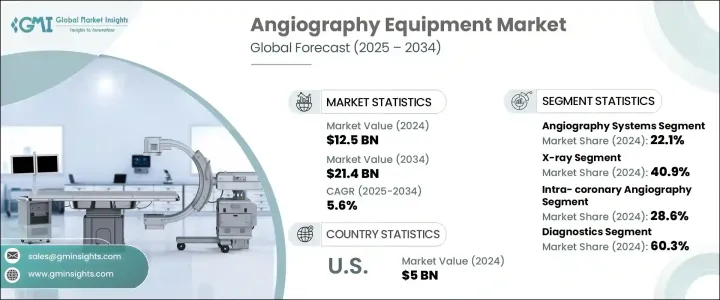

The Global Angiography Equipment Market was valued at USD 12.5 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 21.4 billion by 2034, driven by the rising burden of cardiovascular diseases and an increasingly aging global population that demands frequent diagnostic and interventional care. The escalating prevalence of chronic conditions like hypertension, diabetes, and obesity is significantly increasing the number of patients who require vascular imaging procedures. As the global healthcare landscape shifts toward early detection and minimally invasive treatments, the demand for advanced angiography equipment is expected to soar. Hospitals and diagnostic centers are rapidly adopting cutting-edge technologies to enhance clinical outcomes, reduce procedure time, and minimize patient exposure to radiation.

Technological breakthroughs such as 3D imaging, flat-panel detectors, and AI-enhanced imaging software are revolutionizing the way vascular disorders are diagnosed and treated. Growing healthcare investments, favorable reimbursement scenarios, and rising awareness about preventative cardiac care are creating new opportunities for angiography equipment manufacturers worldwide. Emerging economies are witnessing major improvements in healthcare infrastructure, fueling broader access to advanced diagnostic tools. As governments and private organizations ramp up efforts to tackle non-communicable diseases, the adoption of high-precision imaging solutions like angiography systems is expected to experience robust growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.5 Billion |

| Forecast Value | $21.4 Billion |

| CAGR | 5.6% |

Among all product types, the angiography systems segment accounted for a 22.1% share in 2024. These systems continue to be the preferred choice for detailed vessel imaging in both diagnostic and interventional procedures. Their ability to deliver real-time, accurate, and dynamic imaging has made them crucial in managing complex cardiovascular, neurovascular, and oncological cases. Continuous investments in innovation have led to improvements such as reduced radiation doses and enhanced imaging clarity, helping hospitals deliver safer, more efficient patient outcomes. Enhanced ease of use and advancements in user interface design are further driving their adoption across various care settings.

Based on the procedure, the intra-coronary angiography segment generated a 28.6% share in 2024. As cardiovascular diseases maintain a rising trend, intra-coronary angiography remains vital for both emergency interventions and elective procedures. Innovations like fractional flow reserve (FFR) and optical coherence tomography (OCT) have shifted the focus from purely anatomical assessments to functional evaluations, improving decision-making during interventions. With coronary artery disease presenting a growing global health burden, the role of intra-coronary angiography is set to expand, especially with its integration into hybrid ORs and advanced cath labs.

The U.S. Angiography Equipment Market reached USD 5 billion in 2024, fueled by rising clinical demand and a strong healthcare system. The growing rates of obesity, hypertension, and an aging population have driven national initiatives promoting early diagnostics and preventative screenings. Expanded insurance coverage and the rise of integrated healthcare networks have made angiographic evaluations more accessible across outpatient centers and rural areas. Additionally, the adoption of digital platforms has enabled seamless integration of angiography into routine cardiovascular assessments, boosting speed and accuracy.

Leading companies operating in the Global Angiography Equipment Market include Medtronic, Canon Medical System, GE Healthcare, Cordis, Philips, Merit Medical, Toshiba Medical System, Angiodynamics, Siemens Healthineers, Microport Scientific, Cardinal Health, B. Braun, Abbott, Boston Scientific, and Shimadzu Corporation. Major players are heavily investing in R&D to launch AI-integrated, low-radiation systems and expanding global partnerships to strengthen market reach while tailoring products for emerging markets with localized clinical needs and regulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Rise in aging population

- 3.2.1.3 Technological advancements in imaging techniques

- 3.2.1.4 Growing public health initiatives for early detection of cardiac diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated to equipment procurement and maintenance

- 3.2.2.2 Risk related to radiation exposure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Angiography systems

- 5.3 Catheters

- 5.4 Guidewire

- 5.5 Balloons

- 5.6 Contrast media

- 5.7 Vascular closure devices

- 5.8 Angiography accessories

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 X-ray

- 6.2.1 Image intensifiers

- 6.2.2 Flat-panel detectors

- 6.3 MRA

- 6.4 CT

Chapter 7 Market Estimates and Forecast, By Procedure, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Coronary angiography

- 7.3 Endovascular angiography

- 7.4 Neuroangiography

- 7.5 Onco-angiography

- 7.6 Other angiography procedures

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Diagnostics

- 8.3 Therapeutics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Diagnostic and imaging centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 Angiodynamics

- 11.3 B. BRAUN

- 11.4 Boston Scientific

- 11.5 Canon Medical System

- 11.6 Cardinal Health

- 11.7 Cordis

- 11.8 GE Healthcare

- 11.9 Koninklijke Philips

- 11.10 Medtronic

- 11.11 Merit Medical

- 11.12 Microport Scientific

- 11.13 Shimadzu

- 11.14 Siemens Healthineers

- 11.15 Toshiba Medical System