PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740948

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740948

Aircraft Hydraulic Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

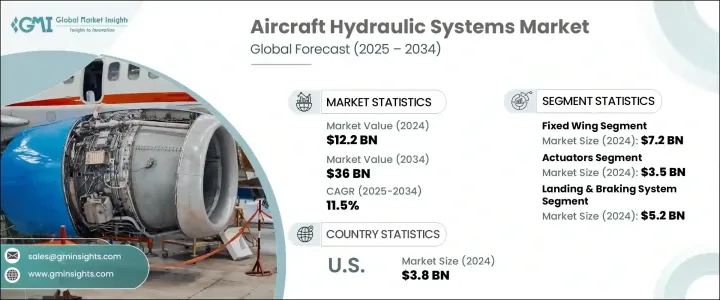

The Global Aircraft Hydraulic Systems Market was valued at USD 12.2 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 36 billion by 2034. This growth is largely driven by the increasing global demand for air travel and the rising integration of hydraulic systems across commercial, military, and unmanned aerial vehicle platforms. As airlines upgrade fleets and governments ramp up defense capabilities, hydraulic systems have become critical for ensuring operational efficiency, reliability, and safety. The continued rise in global air passenger traffic is putting pressure on aerospace companies to invest in more sophisticated aircraft, which in turn is driving the need for advanced hydraulic actuation systems. These systems are essential for various aircraft functions, including maneuvering, flight control, braking, and landing gear operation.

Geopolitical trade tensions in recent years, including the introduction of tariffs, have caused significant disruption in the supply chain, particularly for aerospace components sourced from overseas. These changes forced manufacturers and suppliers to adapt through diversified sourcing strategies, local production, and reevaluation of procurement models to mitigate cost fluctuations and delays. As a result, the shift toward localized and resilient supply chains is becoming a crucial trend shaping the market landscape. On the technology front, the market is experiencing strong momentum due to the rising use of micro and electro-hydraulic systems. These innovations cater to the growing need for compact and energy-efficient solutions in emerging applications such as drones, autonomous aircraft, and urban air mobility vehicles. Moreover, defense investments continue to boost the demand for high-performance hydraulic systems that support advanced aircraft functionalities like stealth, weapons handling, and enhanced control mechanisms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $36 Billion |

| CAGR | 11.5% |

In terms of platform, the market is segmented into rotary wing, fixed wing, and unmanned aerial vehicles (UAVs). The fixed wing category led the market in 2024 with a valuation of USD 7.2 billion. The growth of this segment is fueled by an increase in procurement of new-generation commercial and defense aircraft as well as ongoing upgrades to existing fleets. Rising air traffic and expanded military budgets are encouraging the adoption of technologically advanced jets that require complex hydraulic subsystems for tasks such as flight control, braking, and gear deployment.

By component, the market is divided into reservoirs, pumps, accumulators, actuators, hydraulic fuses, valves, and others. Actuators emerged as the top-performing segment in 2024, generating USD 3.5 billion in revenue. The heightened need for accuracy and reliability in flight control systems is spurring demand for next-generation actuators that are compact, fuel-efficient, and capable of high-performance output. As modern aircraft focus on weight reduction and improved control responsiveness, manufacturers are increasingly investing in electro-hydraulic actuator technologies to meet evolving requirements.

On the basis of application, the market includes flight control systems, thrust reversal systems, landing and braking systems, and other functions. The landing and braking systems segment was the highest contributor in 2024, valued at USD 5.2 billion. These systems are essential for the safe operation of aircraft, especially in regions where aircraft perform frequent takeoffs and landings. Demand is further supported by stricter safety regulations, which require more advanced hydraulic components with features like anti-skid capabilities, improved pressure management, and built-in redundancies.

Regionally, the United States held the largest share of the aircraft hydraulic systems market, accounting for USD 3.8 billion in 2024. The dominance of the US market can be attributed to rising investments in defense programs, commercial aviation upgrades, and R&D efforts across aerospace technologies. The country also benefits from the presence of major aerospace manufacturers and suppliers who are consistently advancing hydraulic system technologies. These companies are placing emphasis on lightweight construction, electro-hydraulic integrations, and systems that align with More Electric Aircraft (MEA) initiatives.

Market competition remains intense, with both established multinational companies and innovative startups competing for share. Leading players are actively focusing on smart hydraulic technologies, integrated diagnostics, and solutions designed for electric and hybrid platforms. There is a noticeable shift toward developing hydraulic systems that offer enhanced fuel efficiency and environmental performance while meeting global safety standards such as FAA, EASA, and AS9100.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global air passenger traffic

- 3.3.1.2 Expansion and modernization of aircraft fleets

- 3.3.1.3 Increased use in commercial, military, and UAV platforms

- 3.3.1.4 Higher power-to-weight ratios and load handling

- 3.3.1.5 Technological advancements in hydraulic systems

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Competition from electric and alternative systems

- 3.3.2.2 High maintenance and operational costs

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Platform, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Fixed wing

- 5.3 Rotary wing

- 5.4 Unmanned aerial vehicles

Chapter 6 Market Estimates and Forecast, By Component, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Reservoir

- 6.3 Pumps

- 6.4 Accumulators

- 6.5 Actuators

- 6.6 Hydraulic fuse

- 6.7 Valves

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Flight control system

- 7.3 Thrust reversal system

- 7.4 Landing & braking system

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AeroControlex

- 9.2 Circor Aerospace

- 9.3 Collins Aerospace

- 9.4 Crane Aerospace and Electronics

- 9.5 Eaton

- 9.6 Gar Kenyon

- 9.7 Liebherr Aerospace

- 9.8 Moog

- 9.9 Parker Hannifin

- 9.10 PTI Technologies

- 9.11 Safran

- 9.12 Senior

- 9.13 Triumph Group

- 9.14 Woodward